Search results for return on investment:

What San Diego MBAs Offer the Best Return on Investment?

Attending a Master of Business Administration program in San Diego sounds like a great idea. There’s great weather year round, beautiful beaches, and you get to enjoy the laid-back California attitude. But do you get a good return on your investment (ROI) going to school in San Diego?

The ROI of your MBA program can be difficult to determine considering the many factors that come into play. Not only do you need to compare the cost of tuition and expected salary upon graduation from each school, but you also have to take into account the cost of living where you go to school and your salary change pre- to post-MBA.

In this article, we’re going to take a look at the best San Diego MBA programs to get the highest return on your investment.

Fowler College of Business Administration – SDSU

MBA students who chose to attend the Fowler College of Business Administration at SDSU can expect affordable tuition and decent job prospects. These MBA graduates have one of the best returns on their investments in San Diego.

Over 70 percent of the most recent Fowler MBA class had a job within three months of graduation, and that percentage increased to 82.94 percent at six months post graduation. MBA students who were employed found jobs at GEICO, EY, PepsiCo, HSBC Group, Qualcomm, and more.

Tuition

Tuition at Fowler is very affordable. In fact, full-time Master of Business Administration students who are California residents can expect to pay just $29,938 over the course of their degree—$7,223 a semester. Non-California residents can expect to pay a little more, approximately $47,758 over two years.

Salary

The mean starting salary for MBA graduates at Fowler is $61,467.

ROI

The salary-to-debt ratio for Fowler MBA graduates who are residents of California is .487, which means that Fowler MBAs can expect to pay off their debt in just the first year. For non-California residents, the ratio is .777, which is still less than a year to pay off the debt.

University of San Diego School of Business Administration

Choosing to attend the University of San Diego School of Business Administration is a fairly reliable choice for return on investment. 83 percent of MBA graduates can expect to be employed three months post graduation at top companies including Amazon, Deloitte, Intel, Bank of America, eBay, Boston Consulting Group, and 21st Century Fox. But what does it look like when you compare tuition to expected salary?

Tuition

Tuition is a bit pricey compared to the other San Diego business schools. For an MBA student, it costs $1,475 per unit with 56 units required. That equals around $82,600 for tuition over two years. In addition, MBA students can expect $1,153.50 a semester for health insurance coverage with approximately $200 in additional fees. Total, over the two years, MBA students can expect to pay $87,614 for tuition and fees.

Salary

Upon graduation, MBA students at USD can expect an average starting salary of $72,363 with a range of $50,000 – $100,000.

ROI

The salary-to-debt ratio for a USD MBA graduate is 1.21, indicating that it would take you only 1.2 years to earn back what you paid for the program if every dime of your salary went to paying off your tuition.

Rady School of Management – UC San Diego

The Rady School of Management is one of the more expensive Master of Business Administration programs in San Diego, at the same time it has some of the best job prospects. Three months post-graduation, 82 percent of Rady MBA graduates accepted employment, and 10 percent started their own business for a total employment rate of 92 percent. Those individuals accepted jobs at such companies as IBM, Boeing, Cisco Systems, Amazon, Tesla Motors, Ernst & Young, Gartner, and Deloitte.

Tuition

Tuition for full-time MBA students who are also California residents is $48,961 a year—$97,922 total. For non-residents, tuition costs $55,546 a year or $111,092 total. Other non-tuition fees including campus fees and health insurance can cost an additional $4,000 a year or $8,000 over the course of the program.

Salary

Rady MBA graduates, on average, earn $84,335 as a starting salary ($87,500 median).

ROI

The salary-to-debt ratio for the Rady School Master of Business Administration program is 1.255 for California residents and 1.41 for non-California residents.

Other San Diego MBA Programs

As for the three other Master of Business Administration programs available in San Diego, not much information is provided.

- Fermanian School of Business – Point Loma Nazarene University: The cost of tuition is $825 a unit for 42 units, for a total cost of $34,650 for twelve months. So, as long as you earn more post-MBA than $40,000 it’s a good investment, though little post-MBA graduation employment information is available.

- California International Business University (CIBU): CIBU costs approximately $26,000 to earn a full-time MBA. No employment information is provided.

- California School of Management & Leadership – Alliant University: An MBA at Alliant costs $698 per unit for a total of 36 to 42 units—$25,128 to $29,316 total. No employment information is provided.

The Best Long Angeles MBA Return on Investment Bets

Return on Investment (ROI) is one of the most important factors a prospective MBA can take into consideration when choosing the right business school.

Of course, the true value of each MBA program may ultimately be something impossible to measure. The kind of connections made through professional networking, the soft skills that students attain which help them navigate through both their personal and professional life—these aren’t things that can be easily quantified. But, thankfully, factors like average salary increase, rate of post-graduate employment and the overall tuition of a program are. And these numbers can help students start to better see an overall picture of what each MBA is worth.

The Best Long Angeles MBA Return on Investment

The Marshall School of Business – USC

The Marshall School of Business at the University of Southern California is consistently one of the top ranked MBA programs in the state of California and even throughout the country. Specific ROI aside, these sorts of honors should also be a factor when considering the overall value of the program: for example, Marshall has been named the third best program for “Most Satisfied Business School Graduates” by Forbes and sixth on The Economist’s ranking of “Best Alumni Networks.”

Based on tuition for the 2017-18 school year, the total expense (tuition, fees and living expenses included) to pursue a full-time MBA at Marshall would be $95,881 for the first year and $82,522 for the second, for a total of $178,403.

Now take into consideration the fact that the average salary for graduates of Marshall’s full-time MBA program within three months of graduation is $115,309, and that the large majority of job offers (38 percent) for MBA students came from on-campus recruiting or job postings through the university. The second highest source of employment (21 percent) came from internships held while in the MBA program. Furthermore, a number of top organizations—such as Apple, AT&T, and Walt Disney Studios—hired the graduates of Marshall’s 2016 MBA class. All of these factors boost the overall ROI of Marshall’s program, making it one of the top valued programs in L.A.—even with the high price tag.

Anderson School of Management – UCLA

The Anderson School of Management at UCLA is another program which offers a high ROI when considering the types of opportunities and salaries available to students after graduation. While the tuition cost is certainly high—roughly $194,220 (including fees and living expenses) for the the two years of the program, the benefits to students are undeniable.

A look at the full-time employment report for the most recent MBA class finds that 92.4 percent of students were offered full-time employment within just three months of graduation, with 87.7 percent acceptances. By far (72.2 percent) , students found their employment opportunities through Anderson-facilitated resources, such as internships, on-campus recruiting, or from UCLA Anderson alumni and classmates.

The salaries for graduating Anderson students also reveals a positive trend: the average post-graduate compensation was $118,150, with 70.6 percent of students earning signing bonuses of up to $89,500. The connections sewn by Anderson internships and alumnae also reveal a significant payoff in the types of organizations hiring Anderson alum: companies like NBC Universal, IBM, Barclays, Google, and other major corporations now have Anderson MBA graduates on staff.

The Paul Merage School of Business – University of California, Irvine

The UC Irvine Paul Merage School of Business is one of the top business schools in the Los Angeles metro area, as evidenced by its consistently high rankings from various publications, such as the Financial Times and U.S. News & World Report.

With the program’s recognition for its high lifetime earnings combined with the relatively low cost the degree, it’s no surprise that that the program at UC Irvine produces a high return on investment. The estimated total annual cost of an MBA at Merage ranges from $67,422—$83,967, depending on if you whether or not you are a resident of California and whether or not you will be using campus. This is compared with an average post-graduate salary of $97,808 for the 2017 graduating class. About 50 percent of all students were employed by graduation, and 81 percent held full-time jobs within three months.

Graziado School of Business and Management – Pepperdine University

One of the reasons Pepperdine’s Graziado School of Business boasts such a high return on investment is the many different formats in which students can pursue a full-time degree. With the opportunity to take the full-time MBA over the course of 12, 15, or 20 months, the Graziado MBA typically costs less overall ($74,250 for the 12-month program, $99,000 for all others) and means less time away from a full-time paycheck.

Combine this with the success rate of 82 percent of students accepting job within three months after graduation and a $120,000 starting salary (at highest), and its understandable why Graziado graduates find incredible value in their degree.

Finding the Best Return On Investment for Your MBA: Dallas

Choosing the right MBA program can feel overwhelming. With nearly 800 accredited business schools in the United States, the idea of wading through the information on every program is intimidating to say the least. A variety of features, such as a school rankings, internship opportunities, and an extensive alumni network may be huge factors where you choose to earn your master’s. But one of the most important variables to consider is a program’s return on investment (ROI). It is essential to pick a school with an enviable ROI, as this will ensure that the time and money you dedicate to earning your MBA are not for naught. Given the considerable cost of higher education, it is important to attend the school that will give you the most bang for your buck.

The Best Dallas MBA Return on Investment

Cox School of Business – Southern Methodist University

At the SMU Cox School of Business, students can expect an admirable rate of return on the cost of education. The tuition rate of $45,976 per year for the two-year program is among the most enviable in the U.S. The average graduating salary for MBA’s was $96,587, which is more than double the yearly cost of tuition. This school is also ideal for students hoping to global perspective, as students at Cox have the opportunity to participate in an international MBA exchange program, which allows them to continue their education in Latin America, Europe, Australia, or Asia. Simply put, SMU Cox doesn’t just provide one of the best Dallas MBA return on investment opportunities, but one of the best in the country overall.

Hankamer School of Business – Baylor University

Baylor’s Hanker School of Business is another excellent option for students seeking a respectable ROI. The full-time program can span from 16 to 21 months, with a tuition of $20,597 per semester (over about three to four semesters, depending on course load and core requirements met during undergrad). According to Hankamer’s website, the average starting salary for MBA graduates in 2017 was $73,314. Additionally, Hankamer’s Career Management team is nationally-ranked, and can provide extra support for students seeking help with job placement.

McCombs School of Business – University of Texas at Austin

The MBA program at the McCombs School of Business currently costs $30,750 per semester, bringing the total tuition to about $123,000. The cost will is steeper for non-residents (closer to $189,000). Though the cost of tuition at McCombs is nothing to sneer at, neither is the reward. In fact, the most recent MBA class had an impressive average starting salary of $117,068. McCombs, which is also one of the largest business schools on this list, also has an extensive alumni network, which includes the CEOs of Southwest Airlines (Gary C. Kelly) and Heinz (William R. Johnson).

Naveen Jindal School of Management – University of Texas at Dallas

Like many of the schools we mentioned on this list, the Naveen Jindal School of Management has a solid track record when it comes to ROI. Tuition for the full-time MBA program is just $32,998 for in-state residents and $64,332 for non-residents. In addition to the reasonable cost, the school’s website states that 80 percent of students receive scholarships that cover an average of 45 percent of the total program cost. In 2017, U.S. News & World Report stated that the school’s MBA program, “… had the highest salary-to-debt ratio among ranked business schools.” According to the article, average starting salary for graduates (of those who were employed within three months of graduation) was $86,644.

Neeley School of Business – Texas Christian University

At TCU’s Neeley School of Business, the average starting salary for the most recent graduates of the full-time MBA program was $93,093, surpassing the total tuition of $88,020. Moreover, Neeley boasts a 92 percent employment rate 90 days after graduation. Recent graduates have taken jobs at renowned companies like Ernst & Young and IBM. In addition to standard core classes, Neeley introduces a great deal of experiential learning into the curriculum. At the end of their first year, students participate in an Integrative Project that offers them the opportunity to apply their skills to real-world business obstacles via a week-long simulation.

USC Marshall Professor Explains the Return on Investment of Gratitude

Glenn Fox, the Head of Design, Strategy and Outreach for USC Marshall’s Performance Science Institute, believes that being thankful comes with a significant return-on-investment in business. According to a press release, Fox has focused his latest research on correlating gratitude and human performance. Continue reading…

Finding Philly’s Best MBA Return on Investment

It’s no secret that Philadelphia’s relatively low cost of living has historically made the Birthplace of America an attractive option for those in search of a big city experience outside the skyrocketing markets of other major East Coast cities.

As people flock from the New York metro region in search of a similar urban adventure at a substantially lower price point, Philadelphia has been controversially dubbed the “6th Borough.” Word to the wise for potential b-school interlopers: never tell any Philadelphian their home has been annexed by New York City.

About 90 minutes by train from New York City, the City of Brotherly Love is no Big Apple, but it’s one-of-a-kind. Sure, tourists and locals alike grip cheesesteaks in one hand while pumping their fists on the steps of the Art Museum a la Rocky, but the city reveals itself to those who have the patience (and wherewithal) to dig into it.

Whether that means embarking on a two-year MBA program or choosing among the accelerated options available, Philadelphia just happens to be home to several top ranked MBA programs in the world. Let’s take a close look at Philly’s programs. Oh, and here’s a napkin for the wiz.

Philadelphia Return on Investment

University of Pennsylvania’s Wharton School of Business

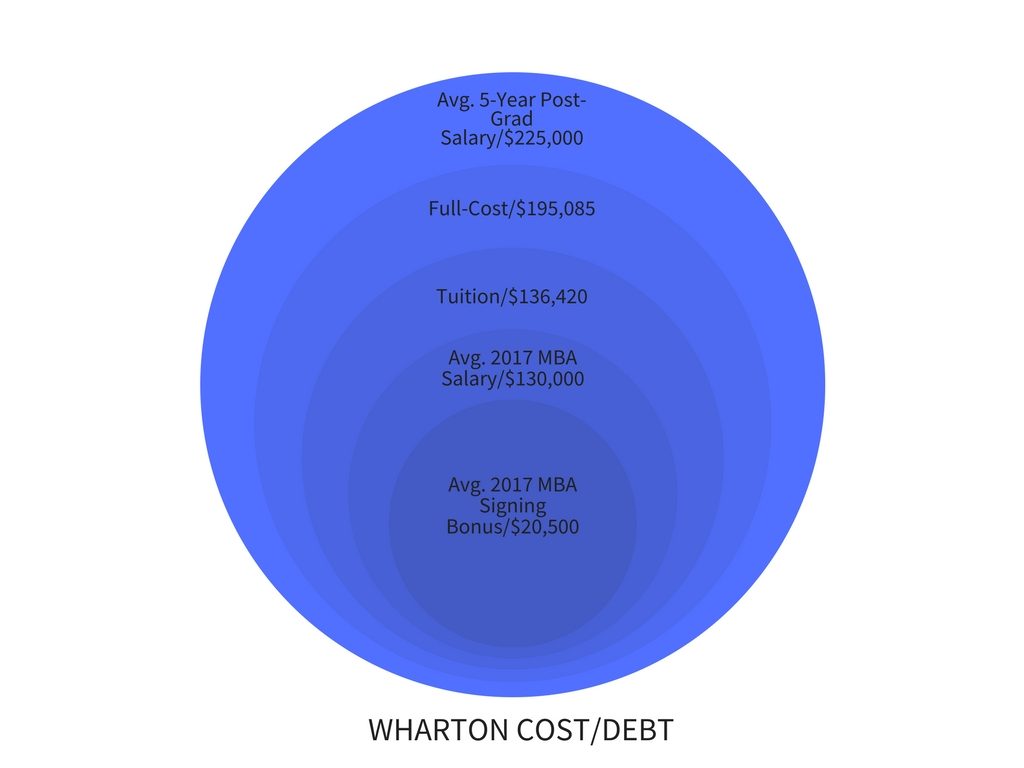

Officially the oldest business school in the U.S., The Wharton School at the University of Pennsylvania boasts well-known alumni billionaire financier Ron Perelman, LinkedIn CEO Jeff Weiner, and John Sculley of Pepsi and Apple. Wharton’s tuition of $136,420 and estimated total budget of $195,085 isn’t to be taken lightly. However, full-time MBA graduates earn an average base salary of $130,000 with an average bonus of $20,500, and a supreme 92.6 percent job acceptance rate. So, while having a somewhat unimpressive salary-to-debt ratio, Wharton’s reputation and alumni network precedes itself.

In fact, the school recently topped the annual Forbes best full-time MBA program list, sporting the best five-year financial gain after graduation. Wharton MBA graduates of the Class of 2012 are making a $225,000 average annual salary—roughly 42 percent higher than recent grads, easily topping the cost/debt ratio of the program.

Saint Joseph’s Haub School of Business

Notable alumni of Haub School of Business at Saint Joseph’s University include CEO of NutriSystems, Inc. Michael J. Hagan, Chairman and founder of Philadelphia Consolidated Holding Corporation James J. Maguire, and Senior vice president of PNC Bank Denise Viola-Monahan. SJU’s $30,294 tuition set against an average base salary of $65,000 means the school offers a competitive MBA to those who don’t want to break the bank.

Temple’s Fox School of Business

Fox School of Business at Temple University’s notable alumni include Systel CEO Jai Gulati, former COO and president for ConocoPhillips John Carrig, and CEO of Actavis and co-founder of Health Care Compliance Association Brenton L. Saunders. Fox’s tuition sits at $57,048 for residents and $80,484 for nonresidents. With a 97 percent job placement rate compared to $25,623 average debt and a $85,278 average base salary, Fox’s salary-to-debt ratio looks attractive.

Drexel University LeBow College of Business

The LeBow College of Business at Drexel University alumni include President and CEO of Rohm and Haas Raj Gupta, former CEO of Science Applications International Corp. Kenneth C. Dahlberg, and the Phillie Phanatic Tom Burgoyne. Tuition is $59,565, and graduating MBAs carry an average debt of $43,894. With a reported average base salary of $84,080, LeBow’s salary-to-debt ratio is competitive. Considering the comparatively low price point, LeBow emerges as an incredibly attractive ROI.

YOU MAY ALSO LIKE: How Philadelphia MBA Programs Help Lower-Income Applicants

University of Delaware Lerner College of Business

A short 20-minute train ride from Center City Philadelphia and under two hours from New York City, the Lerner College at the University of Delaware has an eye-catching reported average base salary of $90,291. Compared to tuition, which ranges from $33,000 to $55,000, depending on residency, Lerner’s ROI could shine through if figures hold true for most MBA earners from this institution.

Penn State Smeal College of Business

Although its central campus is located in Happy Valley, PA, the Smeal College of Business at Penn State offers an executive MBA program in Philadelphia. The program is priced at a hefty $102,000, but average graduate debt is reported at $36,500, and median salaries ranging from $97,890 to $101,857. With such an impressive salary-to-debt ratio, Smeal is an attractive option for those who prefer easy metro access rather than living in the thick of the action. Notable alumni include Chairman and CEO of Petroleum Products Corp. John Arnold, and Former Chairman and CEO of Merrill Lynch & Co. William Schreyer.

Rounding Out the Best Return on Investment for New York City MBAs, Part III

In an accelerated political and economic landscape, New York City remains the center of gravity for international business. But year after year, how do newly minted New Yorkers survive in a city where the cost of living is reportedly 70 percent higher than the national average? This is especially true now when fewer and fewer aspiring professionals can afford to sacrifice continuity of employment to advance their careers.

Looking At New York City’s Best MBA Return on Investment, Pt. II

New York City is an obvious choice for budding entrepreneurs, consultants, and financiers to find their footing.

Manhattan is regularly called a playground for the wealthy, with a 2016 Newsweek article playfully and indiscriminately dubbing rich people New York’s new urban blight. So, if you’re one of the millions of people hopping into New York to extract its cultural and financial resources for personal gain before migrating to some more humane province, why not do an MBA there while you’re at it?

The proximity of New York business schools to the city’s wealth of opportunities means that MBAs have a kind of access that make b-schoolers elsewhere in the country—and the world—salivate. New York’s matchless combination of industry, culture, and strategic location means that any one of the numerous business schools that populate the region will give MBAs a veritable nitrous boost when it comes to post-graduation job placement. In fact, earlier this month we covered five other NYC MBA programs that give graduates the best return-on-investment.

You’ve surveyed the best so let’s try the rest! While Part 1 was populated by the most elite and therefore more expensive MBA options in the region, Part 2 focuses on New York programs that are more practical choices if you’re doing business school on a budget. These programs tend to offer comparatively smaller returns-on-investment but the advantage is their affordability.

So, let’s take a deeper dive into four more New York-area MBA programs that offer the best returns-on-investment for graduates.

Lubin School of Business — Pace University

The Lubin School of Business counts Hearst Magazines president Michael Clinton ’83, HBO Chairman and CEO William C. Nelson ’75, and former Chairman and CEO Ivan G. Seidenberg ’81 among its notable alumni. With tuition for Lubin’s two-year full-time MBA priced at $71,340, the program qualifies one of the mid-range options on our list. MBAs graduate with an average salary-to-debt ratio of 68 percent culled from average debt of $44,076, according to U.S. News & World Report, and an average base salary of $64,425.

Gabelli School of Business — Fordham University

Notable Gabelli School of Business notable alumni include UnitedHealth Group CEO Stephen J. Hemsley, ’74; former JP Morgan CEO Maria Elena Lagomasino ’77; Countrywide Financial Corp Co-Funder, Chairman, and CEO Angelo R. Mozilo ’60; and Empresas Polar CEO Lorenzo Mendoza. At $87,807 for its two-year full-time MBA, Gabelli’s tuition is among the priciest on our list but the handsome 53 percent salary-to-debt ratio makes up for it. MBAs graduate with an average debt of $51,870 and go on to earn an average base salary of $97,404.

Tobin School of Business — St. John’s University

The Tobin School of Business at St. John’s University is one of the most affordable MBA programs on our list, with tuition priced at $43,740 for its two-year full-time MBA. Tobin MBAs graduate with an average debt of $28,291, which when set against their $59,276 average base salary, yielding a 48 percent salary-to-debt ratio.

Stevens Institute of Technology School of Business

Recent noteworthy employers of the Stevens Institute of Technology School of Business MBAs include ExxonMobil, Goldman Sachs, Johnson & Johnson, JPMorgan Chase, L’Oreal, Lockheed Martin, Microsoft, Tishman Realty & Construction Co., Turner Construction, UBS Financial, and Verizon. Although tuition is priced at a competitive $68,988 for its two-year full-time MBA, Stevens actually has the highest salary-to-debt ratio of any school on our list, at 72%. Stevens MBAs graduate with an average debt of $48,244, according to CNN Money, and go on to earn an average base salary of $67,100.

Looking At New York City’s Best MBA Return on Investment (Pt. I)

As real estate in all five boroughs continues to rise, and/or get snapped up by oh-so-wonderful oligarchs, New York City’s pressure cooker reputation has taken a turn for the … banal.

Finding the Best Return on Investment for Your MBA in Washington DC (Part II)

Washington DC is littered with powerful people and exciting opportunities. You could find yourself sitting next to the Fed Chair at the symphony and then running into a Senator at the bar later that evening. So, what better place to start your business education and career than the true seat of power for the entire Western World?

Before investing in an MBA it’s essential to make sure that the school you choose will give you the tools you need to excel in your industry without breaking the bank.

In our first installment to the Washington DC ROI series, we talked about the metro’s schools that give you the greatest bang for your buck. In part two, we delve into even more schools that have topped our list of programs that offer the best return on investment (ROI) for your MBA in DC.

The Best Washington DC Return on Investment (Part II)

Kogod School of Business—American University

With alumni who’ve gone on to positions such as CEO of Goldman Sachs and Executive VP of Turner Classic Movies, it is no secret that Kogod School of Business prepares its students for a range of highly coveted leadership positions. The average starting salary for MBAs is $78,556, which exceeds the $75,166 cost of tuition. Moreover, an average 88 percent MBAs receive job offers within three months of graduation. The full-time MBA is a 49-credit program that lasts for 21 months. Most of the courses are completed during the first year. Kogod’s program includes weekly Business Leadership Luncheons, wherein students can engage in personal conversations with senior executives from companies like Marriott International, IBM, and PayPal.

George Mason University School of Business

At the George Mason University School of Business, students can hone their leadership and management skills while gaining perspective on the intricacies of the ever-changing world of international business. Business school students at Mason can choose to take their classes at either the Arlington or Fairfax campus, both of which are easily accessible from Washington DC. For aspiring MBAs based in Virginia, Maryland, or the capital, this school’s return on investment is undeniable. Residents of the aforementioned areas pay a full tuition of $45,600, and the average salary for graduates is $86,000. Though the tuition is significantly higher for students from outside of Virginia, Maryland, and DC, at $84,072, the significant average salary still makes stellar choice. The 48-credit program involves an optional week-long global residency, offered once students complete the core curriculum. In the past, global residency locations have included places like Singapore, Buenos Aires, and Prague.

Check Out Part 1: Return on Investment – Getting Your Money’s Worth in Washington DC

McDonough School of Business—Georgetown

There is no denying the prestigious reputation of Georgetown’s McDonough School of Business, which was recently named by Forbes as one of 35 best business schools in the U.S. Students in this program have the opportunity to experience real-world work problems through the Global Business Experience, during which they consult with an international company. At the Global Business Conference in DC, students then present their projects to an audience of their peers. A Georgetown degree carries enormous weight, and in recent years the average starting salary for MBA grads has leapt to a remarkable $108,000. The Georgetown name, combined with rigorous curriculum, a prime location in the nation’s capital, and the undeniable financial success of its alumni make McDonough’s overall return on investment undeniable.

Getting Your Money’s Worth: The Return on Investment of the Chicago MBA

Although a growing number of business schools throughout the country are offering part-time or Flex MBA programs, many ambitious business students still choose to pursue their education full-time. However, the often high price of tuition combined with two years of lost income can be a huge deterrent in students choosing a full-time MBA program.

Although the thought of taking two years off from a career may be daunting—especially when it comes to a quickly growing city like Chicago—prospective MBAs should also keep in consideration one of the benefits of having an advanced degree: a salary bump. Considering this, students can better evaluate the true return on investment (ROI) program full-time MBA and make smart decisions about where their money will go farthest.

Don’t let the high price tags of MBA programs in a major business city Chicago scare you away. Below are the Chicago business schools that offer students the best ROI.

Kellogg School of Management – Northwestern University

Northwestern University’s Kellogg School of Management boasts one of the highest ROI’s in the world, ranking fourth overall among the world’s best business schools on Forbes recently released list of the best full-time MBA programs in the U.S. Forbes‘ ranking is weighted specifically by how well compensated graduates are several years after earning an MBA.

Forbes ranking notes that 2012 MBA graduates are now making an average of $84,800 in their return on investment. While several business schools will often have a higher-level of compensation for in-state residents because of tuition differences, Kellogg tuition rates remain constant for both in and-out-of-state applicants. On average, students earn around $80,000 per year prior to enrollment, which increased to an astounding average of $196,000 just last year. Most grads pay their entire tuition back less than four years after graduating.

YOU MAY ALSO LIKE: Kellogg Launches 10 New Courses

Booth School of Business – The University of Chicago

In 2016, the Booth School of Business at the University of Chicago topped the ValueWalk list for having the highest return on investment in the world. Comparing the relatively low cost of a Booth MBA (around $65,000-70,000) with graduate salaries of up to $150,000 or more, Booth graduates will have paid for their degree twice over by the time they have completed their first year of work. Booth graduates are also likely to find work quickly—within three months of graduation, 98.4 percent of all MBA graduates had secured job offers. Booth alumni also find many of their post-graduate opportunities through a broad network of alumni and career support at the university. In 2016, the university was responsible for facilitating 75.2 percent of student’s new jobs.

Lake Forest Graduate School of Management

The Leadership MBA at Lake Forest Graduate School of Management current tuition is $55,600 per year. According to PayScale figures, Lake Forest MBA grads earn around $107,000 annually—a difference of over $51,000. Graduates from the LFGSM are spread throughout the globe, living in all 50 states and in 15 countries around the world. Alumni from the MBA program hold positions as CEOs of major companies, elected officials, entrepreneurs, and leaders in a wide variety of industries.

Return on Investment: Getting Your Money’s Worth in Washington DC

Earning an MBA is a big commitment in terms of both time and financial resources. Attending school in Washington, D.C. will open students up to a wealth of job and internship opportunities. However, with the cost of living and education in the financial capitals of the US rising at an alarming rate, choosing a school that will leave you with the smallest debt for the best job prospects is paramount to not being saddled with debt for the next 30 years of your life.

Though a price can’t be put on the value of the stellar education and business acumen you’re sure to get in business school, we can certainly try. Below, we’ve worked out the schools that guarantee the best return on investment in Washington DC metro.

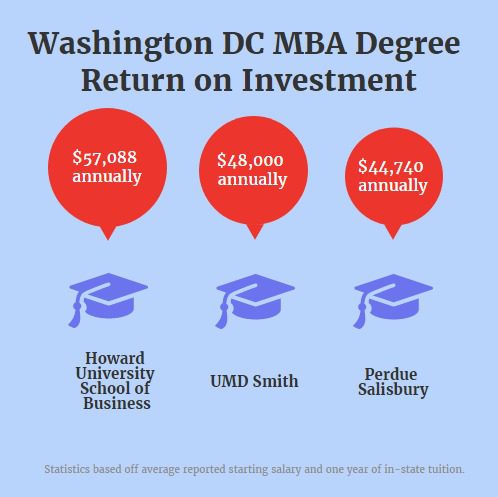

Washington DC MBAs That Offer the Best Return on Investment

University of Maryland R.H. Smith School of Business

At the University of Maryland’s R.H. Smith School of Business, students can earn their degree just eight miles from the White House. Tuition at UMD Smith comes to about $47,004 for in-state residents per year and $56,184 for those from out-of-state. Though the business school’s MBA program may not be considered “cheap,” the average starting salary for MBA’s from the class of 2016 was $95,600—nearly double the annual tuition cost for both in and out-of-state students. This incredibly high average starting salary makes Smith well worth the price. In the past, Smith alumni have landed internships and full-time positions at companies like Amazon, Marriott, and Google. Thus far, majority of Smith MBA grads have gone on to pursue careers in marketing or consulting.

According to the recently released Forbes list of the best MBA programs in the U.S., UMD Smith (46th overall) MBA grads now expect a net-gain of $45,000 five years after graduation, when taking into account the average salary increase, cost of the program, and more.

Perdue School of Business—Salisbury University

Though it is closer to Baltimore than DC, Perdue School of Business MBA students are sure to see a significant return on investment for their education. The tuition is only about about $11,760 for in-state residents and $23,850 for out-of-state applicants. Not to mention the average alumni salary is $56,500, which essentially means the average alum sees a significant return on investment in less than a year. The year-long program is delivered in a hybrid format, so students only need to meet on campus one night per week. Students looking for even greater flexibility can also choose to take 100 percent of courses online. Additionally, students who wish to move at a slower pace can take classes part time and choose their own schedules.

Howard University School of Business

The Howard University School of Business MBA program was the first DC university to earn AACSB International accreditation. Annual tuition for the full-time MBA program per year is a reported $33,996. The total for the two-year program comes to around $70,968. Considering U.S. News puts the average MBA starting salary at $91,084, the return on investment is undeniable. Howard also offers a variety of dual degree programs, including JD/MBA, MD/MBA, BSE/MBA, and more. One unique feature of Howard is its Global Trilateral MBA (GTMBA), which gives students international consulting experience in places like China and South Africa.

Which Boston MBA Programs Offer the Best Return on Investment?

A stellar résumé, well-targeted recommendation letters, and a strong GMAT score may be vital in earning a spot in your dream business school, but one factor that may weight heavier than everything else is the return on investment. Will the school be worth it? How successful are its alumni? How do employers feel about the school name on a diploma?

A person needs to know that their time—and money—will amount to success and a well-paying job. If Boston‘s the city for you, here are the top four business schools if return on investment, or ROI for short, is on your mind.

#1) Harvard Business School

This prestigious university might come as no surprise as first on our list. But it’s not at the top for nothing. Home of one of the world’s first MBA programs, Harvard Business School is a bit separate from the main campus itself in Cambridge, sitting in Boston’s Allston neighborhood.

Unsurprisingly, the program’s ROI is highly-competitive. Tuition at HBS currently costs around $72,000. That’s a lot more than how much a student might pay per year elsewhere, even without considering the usually stellar track record of HBS grads. Graduates in 2016 had median base salaries of $135,000 with a median signing bonus of $25,000. Sixty-eight percent received a signing bonus. That’s a lot of people. And it’s a pretty sure thing. Work hard at Harvard, and it appears you’re sure to reap the benefits.

READ MORE: HBS Announces Largest-Ever Scholarship Donation

#2) Sloan School of Management – MIT

At MIT’s Sloan School of Management, students can feel certain they’ll succeed after graduation. Individuals, of course, may determine their own success, but Sloan knows how to get its students there. The school is known for its business offerings, particularly its global Sloan Fellows program. There, students can walk away with an executive MBA in just one year. Sloan has been growing its educational base since 1914 when its “Engineering Administration” course set a business tone in the technical school.

Currently, tuition at MIT Sloan sits at $71,000, which isn’t much less than Harvard’s. The median base salary for 2016 graduates was $125,000, with salary ranging anywhere from $40,000 to $200,000.

The business school can provide a myriad of opportunities, especially through its various centers and initiatives, which focus on, science, innovation, medical research, and more.

#3) D’Amore-McKim School of Business – Northeastern University

This business school is tucked in Boston’s arts neighborhood, the Fenway Cultural District. Northeastern University offers multiple campuses, but the MBA programs take place at the D’Amore-McKim School of Business.

MBA students pay the same tuition for classes online or in person: $1,560 per credit hour. For a year, that’s roughly $28,080—significantly less than the aforementioned Harvard and MIT. So if you’re not ready or can’t afford to drop a bunch of money on costs, D’Amore-McKim might be the program for you. Its graduates go on to make $81,000 a year, which is nearly 66 percent more than yearly tuition. The top base salary for recent alumni is $115,000.

These employment opportunities come quickly: 96 percent of D’Amore-McKim alumni accept a job offer within three months of graduation.Companies like Zipcar and Hasbro, Inc., hired graduates last year. Resources like the Graduate Career Center and the school’s clubs can help students make it. Clubs like the Emerging Markets Club gives students the hands-on experience they need to succeed.

#4) Questrom School of Business – Boston University

The Questrom School of Business at Boston University offers a variety of MBA programs. The first was launched in 1925, but the school went on to add an executive MBA, public and nonprofit MBAs, evening MBAs, and health sector MBAs.

A full-time MBA tuition costs $51,916 at Boston University. The prices vary depending on which program a student decides is right for them, which contributes to the school’s placement on the list. For example, the executive MBA costs nearly double the traditional MBA rate. However, alumni do go on to make that money back. In 2016, graduates’ mean base salary was $100,820. About 92 percent of graduates accepted a job offer just three months after earning a degree, with nearly all taking an internship. Places like General Motors and IBM hired recently hired Questrom grads.

You could be next. But it’s up to you to decide what school makes the most sense for you. You’re onto something with Boston though. The seafood will never end, and the accents will always entertain. Find the city’s best executive MBA program or explore its one-year MBAs if you need just a little bit more info.

The Best MBA Return on Investment in the Houston Metro

One of the top things an MBA looks for when choosing a business school is the return on investment. Return on investment, or ROI, is one of the most common profitability ratios, and an easy way to determine if an MBA is “worth” your time and money. We took a look at the Houston metro, and ranked the top business schools in the area based on their ROI, comparing average starting salaries with tuition costs. Continue reading…

Metro News & Notes: Return on Investment, Firing CEOs and More

Good morning and happy Friday!

Here are a few stories you may have missed from the week that was …

The Return on Investment of the Rady MBA

Sponsored Content

The constantly changing landscape of business means that those who stand still fall behind. To be successful, business professionals must constantly pursue new knowledge, skills, and experiences. They must also immerse themselves in innovation and invest in their career. One of the best ways to do all of this: earn an MBA.

Gabelli Student Managed Investment Fund Produces 5% Return For Semester

Fordham’s Gabelli School of Business recently revealed its newest milestone: for the first time in the seven-year history of its Student Managed Investment Fund, a group of students produced a 5.44 percent return on investment for the semester, breaking the previous record of 4.64 percent—nearly an entire percentage point higher than ever before.

Cornell’s Business Impact Symposium Returns, and More – New York News

Let’s explore some of the most interesting stories that have emerged from New York City business schools this week.

Cornell Business Impact Symposium: Bridging Sustainability and Enterprise – Johnson Business Blog

Cornell’s SC Johnson Graduate School of Management Center for Sustainable Global Enterprise hosted this year’s Cornell Business Impact Symposium (CBIS), which featured sustainability experts from the food, fashion, technology, and finance industries. Current MBA students shared their takeaways from the symposium on the Johnson Business Blog.

René Bonomi, MBA ’19, cited the “Combating Climate Change with Clean Energy Innovations” panel as a highlight, which surveyed “trends in the energy industry, such as storage improvement, and illuminating innovative start ups such as Dimensional Energy and Energy.”

Sarah Theobald, MBA ’19, was struck by the “From Fashion to Food: Excursions through Sustainable Supply Chain” panel, which “covered an array of hot topics from supply chain traceability and upcycling to the challenges of measuring social impact as well as reconciling emerging market manufacturing practices with United States corporate standards.”

Left to right; Martie Curran (Nestle Waters), Funlola Otukoya (CDP), Eileen Quigley (NRDC), Michael Van Brunt (Covanta Energy), and Jim Armstrong (Climate Changers) / Photo via johnson.cornell.edu

Read more about this year’s CBIS here.

Podcast: Mark Conrad on the Business of Sports – Gabelli Connect

The American sports industry, somehow, is becoming a bigger monolith than ever before. In fact, Forbes projects the professional sports market in the United States to grow from $60 billion to $73 billion by 2019.

Recently, Fordham University Gabelli School of Business associate professor and sports business concentration director Mark Conrad was a featured guest on a Fordham-produced podcast to discuss his organizational predictions for the NFL, Major League Baseball, and NCAA.

You can listen to the interview with Conrad below and find out more here.

A Summer Class Set in Israel – Rutgers Business School Blog

Rutgers Business School Entrepreneurship professor Gary Minkoff has spearheaded a three-week long summer course entitled Doing Business in Israel, which will “introduce students to the entrepreneurial culture and business world inside Israel,” including local Israeli aerospace, artificial intelligence, biometrics, clean technology cybersecurity, pharmaceutical engineering, robotics, and venture investment industries.

“We’re teaching entrepreneurship and innovation, so why not connect students with places where that’s happening. This course aims to plant many seeds for potential collaborations between Rutgers students and Israeli entrepreneurs and innovators,” Minkoff said.

You can learn more about the course here.

Rutgers Director on Complexities of U.S. Investment in Cuba

Kevin Riordan, the Executive Director of the Center for Real Estate at the Rutgers Business School recently surveyed the potential—and pitfalls—of American real estate investment in Cuba.