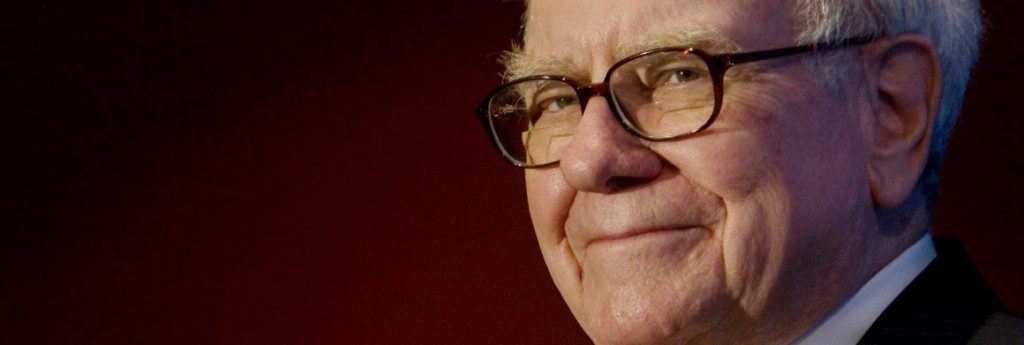

Last month, 20 MBAs from DePaul University’s Kellstadt Graduate School of Business were chosen to meet one of the most successful investors in the world — Warren Buffett.

The group traveled to Omaha, Nebraska — the headquarters of Buffett’s investment company, Berkshire Hathaway. On April 1st, They toured various Berkshire companies before taking part in an informal Q&A session with Buffett himself.

The MBAs from Kellstadt were the only group visiting the “Oracle of Omaha” on April Fools Day. Buffett, who some rank as one of the most successful investors of the 20th century, responded to 16 student questions from a total of 160 people over a two hour period. A wide range of topics were discussed which included Buffett’s investment approach, career advice for students, the financial crisis, his political views, and his biggest investment mistake.

MBA candidate Kevin Carey gave a first-person account of the group’s question and answer session with Buffett in a blog post on the Kellstadt website. Carey writes:

Quite surprising to me, Mr. Buffett offered sound advice not only on his professional area of expertise of investment management, but also on personal matters, such as the importance of family.

When it comes to investing, Mr. Buffett said you should avoid leverage and overreacting. The hardest part of investing is going against the grain, he said.

Often, he said, the best investment opportunities occur when everyone else is overemotional, as in times of economic crisis. The smart investor checks her emotions and looks for the opportunity in the midst of the storm, he advised. In addition, Mr. Buffett recommends mastering the language of accounting and public speaking, as well as understanding business valuation and the behavior of stock markets.

The students were able to get to see how several Berkshire Hathaway-owned companies work, including Nebraska Furniture Mart, Borsheim’s Jewelry, and Oriental Trading Company. In addition to these companies, Berkshire Hathaway wholly owns GEICO, BNSF, Lubrizol, Dairy Queen, Fruit of the Loom, Helzberg Diamonds and NetJets, owns half of Heinz, owns an undisclosed percentage of Mars, Incorporated and has significant minority holdings in American Express, The Coca-Cola Company, Wells Fargo, and IBM.