Northwestern Kellogg Launches 10 New Courses

Northwestern University’s Kellogg School of Management has just launched ten new business courses for the 2017-18 academic year, according to a recent press release.

“We are very excited to continue our tradition of curricular innovation at Kellogg, drawing on both the scholarship or our research faculty and our connections with practice,” Senior Associate Dean for Curriculum and Teaching Mike Mazzeo said.

For data-focused business studies, the school has launched the brand new Data Exploration course, taught by finance professor Robert L. McDonald, who says; “It is now common in business to need to analyze large and unwieldy datasets. We moved from calculators to spreadsheets in the 1980s and now we need to move beyond spreadsheets.” The premise of the Data Exploration course, he added, “is that students should be able to work with and analyze raw data from a variety of sources and a variety of forms, using methods that scale. We will use R, which has become one of the dominant tools in data analytics.”

Two new marketing courses have been introduced to the curriculum: Customer Loyalty, taught by Kellogg Senior Fellow Thomas O’Toole; and Ethnographic Customer Insights, taught by adjunct professor Gina Fong. On the latter, Fong notes; “Ethnographic research is not just a way to answer important business questions, but also a way to bring the customer to life inside a company, helping make the decision-making of the company more customer-centric. Knowing the insight into the customer gives the marketer the ability to anticipate what the customer needs and wants—sometimes before he or she are able to articulate it.”

Two new collaboration and leadership programs have been introduced to the MBA curriculum as well, with Strategic Communications for Organizations, arriving next winter, and Leadership Development Models & Practices, which is available now. In addition, three new Public-Private Interface courses have been or will soon be introduced by Kellogg, covering Strategic Perspectives in Nonprofit Management, Social Impact & Technology Innovation, and Decision-Making for Sustainable Business.

As well, Kellogg has introduced courses in Commercializing Innovations and the CEO Playbook for Health System Success course, both of which will be offered in the winter and spring 2018 semesters, respectively.

You can read more about the new offerings at Kellogg here.

MIT Sloan 2016 Employment Report Reveals Slipping Salaries

The MIT Sloan School of Management, late last week, released its 2016 Employment Report for MBAs, revealing slightly slipping salaries year over year and slightly lower percentages of graduates heading into consulting and technology than in prior years. The pharmaceutical/healthcare industry drew the third largest percentage of graduates—5.8 percent—knocking investment banking out of the top three for the first time—perhaps ever. Investment banks drew just 4.7 percent of the 2016 class, down from 6.1 percent last year, 6.8 percent in 2014 and 8.1 in 2013.

As it has for several years running, consulting snapped up the most MIT Sloan grads this past year, 30.5 percent, but that represents a second consecutive year of decline, from 33.9 in 2014 and 32.1 in 2015. The technology sector drew almost as many graduates as consulting—29.3 percent of the class. That was down slightly from 2015’s 30.7 percent, but an increase over 2014’s 26.1 percent and significantly up from the 19.2 percent that went into tech in 2013.

McKinsey and Amazon Compete with Founders’ Dreams

In terms of absolute numbers, more MIT Sloan ’16 MBAs headed off to work for McKinsey than any other company—26, or 6.6 percent of the entire class. Amazon was second, luring 23 recent grads. Falling right between these two top hiring firms were the 24 graduates not seeking employment because they were starting their own businesses, down slightly from last year’s 28 founders. Representing 6.1 percent of the graduating class this year (and 7 percent last year), the ranks of entrepreneurial founders at MIT Sloan rival schools like Harvard Business School, where founders made up 6.8 percent of the most recent class. But they still trail Stanford Graduate School of Business, with its whopping 15 percent of 2016 graduates who started their own ventures upon graduation.

The other consulting giants—Bain and Boston Consulting Group—drew the next largest contingents of recent grads, 17 and 14 respectively. Then came tech firms Microsoft and Google, snapping up nine and eight a piece. Bank of America Merrill Lynch was the sole investment bank named among Sloan’s top hirers in 2016, employing five recent grads.

Salaries Hover at or Below Prior Year Levels

As for how much money Sloan grads are bringing home, the median base salary for 2016 grads remained at 2015 levels, $125,000. The mean base salary for graduates heading into what MIT Sloan breaks out as service industries—consulting, software/internet, investment banking/brokerage, retail, private equity/venture capital, investment management, diversified financial services and media/entertainment—was $126,841, down slightly from the prior year’s $127,601. Grads heading into manufacturing industries—including pharmaceutical/healthcare, computers/electronics, consumer products, automotive/aerospace, oil/energy, telecommunications and transportation/equipment/defense—claimed a mean starting salary of $120,696, down from last year’s $123,416.

Fewer students—66.1 percent—reported signing bonuses in 2016 than the 75.3 percent who reported them in 2015. But 2016 saw a rise in the prevalence and amount of other guaranteed comp. This year, 22.1 percent of graduates reported receiving other guaranteed compensation, with a median of $23,401. The year before, only 18.8 percent expected other guaranteed compensation and the median was lower at $20,500.

The highest starting salary of the Class of 2016—$200,000—went to a student entering what MIT Sloan categorizes as “Manufacturing, Other,” explaining in a footnote that other refers to manufacturing, telecommunications, and transportation/equipment/defense. The lowest, $50,000, went to a grad heading into the retail industry.

MIT Sloan breaks out signing bonuses not by industry but by function. The highest signing bonus for this most recent group of grads was $77,000, awarded to a graduate who is now working in product management/development. The median signing bonus varied depending on function, with leadership development/general management/consulting/marketing/operations roles coming in around the $25,000 mark but investment banking and “finance, other” (including corporate finance, finance operations, treasury and M&A) reporting median bonuses of $49,000 and $47,500 respectively. The median other guaranteed compensation, meanwhile, was $19,500, ranging from $100 at the low end to $89,380 at the upper limit.

Tech Tops Consulting for Second Year Running in Drawing Sloan Interns

A look at where MIT Sloan Class of 2017 MBA students chose to intern shows technology holding the greatest sway, with 29 percent of students heading to tech firms for the summer. This is down from 2015, when 33.2 percent headed into tech for their internships, but it still outdistances the consulting industry, which this past summer drew 21.9 percent. Unlike with full-time jobs, investment banking held onto the third spot in terms of attracting interns, drawing 8.1 percent of the class. Pharma/healthcare, which beat out investment banking in terms of full-time positions, attracted 7.4 percent.

Salaries for summer interns at Sloan edged upward slightly depending on the industry. For students interning in service industries, the median monthly pay was $8,000, no change from the summer before. But the mean monthly pay moved up to $8,633, from $7,771. For students interning in manufacturing industries, the median monthly salary stayed constant at $7,200, but the mean monthly salary dipped from $7,102 last year to $6,871 for the most recent crop of interns.

Timing of Job Offers, Reason for Accepting Jobs

In terms of the timing of job offers, 88.7 percent of MIT Sloan 2016 grads had job offers at the time of graduation, down from 91.5 percent the year before. But by three months out from graduation, 95.3 percent had offers, pretty much on par with the prior year’s 95.6 percent.

Source: MIT Sloan 2016 MBA Employment Report

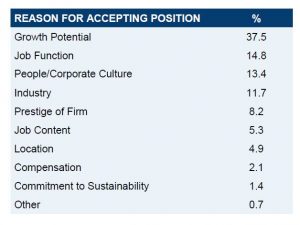

A little dip in salaries may be no big deal for MIT Sloan grads, according to an additional set of metrics shared in the school’s employment reports. Unlike many peer schools, MIT Sloan includes statistics on why graduates accepted the jobs they did. Far and away the most important factor contributing to what job Sloanies accepted was potential for growth, cited by 37.5 percent of graduates. Job function was the reason reported by 14.8 percent, followed by company culture, cited by 13.4 percent, and then industry, named by 11.7 percent. Far fewer Sloanies accepted the jobs they did because of firm prestige (8.2 percent), job content (5.3 percent), location (4.9 percent), compensation (2.1 percent) or commitment to sustainability (1.4 percent).

View the complete MIT Sloan 2016 MBA Employment Report here.

This article was edited and republished with permissions from Clear Admit.