Social Media Do’s and Don’ts MBAs Need To Know

Social media can be an impossibly powerful tool. It is the president’s favorite method of communication, after all. Social media can also determine the future for MBA applicants and candidates.

For better or for worse.

U.S. News & World Report found that 35 percent officers interviewed do check out applicants’ social media accounts. What they find might increase a person’s chance of getting in—or could diminish it. Social media could say a lot about a person that may not be clear in an essay or recommendation letter. So why would school’s not at least be safe and check it out?

“To be clear, the large majority of admissions officers do not visit applicants’ social media sites,” Yariv Alpher, Executive Director of Research at Kaplan Test Prep, said. “However, a meaningful number do, as many note that social media can provide a more authentic and holistic view of applicants beyond the polished applications. And in fact, past Kaplan surveys have shown that a majority of students themselves consider their social networking sites to be ‘fair game’ for admissions officers.”

Well, that means applicants and even students must be really intentional—and careful—about how they use platforms like Facebook, Twitter, or Instagram. Otherwise, they could be looking at revoked acceptances or even long-term suspensions.

There is a science to the art of social media postings. And we’ve got you.

Do

Share achievements and wins. Let’s say you’re set to speak on a panel next week; you should tweet about it. Let the world know to be there. When you do speak, make sure someone takes a pic—and share it. Flaunt your accomplishments while staying humble. New job? Let the Internet know. Published a research article? Inform people.

Don’t

Publicize how you celebrate said achievement. Well, unless that celebration is PG. Even then, though, not everything needs to be broadcast to the world, especially if it involves alcohol. Too many college students or teenagers share photos of them on a night out, but that could be a turn off to admissions officers. So unless you’re sharing a cocktail with a celebrity or business goddess, maybe save the photo for family albums, instead.

READ THIS: Wharton MBAs Will Get You Out Of The Social Media Bubble

Do

Be yourself. You want to stay true to you and be an authentic presence online. There are enough imposters acting as a better version of themselves. And sometimes, it’s just too obvious. So let your posts breathe and let officers get a sense of who you are when they take a look at your social media pages. Maybe that means having an inspirational quote in your bio. Whether it’s Kanye West or Steve Jobs says a lot about who you are. And officers should appreciate that.

Don’t

Be reckless about the version of yourself you show. You gotta’ keep it real, but be mindful about what sides of yourself you showcase, too. A cuss word here or there shouldn’t keep a future school or employer from viewing you negatively, but racist or insensitive language would (and should). Certain behavior and ideology are unacceptable, and if that’s how you’re thinking, you need to take a hard look at yourself.

Do

Brand yourself. Ain’t nothing wrong with whipping up a logo and showcasing it online. Or launching a website that you flaunt on your Facebook page. You want schools to know that you’re already business-savvy and show them that you recognize your most valuable business: yourself. Branding yourself through a clever Twitter handle or website domain is a start. Think color schemes and photos. All the pieces of your page speak more than you think, so work them marketing skills.

Don’t

Use that as reason to steal someone else’s work. If you’re going to whip up a logo, make sure you take the right steps to do so—and mention it in a cover letter or somewhere a school will find out. Don’t copy and paste images or use someone else’s. If you show admissions officers you already know how to operate social media and digital skills within legal boundaries, they’ll be even more impressed. Be sure that you take proper steps to legally share images too. You want to sprinkle up your feed with photography (y’know, let them know you’re sophisticated), but don’t just take from a Google search. That can be illegal. Plus, you want to show off that you know about image sharing sites like Flickr or Getty. You’re a business person, remember?

Do

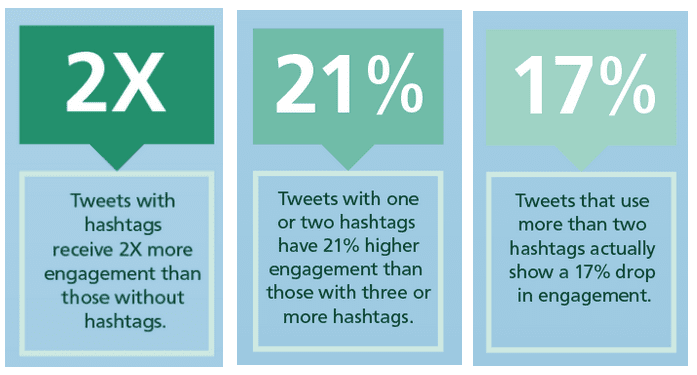

Use hashtags. Schools want students who are with the times. Hashtags are a major part of this time. Remind them that you know when to use them. This will also help others find you if your page is public, so for Twitter, that could mean more followers. On Facebook, that could mean more engagement on posts.

Learning from the hashtag experts could be really beneficial to your overall online presence, despite the cliche connotations. According to Buffer, simple use can greatly increase exposure.

Data via Buffer/Buddy Media

Don’t

Be hashtag-excessive. #EveryLittleThingDoesntNeedAHashtag. Just use relevant hashtags and don’t scare away a school with them. #Please.

Update: Listen to the new “How to Maintain Your Social and Professional Connections” podcast from the Kellogg School of Management for a more in depth perspective.

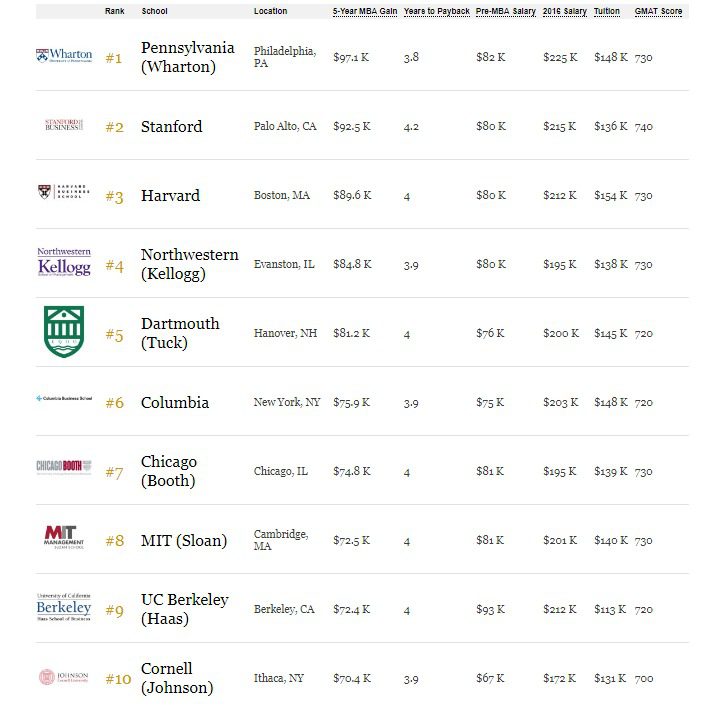

Wharton, Stanford Top Forbes’ 2017 Business School Ranking

For the first time ever, the Wharton School at the University of Pennsylvania topped the biennial Forbes list of the best business school’s in the United States.

Coming in second place on the Forbes 2017 rankings, revealed earlier today, was the Stanford Graduate School of Business, which was followed by Harvard Business School, Northwestern’s Kellogg School of Management, and Dartmouth’s Tuck School of Business rounding out the top five.

Forbes‘ top 10 U.S. business schools (2017)

Rounding out the top 20 were some familiar MetroMBA favorites, such as Columbia Business School (6th), Chicago Booth (7th), MIT Sloan (8th), UC Berkeley Haas (9th), UCLA Anderson (15th), the McCombs School of Business UT-Austin (17th), and the Mays Business School at Texas A&M (20th).

Just making the final cut on Forbes’ newest list, which includes only 70 schools, was the Fox School of Business at Temple University (60th), Pepperdine’s Graziadio School of Business and Management (65th), Northeastern’s D’Amore-McKim School of Business (66th), the Kogod School of Business at American University (67th), and the Gabelli School of Business at Fordham University.

Method To The Madness

Nearly every major publication that reveals its own respective business school ranking list has its own principle methodology in which it follows. For instance, unlike Forbes, the Financial Times ranking system relies more on alumni survey responses for its final ranking. While Forbes does utilize surveys in its ranking, its primary focus is on how graduates fare on their return on investment.

In the ranking release, Forbes staff writer Kurt Badenhausen notes:

“Our ranking of business schools is based on the return on investment achieved by the class of 2012. We examined more than 100 schools and reached out to 17,500 alumni around the globe. We compared graduates’ earnings in their first five years out of business school to their opportunity cost (two years of forgone compensation, tuition and required fees) to arrive at a five-year MBA gain, which is the basis for the final rank. Schools whose alumni had response rates below 15 percent or a negative return on investment after five years were eliminated.”

In regards to Wharton topping the 2017 list, Badenhausen writes, “These days most Wharton MBA students head to finance or consulting jobs upon graduation (79 percent of the class of 2012), which traditionally are the most lucrative areas for MBAs. The concentration in these sectors pushed Wharton’s current total compensation for the class of 2012 to the highest of any school in the world at $225,000.”

YOU MIGHT ALSO LIKE: The Highest MBA Salaries in Philadelphia

The exceptional cost of living around Stanford and shockingly low admissions rates (6 percent) contributed to the business school falling off its top spot from the prior year. Stanford GSB graduates, however, were given enormously valuable stock options after earning employment, with a median value of $380,000. Despite the astronomical figures, Stanford GSB grads still saw a dip of around $40,000 in total five-year compensation compared to the Class of 2010. Similarly, HBS grads saw a $28,000 five-year drop compared to the Class of 2010. Wharton 2012 grads, in contrast, gained $18,000 compared to two years prior.

In regards to employment, not much has changed since 2012. McKinsey and Co. was the top employer of the Wharton Class of 2012, hiring over 50 of the school’s 800-plus graduates. Alongside McKinsey were Bain, BCG, and Deloitte, which are still the school’s top employers. However, since then, Amazon has overtaken Goldman Sachs in the Wharton recruitment war.

Thomas Jueng, Seoul native and 2012 Wharton grad, tells Forbes, “Wharton was a great springboard to make a transition geographically and job position-wise with a strong brand name and network as well as providing practical knowledge.”

Read the entire Forbes list of the best U.S. business schools here.

Top MBA Programs for Producing Founders: 2017-2018 Report

Recently, PitchBook released its latest 2017-2018 Top 50 Universities Report. The ranking focused on those universities that produced the “ultimate building blocks of the venture industry: founders.”

This ranking is vastly different from rankings of top schools for entrepreneurship by U.S. News & World Report, Princeton Review, and Entrepreneur Magazine, all of which focus on factors like peer assessment surveys, curriculum, and entrepreneurial study options. Instead, PitchBook looked at a single criterion: founders of companies who received venture capital (VC) funding between January 1, 2006, and August 18, 2017, and where they went to school.

The report provides a fairly detailed breakdown of top undergraduate programs, companies (by capital raised), MBA programs, female founders, unicorns (companies that have attained the coveted $1 billion evaluation), and more. This article will focus solely on the results that relate to MBA programs, including information on female founders and unicorns.

Top MBA Programs

For the 2017-18 academic year, the top 10 MBA programs to produce founders who received VC funding were ranked as follows:

- Harvard Business School (HBS): 1,203 entrepreneurs, 1,086 companies, and $28,495 million raised

- Stanford Graduate School of Business (GSB): 802 entrepreneurs, 716 companies, and $18,259 million raised

- University of Pennsylvania’s Wharton School: 666 entrepreneurs, 585 companies, and $16,001 million raised

- INSEAD: 455 entrepreneurs, 406 companies, and $7,795 million raised

- Northwestern’s Kellogg School of Management: 445 entrepreneurs, 417 companies, and $5,680 million raised

- Columbia Business School: 441 entrepreneurs, 410 companies, and $5,465 million raised

- MIT Sloan School of Management: 437 entrepreneurs, 384 companies, and $7,797 million raised

- University of Chicago Booth School of Business: 405 entrepreneurs, 368 companies, and $5,470 million raised

- University of California – Berkeley Haas School of Business: 344 entrepreneurs, 314 companies, and $5,191 million raised

- UCLA Anderson School of Management: 247 entrepreneurs, 232 companies, and $3,957 million raised

HBS stands out immediately for producing founders who receive VC funding. Harvard produced twice as many founders as its next closest competitor, and those founders pulled in $10M more in funding for their 1,000+ companies.

As for the reason behind Harvard’s success, there are multiple elements that contribute to its production of entrepreneurs. The school is home to the Arthur Rock Center for Entrepreneurship, which offers programs for budding entrepreneurs including curricular offerings (over a dozen courses), a New Venture Competition (which offers $300,000 in cash prizes), the Rock Accelerator, the Harvard Innovation Lab, and even a Loan Reduction program that supports graduating entrepreneurs with a one-time, need-based award of $10,000 to $20,000. HBS’s extensive alumni network also provides students with connections with managing directors, partners, and founders of top VC firms including Bain Capital Ventures, Apax Partners, and Accel Partners.

Another standout for the 2017-2018 year was INSEAD. The only non-U.S. MBA program to appear in the top 10, it also moved up a spot this year over last. INSEAD grew from 393 entrepreneurs, 348 companies, and $6,131 million in capital raised to 455, 406, and $7,794 million respectively.

INSEAD’s students are supported by the INSEAD Centre for Entrepreneurship (ICE), which was founded in 2003. The center offers MBA students a chance to participate in the INSEAD Venture Competition (IVC), Entrepreneurship Bootcamps, and the Entrepreneurship Teaching Innovation (ETI) Fund, which supports the development of the “Your First Hundred Days” elective for budding entrepreneurs.

Another MBA program of note is MIT Sloan School of Management, which was fourth in capital raised on this year’s PitchBook ranking. This could indicate more successful companies coming out of MIT or a higher percentage of VC funding available to Massachusetts’ graduates.

Some of the unique entrepreneurship opportunities available from other top programs include Stanford GSB’s Startup Garage, an intensive, hands-on project course for MBA students, as well as MIT Sloan’s Martin Trust Center for MIT Entrepreneurship, which includes an accelerator, coaching, and various events. Finally, the Penn Wharton Entrepreneurship Center offers resources, events, and courses for MBAs looking to explore, develop, launch, and scale a startup.

Top Female Founders & Unicorns

PitchBook also reviewed the top MBA programs for female founders. Once again, HBS and Stanford GSB ranked first and second, respectively, with 202 and 119 female founders. Columbia Business School ranked third with 77, Wharton ranked fourth with 71, and MIT came in at fifth with 60 female founders.

As for the unicorns, the top five MBA programs are similar to the previous lists.

- HBS: 22 entrepreneurs, 17 companies

- Stanford GSB: 14 entrepreneurs, 11 companies

- Wharton: 11 entrepreneurs, 8 companies

- INSEAD: 8 entrepreneurs, 7 companies

- MIT Sloan: 6 entrepreneurs, 6 companies

This article has been edited and republished with permissions from Clear Admit.

Drexel LeBow Professor Talks Pitfalls of Paid Parental Leave Laws

Natalie Pedersen, Assistant Professor at Drexel University’s LeBow College of Business wrote an opinion piece for the Philadelphia Inquirer in which she examined the dilemmas many companies face surrounding parental leave for new parents. The main issue Pedersen explored in the article was the complexities of accommodating the needs of new mother versus new fathers.

Well-meaning employers have faced costly legal battles for providing too much leeway for new mothers. Estee Lauder, for example, employed a policy in 2013 that gave new mothers six weeks of paid parental leave in addition to paid time off to recover physically from giving birth. Fathers, under the company policy, earned two weeks of paid parental leave. This seemingly compassionate policy was actually the justification for a class-action law suit against the company. JPMorgan Chase & Co. is facing a similar class-action lawsuit for offering “primary caregivers” 16 paid weeks of parental leave after the birth or adoption of a child, but only two weeks for the nonprimary giver.

According to the Equal Employment Opportunity Commission, the policy violated the Equal Pay Act of 1963 and the Civil Rights Act of 1964, both of which do not allow companies to pay employees differently and offer different benefits based on gender.

In fact, under federal law, U.S. employees are not guaranteed any paid parental leave whatsoever. The Family and Medical Leave Act (FMLA) does require that some employees are given three months unpaid parental leave.

Pedersen sites studies that show that giving new parents time off of work is important for several reasons. Babies whose parents stayed home with them when they were newborns have been shown to have higher IQs and decreased infant mortality rates. Pedersen also mentions that paid leave is a wise move on the part of employers, because it will strengthen employees’ loyalty to the organization.

Companies who wish to provide benefits for new parents that extend beyond the minimum requirements of the FLMA do have options. Employers can give paid parental leave, so long as they are cautions about adhering to the parameters of the law. In fact, they can even offer slightly different benefits for new mothers and new fathers without legal ramifications. Birth mothers are recuperating from the physical aftermath of pregnancy and birth, so they can receive paid time off for medical reasons, whereas new fathers are ineligible for this benefit.

Natalie Pedersen teaches legal studies at LeBow College of Business, and has been published in several journals, including the Journal of Empirical Legal Studies and the Hofstra Labor and Employment Law Journal. She earned her BS in economics from The Wharton School at UPenn and a JD from Harvard University.

Harvard Business School Announces Largest-Ever Scholarship Donation

Harvard Business School (HBS) yesterday announced its largest-ever donation for scholarship aid—a $12.5 million pledge that will help support students who were the first in their families to attend college, among others. The pledge comes from HBS alumni Jonathan Lavine, Co-Managing Partner of private investment firm Bain Capital, and his wife Jeannie (both MBA ’92).

The first $10 million will support the Lavine Family Fellowship Challenge Fund, a matching fund designed to motivate others to donate in support of the school’s scholarship needs. The remaining funds will endow two $1 million fellowships—the Lavine Family Fellowship and the Herbert J. Bachelor Fellowship—and provide an additional $500,000 to the HBS Fund for various school priorities.

The Lavine’s have stipulated that, wherever possible, the fellowships be made available to first-generation college graduates in honor of Jeannie’s father, Herbert Bachelor, who was the first in his family to go to college. Bachelor worked 40 hours a week while an undergraduate at Harvard College to cover expenses but still accumulated a large amount of debt, which grew larger still as he earned his MBA from HBS (’68).

Jeannie and Jonathan Lavine

“It was his dream to have his own children be able to attend college without the stress of holding down a job or the added burden of student debt upon graduation,” said Jeannie Lavine in a press release announcing the gift. She followed in her father’s footsteps, obtaining both her bachelor’s and MBA degrees from Harvard. “He was able to make that dream come true for my siblings and me, and Jonathan and I would like to pay that forward and give other people the same opportunity, especially those who are the first in their family to attend college,” she continued. “We know that intellect is not distributed based on income, and neither should a top education.”

HBS Admissions Is Merit-Based, Need-Blind

HBS prides itself on its merit-based admissions policy, which means that an applicant’s ability to afford tuition does not factor into the admissions process. Once students are admitted, fellowship grants are awarded based solely on financial need. Approximately half of the HBS class receives financial aid each year—$37,000 per student on average—and the school provided $35 million in financial aid to MBA students in the 2016-17 academic year.

“We are thrilled about this gift and grateful to the Lavine family because students who are the first generation in their family to go to college represent an important and needed perspective in the classroom,” HBS Managing Director of Admissions and Financial Aid Chad Losee told Clear Admit. “We admit based on merit and support financially based on need, which makes us different from other business schools,” he added. “Everyone here is here for a reason: because of their talent and merit and what they bring as a leader.”

Close to 10 percent of the HBS class each year is comprised of first-generation college graduates, according to Losee. “We hope this gift and this announcement will help get the word out to people from all different backgrounds who otherwise may feel like HBS isn’t accessible to them,” he said.

Earlier this year, HBS announced another fellowship likewise designed to support students with limited financial means. The Forward Fellowship, announced in July 2017, will award between $10,000 and $20,000 per year to students from lower-income backgrounds above and beyond HBS need-based fellowships. Unlike the HBS need-based fellowships, which are awarded based on students’ individual financial situations, the new Forward Fellowships take into consideration the applicant’s family circumstances and financial history so the available funds can be distributed to those who need them most. These can include not only students who grew up in lower-income households, but also those who plan to provide financial support for their parents during their graduate school careers or after obtaining their MBA.

“We want HBS to be the place where the best leaders from anywhere in the world can come and thrive and be successful,” Losee said. “This most recent gift from the Lavines is great and continues to tell the story that we want to support students when they get here.”

Lavine Family Philanthropic Roots Run Deep

The Lavines’ gift adds to the financial aid resources available to HBS students and builds on the couple’s history of philanthropy, which has long been focused on creating a more equal playing field for all through access to quality education. Jonathan serves as chair of the national Board of Trustees for City Year, an organization focused on reducing the high school dropout rate in U.S. cities. And the couple has also made major contributions to uAspire, an organization focused on providing financial resources to attain a postsecondary education; LIFT, a national nonprofit focused on breaking the cycle of intergenerational poverty; and numerous aid programs at Columbia University, where Jonathan also serves as vice chair of the Board of Trustees.

In addition, they are long-time benefactors and actively involved at Harvard. In 2011, they established the Lavine Family Cornerstone Scholarship Fund to support four undergraduates annually through Harvard’s financial aid program. In 2012, they established the Lavine Family Humanitarian Studies Initiative at the Harvard T. H. Chan School of Public Health to support the training and education of humanitarian relief workers. They also both serve on the dean’s advisory boards at HBS at the School of Public Health and co-chair the latter school’s capital campaign.

“We’re proud to support the work of great academic institutions, because we know first-hand the impact they can have on the world,” said Jonathan Lavine in press release. “There is no greater way to improve someone’s future than giving them access to high quality, post-secondary education. We spent a great deal of time discussing with Dean [Nitin] Nohria our passion for education and how inspired we are by my father-in-law’s journey and appreciative of the opportunity our parents provided us. As a result, we decided that this is the best way to bring those interests together.”

Financial Aid at HBS Is Personal

Losee notes that the newly established Lavine fellowships also help highlight how personal the financial aid process at HBS. “The Lavines will be matched with the individual students they are supporting,” he says. “They will meet them and can develop a mentoring relationship with them.” HBS also features an annual dinner that brings together all HBS donors and the students their gifts help support, he said.

Calling them “the lifeblood of the institution,” Professor Felix Oberholzer-Gee, Senior Associate dean of the MBA program, noted that gifts like the Lavines’ benefit not only the students who receive them but also the school as a whole. “They allow us to focus exclusively on filling our classrooms with the very best students,” he said in a release. “Our learning community is enriched by diversity in all its forms, and the fellowships we offer make it possible to bring people here from all walks of life around the globe.”

Learn more about the Lavines’ $12.5-million gift to support scholarship aid at HBS.

This article has been edited and republished from Clear Admit.

A Recommendation Revolution Is Underway in MBA Admissions: What You Need to Know

I’m busy, you’re busy, your boss is most definitely busy. Indeed, publications ranging from Men’s Health to the Atlantic, the Washington Post to Forbes are all reporting that “busyness“ has become the new status symbol for our times. Which is part of what makes asking someone to write you a letter of recommendation for business school so daunting. Now, try telling that person that you actually need five different letters for five different schools. Oy vey.

As uncomfortable a spot as it puts applicants in—it’s no better for recommenders. Even your most vociferous supporter is going to wonder what in the world she’s gotten herself into when she realizes that helping you in your pursuit of acceptance to business school means taking time away from work or play or family or whatever else to labor over leadership assessment grids, each a little different from the one before, and write 10 slightly different answers to 10 slightly different questions. Here’s hoping that your top-choice school doesn’t happen to be the last one she gets around to…

Good news. The graduate management education industry recognizes the strain that letters of recommendation put on applicants and recommenders alike and has been wrestling with ways to make the process easier for everyone involved. To this end, the Graduate Management Admission Council (GMAC) established a committee made up of admissions representatives from dozens of leading business schools to brainstorm about ways to lessen the burden while still collecting the third-party assessments of candidates that are so critical to the MBA application process.

GMAC Pilots Common MBA Letter of Recommendation

As an outgrowth of that committee’s work, GMAC last year piloted a common MBA letter of recommendation (LOR) that schools can choose to incorporate into their applications to reduce the burden placed on applicants and recommenders alike.

“The Common Letter of Recommendation (LOR) effort is intended to save you and recommenders valuable time by providing a single set of recommendation questions for each participating school,” reads the GMAC website. “This allows your recommenders to use the same answers for multiple letter submissions, alleviating the workload of having to answer different questions for each school multiple times. You benefit because it makes the ask for several different letters to be written on your behalf much easier.”

Cornell’s Johnson Graduate School of Management, NYU Stern School of Business, and Michigan’s Ross School of Business were among the first schools to pilot the Common LOR last year. In addition to a single set of open-ended essay questions, the pilot Common LOR also included a leadership assessment grid inviting recommenders to rate applicants on 16 “competencies and character traits” grouped into four main categories of achievement, influence, personal qualities and academic ability.

“At Johnson, we saw the Common LoR as a clear opportunity to improve the admissions process for candidates and their recommenders in a way that would also add value to our own assessment of applicants,” Judi Byers, Johnson executive director of admissions & financial aid, told Clear Admit. “A thorough and consistent review is important to us and the grid provides a straightforward base of insights that can be assessed and compared reliably while the accompanying letter adds meaningful detail and context,” she added.

Soojin Kwon, managing director of full-time MBA admissions and program at Ross, sees applicants and recommenders as the main beneficiaries of the Common LOR and is pleased that more schools are coming on board. “As more schools adopt it, applicants won’t have to feel like they’re burdening their recommender with completing multiple rec letters with different questions and ratings grids,” she told Clear Admit. “This year, more than a dozen of the top 20 schools are using it.”

Ross was also among the schools to first pilot the Common LOR last year, and Kwon served as part of the GMAC committee that helped craft it.

Common Questions Easy to Agree on, Common Leadership Grid Not

“What we found in using the Common LOR this year past year was that the questions gave us helpful insights into applicants, particularly on the important area of constructive feedback. The questions, however, were fairly similar to what we and other schools were using before, so it was easy for the AdCom to use it,” she notes.

Those questions are as follow:

- Please provide a brief description of your interaction with the applicant and, if applicable, the applicant’s role in your organization. (50 words)

- How does the performance of the applicant compare to that of other well-qualified individuals in similar roles? (E.g. what are the applicant’s principal strengths?) (500 words)

- Describe the most important piece of constructive feedback you have given the applicant. Please detail the circumstances and the applicant’s response. (500 words)

- Is there anything else we should know? (Optional)

“The rating grid was quite different from what we’d used in the past,” Kwon continued. “It was also the most difficult part for the GMAC advisory group to develop and get agreement upon. The group worked this past year to revise and simplify the grid so that AdComs could get more meaningful insights from it.”

This year, the 16 competencies and character traits from the original grid have been distilled to 12, with specific questions about analytical thinking and information seeking omitted. Johnson and Ross have both incorporated the revised leadership grid into the LOR distributed to applicants as part of their applications, as have most other schools that have this year decided to incorporate both the grid and open-ended essay question portions of the form. UT’s McCombs School of Business and Rice University’s Jones Graduate School of Business, notably, still seem to feature the earlier version of the leadership grid in their application, the one that calls on recommenders to assesses applicants on 16 competencies and traits.