Rutgers Supply Chain Analytics Student Spends Summer at Amazon, and More – New York News

Let’s explore some of the most interesting stories that have emerged from New York business schools this week.

Beginning a Career in Supply Chain at Amazon – Rutgers Business School

Rutgers Business School exchange student Qiying Xu recently had an opportunity to put her supply chain management theory and Lean Six Sigma course work to use as part of an entry-level management position she will pursue at one of Amazon’s new fulfillment centers.

Xu writes that the Rutgers specialty master’s program in supply chain analytics gave her “the picture of the whole supply chain. The data analytics skills she’s accrued have almost single-handedly “changed the course of [her] career.”

You can read the full article on Xu’s work here.

Bridging the Gap Between Politics and Renewables – Johnson Business Feed

In a new op-ed with his alma mater, recent Johnson SOM graduate Mark DesMeules, MBA ’18, wrote about the role his school played in his career pivot from politics.

“I came to Johnson to accomplish what is colloquially known in the MBA world as a ‘career pivot.’ Prior to joining the Johnson community, I worked in politics in the nation’s capital—Washington DC. After gaining nearly five years of advocacy experience through my work with start-ups, non-profits, and Fortune 500s on intellectual property and technology policy issues, I decided to shift my career trajectory toward an industry I had always been passionate about: renewable energy.”

DesMeules writes that he was immediately sold on Johnson because of the school’s “robust academic and extracurricular offerings on sustainability and renewable energy.”

He elaborates, “At Johnson, I had the chance to explore the intersection of energy, sustainability, and business, all while becoming comfortable with ambiguity and complex business problems.”

“My Johnson colleagues, peers, and professors helped me learn, grow, and successfully pivot from the world of policy to the renewable energy industry. I am excited for the future and look forward to continuing to grow in the next chapter of my career.”

You can read the full op-ed from DesMeules here.

Governor Phil Murphy Selects Stevens to Announce New STEM Initiatives – Stevens Institute of Technology Blog

New Jersey Governor Phil Murphy recently visited Stevens Institute of Technology School of Business’ ABS Engineering Center to announce “two new STEM initiatives to retain highly-trained, technology-savvy college graduates in the state.”

The first is a “loan forgiveness program,” which will see “anyone who has worked in a STEM-related job in New Jersey for at least four years receive $2,000 per year, in years 5,6,7,8 at the same job, for a total benefit of $8,000. Employers and the state would split the covered amount 50/50.”

NJ Gov. Phil Murphy speaking at the Stevens Institute of Technology School of Business / Photo via stevens.edu

The second is an internship program for high school and college students in STEM fields, which reimburses “participating employers 50 percent of intern wages, up to $1,500 per student.”

Murphy said, “Stevens is one of the premier places where tomorrow’s leaders in innovation are learning the skills they will need to be successful and to change our world. If we are to grow the innovation economy again, we cannot lose our college graduates after graduation. I want them to stay here, in New Jersey, to be part of our economic future.”

Check out the full article here.

NJ Monthly Mag Highlights Rutgers EMBA Doctors, and More – New York City News

Let’s explore some of the most interesting stories that have emerged from New York City business schools this week.

NJ Monthly Mag Highlights Rutgers EMBA Doctors – Rutgers Business Blog

According to stats released by Rutgers Business School, it’s not uncommon to find between 1-5 doctors in a typical EMBA class. This is largely due to the new reality of the medical profession, which has increasingly required that doctors “transition from medical practice to running hospitals, managing hospital finances, heading-up HMOs, working for pharmaceutical companies and becoming Chief Medical Officers.”

Three Rutgers EMBA Doctors made New Jersey Monthly Magazine’s annual “Top Doctors” list:

- Clifford Sales, a vascular surgery specialist at Overlook Medical Center

- Eric Seaman, a male infertility specialist at the Urology Group of New Jersey

- Jacqueline Williams-Phillips, the medical director of the Pediatric Intensive Care Unit at Bristol-Myers Squibb Children’s Hospital at Robert Wood Johnson University Hospital in New Brunswick and associate professor of Pediatrics at UMDNJ-Robert Wood Johnson Medical School.

Learn more about these EMBA Superstar Doctors here.

Patagonia Exec Talks ‘Fast Fashion,’ Fair Trade, and What It Means to Be A Responsible Company – Gabelli Connect

The Gabelli School of Business‘ Center for Humanistic Management recently hosted a guest lecture from Vincent Stanley, the Patagonia director of philosophy, in which he talked about how corporate responsibility has directly shaped the company’s business.

“One of our big concerns is how we look at the challenges of the planet and ensure that our company is not contributing to those challenges and instead contributing to the solutions. Nature is not just where we go to play. The health of our natural systems underlines all of our social and industrial systems, even in this tiny little town where we were based.”

Vincent Stanley, Patagonia director of philosophy / Photo via fordham.edu

You can read more about Stanley’s lecture here.

Can Stevens Students Create a Cryptocurrency Exchange? Bank on It – Stevens Institute of Technology SOB Blog

A team of Stevens Institute of Technology School of Business seniors recently announced its plans to unveil Coin Complex, a cryptocurrency exchange designed to address and improve upon the limitations of the current trading options, at the May 2 Innovation Expo. George Engroff, a senior finance major who recently completed a summer internship with Credit Suisse, elaborates: “The exchanges I was using were completely inadequate—none of them gave you a good understanding of the market and your portfolio. So I thought, here at Stevens, we have a lot of smart people and innovators—I’m sure we could make a better exchange than what’s out there.”

The Coin Complex login / Photo via Tom Braunck

You can find out more about Coin Complex here.

2018 Trends: New York City’s MBA Future

It doesn’t take a stable genius™ to figure out that New York City is the world’s most highly sought-after 22.82 mi² strip of land to pursue an MBA.

As is the case with most prime real estate, the stakes are high and the competition fierce. For many prospective business schoolers, the decision to step into the gauntlet is one made with a healthy sort of trepidation.

Hefty price tags and cutthroat admissions present real barriers for prospective students and deter more than a few. Still, many equate the New York MBA experience to a dream scenario—or a Gordon Gecko-style fantasy, replete with the promise of a staggering salary, an attractive range of employment opportunities, and prime placement in a city of constant progress.

How does the dream stack up to reality? Schools weigh in on 2017 trends for graduates, many of whom report satisfaction with employment offers. Let’s take a look at how MBA graduates are getting the most of their newly minted degrees!

2018 New York City MBA Trends

Columbia Business School

According to the school’s most recent MBA employment report, less than 2 percent of Columbia Business School graduates reported salary as the primary reason for accepting an offer. While the honestly of that polling answer pool is debatable, Columbia School of Business is the king when it comes to starting salaries on our list, with median salary of $125,000. Of the graduating class, 93.2 percent of students accepted employment offers within three months. Approximately 28 of 1,019 total students stepped aside to create their own companies. Per the standard with many of the NY-area schools, the largest portion of graduates selected financial services (34.4 percent) as their field of choice, followed closely by consulting (33.1 percent) and media and technology (15.6 percent). Companies such as McKinsey & Company, Amazon, Goldman, Sachs & Co., and Morgan Stanley welcomed a majority of Columbia’s finest.

The boastful salary expectations, unsurprisingly, are tempered a bit by the costs of the CBS MBA program. The current estimated budget for Columbia MBAs comes in at $107,749 in the first year, of which includes over $21,000 for room and board. Tuition in isolation, however, costs $71,544 for the first year. Looking at a degree at any New York City school, never mind an Ivy League institution, means cost of living has to be taken in heavy consideration, which can vary greatly from borough to borough.

Fordham University’s Gabelli School of Business

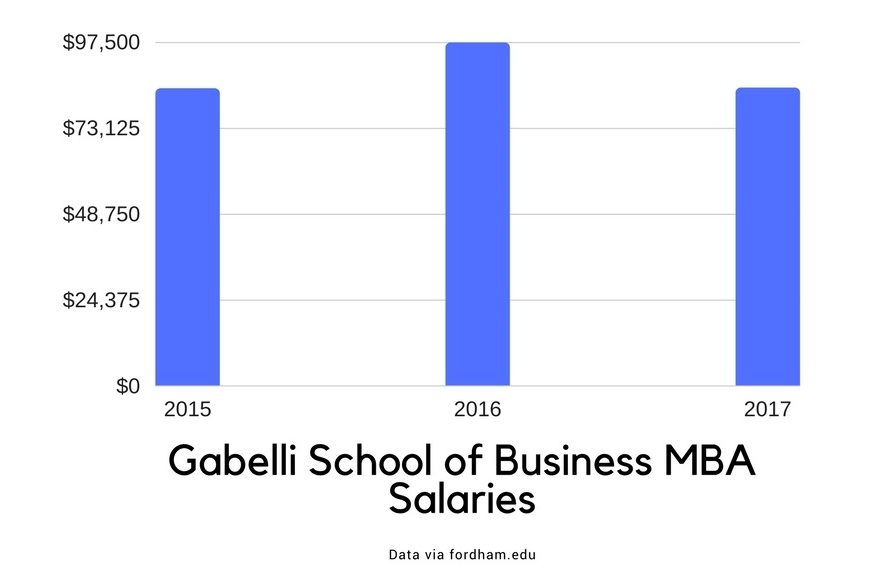

About 88 percent of students in the Fordham Gabelli School of Business graduating class accepted employment offers within six months after graduation. Starting salary rates were below Columbia’s, at an average of $84,593, with an average signing bonus of $15,536 and additional compensation of $14,510. That average salary figure is an approximate 13 percent drop from the previous year’s reported averages.

Out of the many fields MBA students typically chose this year, Fordham students favored less predictable fields: just under 50 percent went into financial services, while 11 percent earning employment in consumer products, technology, and media, respectively. Unlike MBA graduates from many other NYC schools, however, only 5 percent of Gabelli students went into consulting, signifying a deeper trend of tech continuing its encroachment on MBA talent.

Compared to many other schools on this list, Gabelli’s distinct advantage is cost. The first year of the MBA program currently costs $49,645: more than 30 percent less than the cost of the Columbia full-time MBA tuition.

NYU Stern School of Business

This may shock you, but, NYU Stern MBA students are doing pretty well, with an average starting salary of $121,146 in placement of some of the most prestigious institutions in finance (32.4 percent), consulting (26 percent), technology (16.8 percent), real estate (3.5 percent), and retail (3.2 percent). Around 83 percent of those students landed jobs in the Northeast U.S., while nearly 10 percent of graduates found positions in Asia, Europe, and South America. Nearly half of all job offers were the result of an internship facilitated by NYU.

Like the trend at Gabelli, NYU grads jumping into tech has been steadily climbing over the past few years, rising from just 6 percent of employed grads from the Class of 2014, to 17 percent for the most recent class. The incremental increase coincides with the school’s recently added Tech MBA.

Stevens Institute of Technology School of Business

In a metro brimming with very successful business schools, the Stevens Institute of Technology School of Business separates itself with an incredible employment placement rate of 94.9 percent; the best placement among all business schools in the country, according to U.S. News & World Report.

The Stevens MBA faculty claim to provide “exceptional career services much earlier than other universities.” 90 percent were employed in the industry of their choice. Starting salaries fell between $88,805—$125,000. Companies such as Goldman Sachs, Protiviti, PwC ,and Prudential offered employment opportunities for these students.

Cornell University’s SC Johnson Graduate School of Management

About 93 percent of students from Cornell‘s Ithaca and NYC campuses received employment offers within six months of graduation. The average base salary was $125,578, which was an increase from previous years “driven by salary growth in consulting and finance.” Chosen fields for students were finance (38 percent), consulting (26 percent), and general management (21 percent). Out of the 122 companies that sought 2017 graduate students, the top recruiters were Citi Group, Amazon, Deloitte Consulting LLP, Ernst & Young, and McKinsey & Company.

Even Cornell MBA students in an internship were earning some of the best salaries in the country, pulling in a reported $8,764 per month. Those figures out over a 12-month rate are more than triple the average intern salary, according to Glassdoor data.

Looking At New York City’s Best MBA Return on Investment, Pt. II

New York City is an obvious choice for budding entrepreneurs, consultants, and financiers to find their footing.

Manhattan is regularly called a playground for the wealthy, with a 2016 Newsweek article playfully and indiscriminately dubbing rich people New York’s new urban blight. So, if you’re one of the millions of people hopping into New York to extract its cultural and financial resources for personal gain before migrating to some more humane province, why not do an MBA there while you’re at it?

The proximity of New York business schools to the city’s wealth of opportunities means that MBAs have a kind of access that make b-schoolers elsewhere in the country—and the world—salivate. New York’s matchless combination of industry, culture, and strategic location means that any one of the numerous business schools that populate the region will give MBAs a veritable nitrous boost when it comes to post-graduation job placement. In fact, earlier this month we covered five other NYC MBA programs that give graduates the best return-on-investment.

You’ve surveyed the best so let’s try the rest! While Part 1 was populated by the most elite and therefore more expensive MBA options in the region, Part 2 focuses on New York programs that are more practical choices if you’re doing business school on a budget. These programs tend to offer comparatively smaller returns-on-investment but the advantage is their affordability.

So, let’s take a deeper dive into four more New York-area MBA programs that offer the best returns-on-investment for graduates.

Lubin School of Business — Pace University

The Lubin School of Business counts Hearst Magazines president Michael Clinton ’83, HBO Chairman and CEO William C. Nelson ’75, and former Chairman and CEO Ivan G. Seidenberg ’81 among its notable alumni. With tuition for Lubin’s two-year full-time MBA priced at $71,340, the program qualifies one of the mid-range options on our list. MBAs graduate with an average salary-to-debt ratio of 68 percent culled from average debt of $44,076, according to U.S. News & World Report, and an average base salary of $64,425.

Gabelli School of Business — Fordham University

Notable Gabelli School of Business notable alumni include UnitedHealth Group CEO Stephen J. Hemsley, ’74; former JP Morgan CEO Maria Elena Lagomasino ’77; Countrywide Financial Corp Co-Funder, Chairman, and CEO Angelo R. Mozilo ’60; and Empresas Polar CEO Lorenzo Mendoza. At $87,807 for its two-year full-time MBA, Gabelli’s tuition is among the priciest on our list but the handsome 53 percent salary-to-debt ratio makes up for it. MBAs graduate with an average debt of $51,870 and go on to earn an average base salary of $97,404.

Tobin School of Business — St. John’s University

The Tobin School of Business at St. John’s University is one of the most affordable MBA programs on our list, with tuition priced at $43,740 for its two-year full-time MBA. Tobin MBAs graduate with an average debt of $28,291, which when set against their $59,276 average base salary, yielding a 48 percent salary-to-debt ratio.

Stevens Institute of Technology School of Business

Recent noteworthy employers of the Stevens Institute of Technology School of Business MBAs include ExxonMobil, Goldman Sachs, Johnson & Johnson, JPMorgan Chase, L’Oreal, Lockheed Martin, Microsoft, Tishman Realty & Construction Co., Turner Construction, UBS Financial, and Verizon. Although tuition is priced at a competitive $68,988 for its two-year full-time MBA, Stevens actually has the highest salary-to-debt ratio of any school on our list, at 72%. Stevens MBAs graduate with an average debt of $48,244, according to CNN Money, and go on to earn an average base salary of $67,100.