B-School Students Question Buffett, Gates and Munger On Live Telecast

Not just anybody is given the title of Oracle.

Superstitions aside, to become known as a wizard, sage or fortuneteller is a sign of wisdom and great respect. Warren Buffett, Chairmen and CEO of Berkshire Hathaway, could be considered a fortuneteller— he earned his nickname, the Oracle of Omaha, by becoming known as one of the most successful investors of the 20th century.

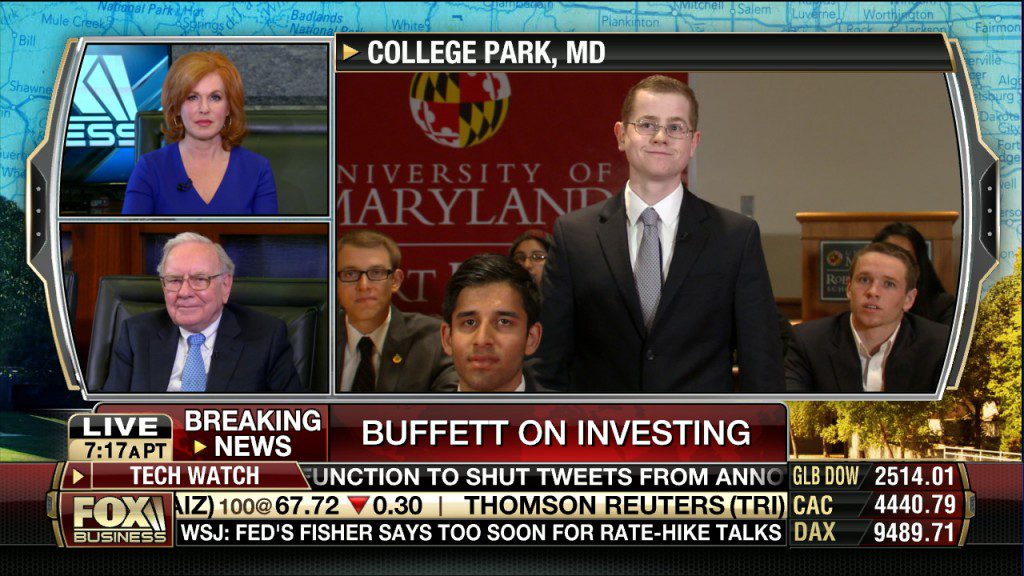

And if Buffett is the Oracle, then Bill Gates and Charlie Munger would be two of his wise men— together, this Holy Trinity of Billionaires and Berkshire Hathaway chairmen sat down with Fox Business Network’s Liz Claman during the annual BH Meeting in Omaha, Nebraska. They fielded questions from graduate students representing New York University’s Stern School of Business, University of Chicago’s Booth School of Business and University of Maryland’s Robert H. Smith School of Business.This was the seventh year that Buffett granted FBN an interview and the second year that FBN has brought in MBA students via remote uplink to ask Buffett and his top men questions. Buffett has a reputation of being someone who loves to help students; he hosts business school students in Omaha each year including 40 universities this past year alone.

Kevin Baker of the Stern School of Business asked a question on the topic of activist investors. He asked Buffett under what circumstances he would choose to take an activist role in an investment and use his equity stake in a corporation to put public pressure on its management.

“You might say I took an active role in Berkshire Hathaway in 1965 when I took control, but we’re not looking to change people,” Buffett said. “We may be in a situation with them where [taking an active role] might influence, but we want to join with people we like and trust. We will not come in in a contentious way–it’s just not consistent with Berkshire principle.”

Buffett recently made headlines when he abstained from placing a vote on Coca-Cola’s compensation packages. Buffett, who owns 9 percent of the world famous soft drink corporation, could have made a statement about excessive self compensation through his vote but “didn’t want to go to war” with Coca-Cola CEO Muhtar Kent.

“I think we made a statement— we’re talking about it now,” Buffett said. “We made a huge statement and did it without going to war. I’ve spoken to Muhar and I like the corporation, I just happen to disagree on this.”

Catriona Duncan, a student at the Booth School of Business and Microsoft shareholder, asked Gates if there is an opportunity to create shareholder value by separating Microsoft into different companies, more specifically via spinning off Xbox and Bing.

“Certainly the Bing technology has been the key to us learning how to do large scale data centers and lets us see what’s going on in the internet…I see that as a pretty fundamental technology for the company, even for its office business and that is a very core business,” Gates said. “We’ve done spin-offs historically— Expedia got started off inside Microsoft, Slate Magazine did, and we’re thinking about our other pieces that are separable. But our basic research including the stuff that goes into Bing, I can’t see that making sense to break it off.”

Finally, students from the Smith School of Business asked Buffett what his preferred strategy is when deciding to invest in a company: a) Buy minority position in the company through publically traded stock b) Buy out the entire company and c) Pursue the strategy represented by the partnership BH forged with 3G Capital to buy out Heinz.

“We look for the best opportunity available at any given time,” Buffett said. “If 3G would come to me today and say we have a wonderful idea and would we want to join them, the odds are very high that I would say yes… I like owning businesses over the long term better than I like owning stocks simply because it keeps building Berkshire, but stocks are a marvelous alternative. But buying a business outright is what we’re really looking to do and when we get a chance to partner up with a wonderful operating partner like 3G, that’s almost too good to be true.”

In one last business school twist, the billionaires were asked about their take on the student loan debt that is bigger than most other debts out there and whether it could be crushing enough to eventually burst a higher education bubble.

“I don’t worry about it causing a bubble, I just worry about the individuals taking it on,” Buffett said. He explained how many of the students he hosts in Omaha are in debt but that those students acknowledge that the investment is worth it in the long run. “I think in many cases they are right, but in some cases they are wrong. It’s a choice to be made, I mean, do you want to trade away part of your income early on for increasing your skills early on?”

Want to hear more from Buffett, Gates and Munger? You can check out the entire interview here.