Search results for :

Check Out This Week’s Diverse Selection of New MBA Jobs

One of the best things about an MBA is how it can be applied to numerous fields and industries. The flexibility of the degree is especially evident in new MBA jobs listings, where new opportunities pop up in sectors ranging from financial services to defense, and everything in between. Continue reading…

Full-Time MBA

Fuqua School of Business Full-Time MBA Program Structure

Students in the 22-month Duke Fuqua full-time MBA program, better known as the Daytime MBA, begin the program with a month-long immersion and orientation. This leg of the MBA features, “three courses that emphasize leadership in a global society,” according to the school.

The remaining first-year schedule of the Daytime MBA is broken up between four six-week semesters, which are split by winter and spring breaks. Classes are usually held twice per week, lasting just over two hours per session. Approximately 14 core courses are completed in the first year, with four or more electives. The majority of the second year in the program features elective courses, designed around the student’s individual career goals in mind.

Curriculum

After orientation and the Global Institute program in the summer, first-year students are paired off into teams of four to five. Together, those students complete group projects and courses. The majority of courses completed in the first fall of the program are core courses, with students beginning to integrate electives by the spring semester. Students may choose from 16 concentrations which include energy finance, leadership & ethics, management and marketing.

Elective options are available for the following types of courses: accounting; decision sciences; economics; energy and environment; finance; health sector management; leadership; management and organizations; marketing; operations management; and strategy. There are 100 elective options for Daytime MBA students.

Full-Time MBA Rankings

• U.S. News & World Report: 12

• Bloomberg: 20

• Forbes: 14

• Financial Times: 9

• The Economist: 11

Class Profile

The Duke Fuqua full-time MBA Class of 2022 features 408 total students. Those students are 29-years old, on average, and have 5.6 years of work experience. About 46 percent of the class is female, with 38 percent minority students, and 38 percent international students.

The average GMAT score of the class is 700, and the undergraduate GPA is 3.47.

Career Statistics

According to the most recent Duke Fuqua full-time MBA employment report, about 93 percent of graduates earned a job offer within three months of earning their degree, with 91 percent accepting their offers. The average base salary among graduates that reported data was $135,935 per year, with a signing bonus average of $35,032. By function, consulting drew the most students with 33% of graduates accepting jobs in that field. Twenty-two percent of the most recent class pursued a career in finance and 18% in general management.

Tuition, Scholarships, and Financial Aid

The estimated tuition for the Duke Fuqua full-time MBA program is currently $70,000. With added living expenses and cost of supplies, the first year total comes to $97,741. The school estimates tuition rates to rise at around 4 percent annually.

All applicants are automatically considered for merit-based loans. U.S. applicants can help finance their education through Federal direct unsubsidized loans and graduates plus loans, as well as private loans. International applicants can apply to the International Student Loan Program, which does not require co-sign assistance.

Full-time nonprofit and government employees are eligible for the The Rex and Ellen Adams Loan Assistance Program, which helps select students with loan forgiveness awards. U.S. military veterans and service members can also help fund their education through the Yellow Ribbon program.

Admissions

In order to apply to the Duke Fuqua full-time MBA program, applicants must submit:

• A completed online application

• Official transcripts

• Answers to three short essay questions (500 character limit, each), two longer-form essay questions, and an additional optional long-form essay question

• A resume

• Two letters of recommendation

• GMAT/GRE scores (no minimum required)

• A nonrefundable $225 application fee

All applicants are subject to interviews before admission.

Daytime MBA Deadlines

| Round | Application Deadline | Interview Decision Sent | Final Decision Release | Deposit Deadline |

| Early Action | Sept. 2, 2021 | Sept. 20, 2021 | Oct. 14, 2021 | Dec. 1, 2021 |

| Round 1 | Oct. 11, 2021 | Nov. 8, 2021 | Dec. 15, 2021 | Feb. 18, 2022 |

| Round 2 | Jan. 5, 2022 | Feb. 2, 2022 | Mar. 16, 2022 | Apr. 25, 2022 |

| Round 3 | Mar. 24, 2022 | Apr. 7, 2022 | Apr. 29, 2022 | May 13, 2022 |

* International applicants should apply in EA, Round 1, and Round 2 to allow time for visa processing.

Get an MBA Admissions Edge with the LiveWire Data Dashboard

Curious about your chances of gaining admission to top business schools? Now you can see how hundreds of previous applicants fared at Fuqua in just a few clicks. The LiveWire Data Dashboard’s interactive data visualization tools allow you to spot trends, compare MBA programs, and benchmark your stats against successful applicants at your target schools. Learn more here! Ready to explore the data? Purchase a 30-Day or 365-Day subscription in our shop for immediate access!

Fuqua School of Business – Duke University

History

The Fuqua School of Business at Duke University was originally founded as the Graduate School of Business Administration in 1969—nearly 131 years after the university’s original founding. The Durham, North Carolina business school received large donations from Virginia businessman and philanthropist J.B. Fuqua, who helped establish his career borrowing books from the Duke University library, which later renamed the business school in his honor.

School Rankings

• U.S. News & World Report: 10 (tie)

• Bloomberg: 20

• Forbes: 14

• Financial Times: 19

• The Economist: 11

Location(s)

The Fuqua School of Business is in the West Campus region of Duke University. The Fuqua School of Business has a renown international program, with a litany of international partnerships and exchange programs, which can be more fully explored here.

The central campus is located less than 20 miles from the Raleigh-Durham International Airport.

Facilities

The main facility of the 490,550 square-foot Fuqua campus is the Fox Student Center, which connects the school’s main wings and provides students and faculty living and dining spaces, as well as a picturesque indoor garden. Breeden Hall, built in 2008, houses the school’s MBA admissions offices, classrooms, meeting rooms, and the Ford Library.

Faculty

There are currently 140 full-time faculty members at the Fuqua School of Business teaching across 11 concentration fields.

Student Body

The Duke Fuqua School of Business Daytime MBA Class of 2020 features 440 total students. Those students are 29-years old, on average and have 5.6 years of work experience. About 42 percent of the class is female, with 30 percent minority students, and 38 percent international students.

Fuqua’s Global Executive MBA Class of 2019 features 94 students. An estimated 33 percent of the class is female, with 38 percent of students holding international citizenship. The age range for the class is 25-54, with 5-30 years of experience per student.

The Weekend EMBA Class is slightly larger than the Global alternative, with 131 students in the Class of 2019. About 25 percent of the class is female. The age range is 28-54-years old, and the work experience range is 5-27 years.

MBA Degree Offerings

The Duke University Fuqua School of Business offers three MBA programs: the full-time, Daytime MBA; the Global Executive MBA; and the Weekend Executive MBA. In addition, the school provides four joint degree options and a dual degree in partnership with Seoul National University.

For students looking to earn other master’s degree options, Fuqua also offers a 10-month Master of Management Studies, and the 10-month global master’s program that takes place both in Durham, NC, and Duke’s China campus in Kunshan.

Inside NYU Stern’s New MS in Quantitative Management

Getting into business from a non-business background always presents a significant learning curve. And while most MBA programs can help candidates no matter the experience, it can still leave you feeling behind.

Luckily, that may not be the case for NYU Stern’s newly launched online Master of Science in Quantitative Management (MSQM) program. Explicitly designed for non-business majors, it helps students grow business fundamentals and analytics, all from the comfort of home. It’s officially marked as the “first and only top-ranked U.S. business school to deliver an MS in Management online,” according to a recent press release. Continue reading…

Full-Time MBA

UNC Kenan-Flager Full-Time MBA Program Structure

The two-year Kenan-Flager Business School full-time MBA program is built around case method studies and group activities, splitting students into groups of 70-75. Each semester of the program is broken into two separate modules, which last an estimated seven weeks. The time between completing the modules is split for various breaks in the academic year.

Curriculum

Courses at Kenan-Flagler emphasize learning through case studies and small group activities. For their first year, students are assigned to groups of 70 to 75 people who take the same required courses together.

Kenan-Flagler breaks each semester into two seven-week periods of instruction called “modules,” with breaks for holidays and fall, winter and spring vacations. Two pre-term summer sessions called the Analytical Skills Workshop and Tools of Financial Markets are available to first-year students who wish to review key analytical and financial skills prior to beginning their degree. First-years begin formal classes in the second week of August, while second-year classes start a week later.

Kenan-Flagler students are required to complete 14 core courses their first year along with a Core Case Competition. Topics for core courses cover business fundamentals such as finance, microeconomics, marketing, accounting, ethics, and business strategy. Kenan- Flagler offers almost no waivers for its core courses; only those holding CPA designations may waive the accounting-related course.

To complete their business degree, students must take 62 credits worth of classes. Each core course is worth 1.5 to 2.5 credits, and the remaining credits are fulfilled through elective courses. Students may begin taking electives in the spring semester of their first year, and the second-year curriculum is comprised entirely of electives. The school reports that at least 10% of elective courses are new each year in order to keep class material current with faculty research. There are no required majors at Kenan-Flagler, but there are six suggested concentrations for students who wish to demonstrate their interest and proficiency in subjects such as real estate or operations management. Typically, each concentration requires students to complete five or six elective courses.

Kenan-Flagler also encourages students to design their own independent study or practicum project in which students apply theory to real-world business situations. Students interested in gaining international experience may study abroad for a semester at one of Kenan-Flagler’s more than 50 MBA exchange partner schools or spend one to two weeks abroad as part of a “Doing Business In” immersion course. Alternatively, students can pursue a Global Immersion Elective, a semester-long course that teaches students about a particular region’s culture and history and concludes with a 10- to 14-day tour of that region.

Full-Time MBA Rankings

• U.S. News & World Report: 20

• Bloomberg: 18

• Forbes: 15

• Financial Times: 26

• The Economist: 22

Class Profile

Kenan-Flagler’s Class of 2022 has 344 students, with a median GMAT of 694 and a median GPA of 3.4. Altogether the new class averaged 4.5 years of pre-MBA work experience. Eight percent of students are international and women make up 31% of the class. Twelve percent identify as underrepresented minorities.

Career Statistics

Eighty-six percent of Kenan-Flagler’s Class of 2020 received job offers within three months of graduation, and 85% of the class had accepted offers by that time. The average salary for this class was $126,957 while the average signing bonus was approximately $29,588. Thirty-six percent of graduates entered the financial world, while 26% went into consulting and 15% into general management. Another 14% of the class accepted marketing positions, with operations/logistics roles following at 4%.

The most popular industry for recently minted graduates was financial services, which attracted 19% of the Class of 2020. An additional 18% entered the tech industry, 16% to consulting, 13% in health care, 11% in real estate, and 5% in energy. Consumer packaged goods drew 4%, and retail claimed 3%.

Given the school’s location, Kenan-Flagler graduates unsurprisingly gravitated towards positions in the Southern U.S., with 37% of the class taking a job in that area. Another 16% of 2020 graduates left for the West, while 18% found work in the Northeast. Twelve percent of the class went to the Mid-Atlantic, while 5% left for the Midwest and 11% chose jobs in the Southwest.

Tuition, Scholarships, and Financial Aid

2021-2022 tuition for the UNC Kenan-Flagler full-time MBA is $66,840 for out-of-state residents and $51,152 for in-state residents. Tuition rates are subject to change and are finalized during the summer prior to the oncoming fall semester.

Cost of Attendance

Tuition:

State Resident $51,152

Out-of-state Resident $66,840

Additional Expenses:

Books $1,002

Food $5,004

Housing $13,756

Health Insurance $2,616

Miscellaneous $1,934

Direct Loan Fee $258

Travel $1,260

Orientation Fee $345

Student Association Dues $550

U.S. residents can help provide funding for the degree through Federal Direct Unsubsidized Loans, Federal Direct Graduate PLUS Loans, and private loans. International residents can also fund their education with private loans, if necessary.

Full and partial scholarships are automatically awarded to an estimated 30 percent of enrolled students. Multiple fellowship opportunities are also available for domestic and international applicants, which can be viewed here.

Admissions for the UNC Kenan-Flagler Full-Time MBA

In order to apply for the UNC Kenan-Flagler full-time MBA program, the following must be submitted:

• A completed online application

• Official transcripts

• GMAT/GRE scores

• A résumé

• IELTS, TOEFL, PTE English proficiency test scores (if needed)

• Two letters of recommendation

• Proof of residency for NC applicants

• Two required essays and one additional, optional essay

• A $150 application fee (non-refundable)

All admitted applicants are subject to interviews.

2020-2021 UNC Kenan-Flagler Full-Time MBA Deadlines

| Submission Deadline |

GMAT/GRE Waiver Deadline (Recommended) |

Decision Release |

Deposit Deadline |

|

|---|---|---|---|---|

| Round 1 | October 13, 2020 | September 29, 2020 | December 14, 2020 | January 11, 2021 |

| Round 2 | January 5, 2021 | December 15, 2020 | March 8, 2021 | April 5, 2021 |

| Round 3* | March 1, 2021 | February 15, 2021 | April 12, 2021 | May 10, 2021 |

| Round 4 | April 12, 2021 | March 29, 2021 | May 24, 2021 | June 7, 2021 |

Get an MBA Admissions Edge with the LiveWire Data Dashboard

Curious about your chances of gaining admission to top business schools? Now you can see how hundreds of previous applicants fared at Kenan-Flagler in just a few clicks. The LiveWire Data Dashboard’s interactive data visualization tools allow you to spot trends, compare MBA programs, and benchmark your stats against successful applicants at your target schools. Learn more here! Ready to explore the data? Purchase a 30-Day or 365-Day subscription in our shop for immediate access!

Friday News Roundup – Northwestern Introduces New Classes, and More

Let’s take a look at some of the biggest stories from this week, including new Northwestern classes for its MBA program.

NYU Stern Faculty to Share Expertise on Artificial Intelligence – NYU Stern News and Events

NYU Stern School of Business has announced that select faculty members will be available for speaking engagements, panel discussions or other knowledge sharing on the state of one of tech and business’ greatest forces: artificial intelligence.

According to a recent announcement, leaders in their various fields will be available for comment in articles, or for speaking engagements and discussions on AIs present and future. Information Systems Professor Vasant Dhar, an expert on machine learning in finance, has explored the question of how reliable AI is in the handling of personal finances, as well as AI in big data, healthcare, and education.

Professor of Economics Nicholas Economides, which seems a little too on the nose for an economic’s professors name, is available to share his knowledge on the inequality that tech culture can perpetuate, particularly in California’s IT sector. His research focuses upon how public policy accommodates changes in technology, and how the ebbs and flows of the tech sector affect workers disproportionately to owners and shareholders.

Other topics on which faculty members will contribute their expertise are the ethical concerns behind the use of AI; the possibilities behind AI and crowdsourcing; the legacies of certain innovators throughout history, and a look at how workforce policy has addressed the shifts of the sharing economy.

For more on potential faculty engagements on the topic, read here.

UC Davis Graduate School of Management Professor Weighs in on Stock Buybacks – Yahoo! Finance

University of California, Davis Graduate School of Management professor Paul Griffin recently weighed in on corporate stock buybacks for Yahoo Finance.

A recent op-ed piece for the New York Times by Senator Chuck Schumer and Bernie Sanders criticized the practice for its marginalization of citizen stock traders in favor of corporations by increasing the value of shareholders’ stock options. In certain situations, however, buybacks have an unfavorable effect on stock prices.

Historically, during buybacks for large corporations such as Xerox and General Electric, stock devaluation has been the unfortunate end result. UC Davis’ Griffin notes, “The initial response generally positive, [shares] get a little bump in price. Then people start thinking more about what’s going on here, how a firm is performing on an economic basis rather than managed number basis.”

Few company’s damaged itself through stock buybacks more than General Electric, which bought $40 billion of its own stock (15 percent of its entire market) share. In 2016, the company’s individual stock price was valued above $30, but now consistently is sold between $7-10 per share.

Among the other companies that have landed in Yahoo! Finance‘s “Hall of Shame” are Viacom, GM, IBM, General Electric, and Sears.

Read here for more on corporate stock buybacks.

New Courses at Kellogg Will Focus on Shifts in Global Business – Northwestern Kellogg News & Events

Northwestern University’s Kellogg School of Management has announced 12 new courses that will explore the evolution of global business trends.

“To address the ever-evolving professional development needs of our students, it is a top priority to continually innovate our MBA curriculum … We’ve incorporated a mix of experiential learning, diverse intellectual perspectives and emerging business topics in our latest course offerings.” says Michael Mazzeo, Senior Associate Dean of Curriculum and Teaching.

Among the new course offerings are Blockchain Technology, Digital Assets and the Future of Finance, Corporate Entrepreneurship: Organization Design for Disruption, Leadership Ethics and Empathy, and The Right Stuff: Principles Behind Successful Careers.

Kellogg’s Curriculum Committee, which is comprised of seven faculty members from each of the school’s department, reviewed and approved the new courses via a detailed process that ensures the relevance and breadth of the coursework. To learn more about the new courses, read here.

Habitat for Humanity CEO Speaks at Fox on the Challenges of Non-Profit Fundraising – Fox School of Business News

Temple University’s Fox School of Business‘ Board of Fellows recently gave a presentation on issues pertaining to non-profit fundraising for an audience of MBA students.

Featured guest speaker Christine O’Connell, CEO of Habitat for Humanity, presented the challenges inherent in raising money for non-profit entities learned from her over twenty years of experience. “There is never enough money,” O’Connell says, “and there is entirely too much need. To put that need into context, 800 people call us a month. We are [only] building twelve houses a year and repairing 100.”

O’Connell focused upon the importance of maintaining strong relationships with donors, and of treating each donor with equal respect. Six figure donations, she believes, should be received with the same level of gratitude as smaller amounts. ““You gotta make a connection with people,” O’Connell says, “… You gotta create empathy, and you have to have people feel and know that they are empowered and that their gift counts.”

“[O’Connell] presents Habitat in such a way where she hones it down and says this is how you can help, by supporting this organization and talking about the breadth and depth of what they do, not just that they do it,” said Ellen Marshall, an advisor for Fox Management Consulting and Strategic Clarity Advisors and longtime fundraiser for non-profits.

Read more on O’Connell’s talk here.

Credit Card Company for Emerging Markets Wins Sloan’s Startup Competition – MIT Sloan News

A credit card company for emerging markets won this year’s “MIT Sloan Accelerate 100K Entrepreneurship Competition.”

The company, Duo, is aiming to help the millions of small and mid-sized Latin American businesses that lack credit. In Mexico, businesses that are less than two years old are not granted credit, which lands many of them in massive amounts of debt.

Duo co-founder Hugo Lopez-Velarde, (MBA ’20), winner of this year’s “MIT Sloan Accelerate 100K Entrepreneurship Competition.”

Duo co-founder Hugo Lopez-Velarde, (MBA ’20) says, “In Mexico, corporate cards are uncommon—often, business owners use personal cards and take on credit on behalf of their businesses … This is the first step for next-generation financial products for companies in Mexico.”

Duo users will not only be free of personal debt, but they will also establish credit history. Duo’s card also boasts an analytics dashboard that will allow business owners to manage spending.

Runners-up focused upon emerging technologies in healthcare. The startup Encora created a therapeutic wearable wristband that alleviates hand tremors in neurodegenerative patients. Hikma Health designed customized data systems for healthcare providers who are treating the Syrian refugee population.

Accelerate 100K’s winner and runners up were chosen based upon audience votes, and will advance to Sloan’s Launch competition this spring. Read more about Accelerate’s winners and about Launch here.

Full-Time MBA

UVA Darden Full-Time MBA Program Structure

The UVA Darden Full-Time MBA is structured primarily around case method style teaching and engaging classroom discussion. Students are broken into teams of 50-60, and then further into learning teams of five or six students. Students do not technically pick majors in the MBA program. Rather, they select optional concentrations in the “career” and “theme” track categories. Students can take up to two tracks in the program.

Curriculum

Darden offers a balanced management curriculum within the framework of the case method teaching style and active classroom engagement. Darden’s case-based program means that student discussions constitute a significant chunk of in-class time as the students work through practical scenarios to resolve different business challenges.

There is no selection of academic majors at Darden. Instead, students may opt to pursue concentrations in specific areas of business, though this is not required. The school classifies its concentrations by “career track” and “theme track” categories, and the former includes seven tracks while the latter comprises six. MBA students may pursue as many academic tracks as they would like during their tenure at Darden, provided they can satisfy the academic requirements of each.

The typical incoming class at Darden includes just over 300 students, and each class is divided into five sections of 60 to 65 students and then into learning teams of five to six students. Each section works with its own set of faculty members and competes together in various events throughout the year as part of the Darden Cup. The Darden Cup comprises sporting events, trivia contests and myriad charity efforts for which each section can earn points.

First-year students are afforded several pre-term and orientation options prior to the start of fall classes, which include optional courses in key quantitative areas and many informal meet-and-greet events. The Darden MBA program structures first- and second-year schedules differently, giving first-year students core coursework over four terms and a capstone project while second-years have four quarters in which to take classes. In the first year, students all undertake the same required courses, and first-years participate in a strategy simulation upon finishing the required core curriculum. In the final term of students’ first year, they may begin to take electives and complete Darden Consulting Projects in their areas of interest.

During the second year of the MBA, students take electives at Darden and can also complete courses at other schools within the University of Virginia. Second-years are required to finish one leadership elective before graduation. Students may also study abroad through Darden’s exchange programs; in total, the school offers MBA exchange programs with 18 international institutions. Students wishing to spend one to two weeks abroad may opt for Darden’s Immersion Courses, which are usually offered in March. The Immersion Courses are open to both first- and second-year students.

UVA Darden Full-Time MBA Rankings

• U.S. News & World Report: 12 (tie)

• Bloomberg: 5

• Forbes: 11

• Financial Times: 23

• The Economist: 16

Class Profile

Darden’s Class of 2021 comprises 336 students. Of these, 40% are women and 21% identify as members of domestic minority groups, including students who are African American, Asian American, Hispanic or Latino American, and Native American. Thirty-three percent of students were born outside of the U.S., and in total 38 countries were represented in the Class of 2021. The mean GMAT score reported was 713, and the average GPA was 3.5. Students averaged 27 years of age at the time of entry into the program.

Career Statistics

A full 97% of the Class of 2019 had received job offers three months after graduation, and 96% of the class had accepted a position within three months of graduating. The average base salary of 2019 graduates was $135,168 with an average signing bonus of $33,458.

Consulting was the most popular industry among 2019 Darden graduates, as nearly 36% of the class entered this field, followed by financial services at 24%. The technology sector drew 15% of graduates, while 4% entered manufacturing and 3% opted for consumer packaged goods. Students also chose positions in industries such as real estate and energy.

By function, the Class of 2019 pursued the most roles in consulting, a function chosen by 36% of students. Finance was the second most popular function at 24%, and General Management and Marketing attracted approximately 19% and 15%, respectively.

Geographically, most Darden MBAs relocated to the Northeast, where 31% worked upon graduation. Nineteen percent of the Class of 2019 remained in the Mid-Atlantic region, while 12% pursued roles in the South, 17% in the West, and 7% in the Midwest. Finally, 8% of students chose to work in the Southwest, and another 6% pursued work outside of the U.S.

Tuition, Scholarships, and Financial Aid for the UVA Darden Full-Time MBA

Tuition for the UVA Darden Full-Time MBA 2020-2021 academic year is $69,600 for residents of Virginia and $72,600 for non-residents, while international students pay $72,800. With fees, living expenses, and more, students can expect to pay total per-year costs of:

Cost of Attendance 2020-2021

Tuition & Fees

• Virginia Residents $69,600

• Non-Virginia Residents $72,600

• International Students $72,800

UVA Health Insurance $2,980

Living Expenses $18,176

Case Fees & Books $2,000

Computer $1,500

Transportation (domestic students) $1,000

Transportation (international students) $4,000

Federal Loan Fees (domestic students) $2,116

Totals

• VA Residents $97,372

• Non-VA Residents $100,372

• International Students $101,456

UVA estimates that tuition rates will increase 5 percent annually and that living expense rates may rise 3 percent annually. The school also notes that international students should “allot an additional $7,000 for a spouse and $4,000 for each additional dependent on the Financial Guarantee Form, which is part of the I-20.”

All U.S. residents are eligible for Federal Direct Subsidized Loans and Federal Graduate Plus Loans. The former has a current interest rate of 6.6 percent, while Graduate Plus Loans have a current interest rate of 7.6 percent. Students may also earn an MBA through employer sponsorship.

All candidates are automatically considered for the school’s merit-based scholarships and a myriad of fellowships. You can find a list of scholarships and fellowships for the UVA Darden MBA program here. U.S. military active members and veterans also may be eligible for multiple scholarships, which can be found here.

Admissions

In order to apply to the UVA Darden MBA program, applicants must submit:

• A completed online application

• Official transcripts

• GMAT/GRE scores

• Proof of English proficiency (if necessary)

• A résumé

• Two professional recommendations

• Answers to several short essay questions, which can be found here.

• Proof of residency

• A $250 application fee

Those accepted to the program must first conduct an interview with the school’s admissions committee. U.S. residents must interview in-person at the Darden campus, while international students are invited to do so, but can also interview with recruiting members on international trips, or through Skype.

2021-2022 UVA Darden Full-Time MBA Deadlines

APPLICATION DEADLINES

| EARLY ACTION | ROUND 1 | ROUND 2 | ROUND 3 | |

|---|---|---|---|---|

| Application Deadline | 9 September 2021 | 6 October 2021 | 5 January 2022 | 6 April 2022 |

| Interviews | Limited Open Interviews | By Invitation | By Invitation | By Invitation |

| Decision Release | 20 October 2021 | 8 December 2021 | 16 March 2022 | 4 May 2022 |

Get an MBA Admissions Edge with the LiveWire Data Dashboard

Curious about your chances of gaining admission to top business schools? Now you can see how hundreds of previous applicants fared at Darden in just a few clicks. The LiveWire Data Dashboard’s interactive data visualization tools allow you to spot trends, compare MBA programs, and benchmark your stats against successful applicants at your target schools. Learn more here! Ready to explore the data? Purchase a 30-Day or 365-Day subscription in our shop for immediate access!

Virginia Tech’s Director of MBA Programs Answers 5 Questions

In our latest installment of the MetroMBA “5 Questions” series, we speak with Dana Hansson, the Director of MBA Programs at Virginia Tech’s Pamplin College of Business. Hansson talks about the school’s culture, the faculty, and the networking opportunities available for students.

How would you describe the culture of Virginia Tech Pamplin?

“We are a community of professionals seeking greater opportunities through learning and networking. Our faculty scholars love to teach graduate students and build relationships,” says Hansson. “Our student body is engaged, curious and supportive. Our MBA program is flexible, allowing you to choose the pace, which meets your lifestyle and select courses to expand your horizons.”

According to Dean Robert Sumichrast, “Pamplin has large and expanding programs in Northern Virginia, including our MBA and other planned programs that take advantage of the business and government environment of the Washington metro area.”

What type of student is the best fit for Pamplin’s MBA program (career goals, experience, interests, etc)?

“Pamplin MBA students have professional experience and are ready to take the step in their career, be that seeking a promotion at their employer, shifting from one sector to another or making a pivot to something new such as launching a business concept,” explains Hansson. “Our students are service oriented, embracing the ‘Ut Prosim: That I May Serve at Virginia Tech,’ with many having military service. They enjoy the large and active alumni base, feeling a part of something dynamic.”

Speaking of military service, MBA students with a military background looking to transition to a civilian career or move up the ranks will find lots of support at Virginia Tech. A few of the benefits provided include:

- Military application fee waiver.

- There are Student Affairs specialists available to liaison with the VA on your behalf.

- Financial aid is available including Post 9/11 help.

- Alumni and current students can speak with you about their experience.

If there was just one piece of advice you could give to an MBA applicant considering Pamplin, what would it be?

“Do your due diligence as you explore programs; learn the basics of the program, talk to current students, alumni of the program and faculty,” Hansson encourages. “You will be making a large investment in time and money, as well that from your significant others and employers, so make sure you have chosen the best program to meet your needs.”

Dana Hansson, the Director of MBA Programs.

To help you with your research, Pamplin regularly hosts information sessions all about their MBA programs.

- March 13: Evening MBA Information Session (Northern Virginia Center)

- March 14: All MBA Programs Information Session (online)

- April 9: Evening MBA Information Session (Northern Virginia Center)

- April 17: All MBA Programs Information Session (online)

How accessible are Pamplin professors? Can you give an example?

“MBA program faculty reside in Northern Virginia and have weekly office hours, and are available to meet you at your convenience,” Hansson says. “Emails work well too.”

In terms of faculty and staff, Pamplin is a very small college. This makes it a rather intimate experience. In addition, the school recently appointed “some of the most promising new and accomplished faculty from around the world,” says Dean Sumichrast. He admitted that this was an “intentional change” to increase diversity, raise expectations, and improve faculty research and teaching.

In particular, the school has made prominent strides toward diversity. Among faculty, the percentage of underrepresented minorities is now 16 percent from 0 percent four years ago.

Sumichrast also states, in the same speech, that the college is a very open and friendly environment, “An important part of community is becoming more welcoming and inclusive of everyone, and we have become more welcoming,” he says.

What club would you recommend for a student to check out and why?

“As our MBA program is a part-time offering, our students are busy with life and work,” Hansson explains. “Clubs are not available. However, we offer several networking and alumni mentoring opportunities each semester.”

In regards to networking, the MBA Career Network, launched in 2014, is an opportunity to match MBA students with alumni volunteers. And with a vast Hokie Nation to choose from, there are many mentoring opportunities across Northern Virginia, Richmond, and Roanoke.

As for opportunities beyond clubs, Evening MBA students can choose to participate in a study abroad course to gain international experience. This two-week study abroad portion, allows students to visit several multinational and international corporations, local businesses, and cultural venues.

MBA

Tuck School of Business MBA Program Structure

The lone Dartmouth Tuck MBA offering is a traditional, full-time, two-year program. The near 300 students in the program are broken up into large groups of 60 to 70 students through the first fall term. Those groups are then broken down even further to five-to-six per study group. The program’s quarter schedule features three terms of class and a summer term, which is usually reserved for internships.

To fully complete the program, students must complete 41.5 credits in the first year, and 36 is the second for a total of 76.5 credits.

Curriculum

Students start their MBA schedule with the two-week-long Tuck Launch program, which takes place early August prior to the start of the first academic year. First year students officially begin courses in late-August, a couple weeks prior to second-year students. The bulk of courses in the first year are required core courses. During the spring, first-year students must complete the First-Year Project, which is a five-student consulting project.

Second-year students may choose from over 100 electives and must complete a minimum of 12 full-term courses. Students in the second year also have the opportunity to study abroad with many of Tuck’s international exchange programs, which includes universities in Europe, Asia, and Latin America.

Full-Time MBA Rankings

• U.S. News & World Report: 11

• Bloomberg: 5

• Forbes: 6

• Financial Times: 12

• The Economist: 10

Class Profile

A total of 287 students are enrolled in the Dartmouth College Tuck School of Business Class of 2024, 45 percent of which are women. Forty-three percent of the class is made up of international students, and 31 percent are U.S. minority students.

Among these students, the average GMAT score was 726, and the undergraduate GPA was 3.52. The average work experience of new students was 5.6 years.

Career Statistics

The most recent Tuck School of Business employment report revealed that MBA graduates from the school earn a median base salary of $175,000 and a median signing bonus of $30,000. 93 percent of MBA grads earned a signing bonus, ranging anywhere from $5,000 to $128,500.

Within three months of earning the degree, about 98 percent of Tuck MBA holders were offered jobs, with 96 percent accepting new roles. The majority of hires were in consulting (47 percent), financial services (20 percent), and technology (11 percent).

Tuition, Scholarships, and Financial Aid for the Dartmouth Tuck MBA

The annual base tuition for the Dartmouth Tuck MBA is currently $77,520. With other costs, including books, supplies, and fees, among others, the total cost is $114,825 for first-year students living on campus.

All U.S. students qualify for an annual direct unsubsidized loan for $20,500 from the U.S. Department of Education. The current interest rate is 6.54 percent. Those that need more financial assistance than the unsubsidized loan can provide are eligible for the Graduate PLUS loan, which has a current interest rate of 7.54 percent. Private, international, and school-direct loans are also eligible for those that qualify.

The Tuck School of Business offers multiple scholarship and fellowship opportunities, including through the Forté Foundation and the Yellow Ribbon Program for U.S. armed services members and veterans.

Admissions to the Dartmouth Tuck MBA

In order to apply for the Dartmouth Tuck MBA program, the following must be submitted:

• A completed online application form

• A non-refundable $250 application fee

• Academic transcripts

• GMAT/GRE scores (no minimum score required)

• Proof of English proficiency (if necessary)

• Essays

• Resume

• Two letters of reference

All applicants admitted to Tuck will interview prior to an admissions offer. Round 1 applicants who submit their complete application, including Letters of Reference, by September 1, 2022 (or October 1, 2022, if applying to Tuck through the Consortium), and all Round 2/Round 2 Consortium applicants who submit their complete application by December 1, 2022, will be guaranteed an interview. For all other applicants, interviews are offered by invitation only. We will review your application and invite you to interview if we believe it will help us learn more about how you demonstrate our admissions criteria.

2022-2023 Dartmouth Tuck Full-Time MBA Deadlines

Round 1: September 26,2022

Round 2: January 4, 2023

Round 3: March 27,2023

Working on your Tuck School of Business application? Check out the Clear Admit Tuck Essay Topic Analysis for advice on how to approach your essays.

Get an MBA Admissions Edge with the LiveWire Data Dashboard

Curious about your chances of gaining admission to top business schools? Now you can see how hundreds of previous applicants fared at Tuck in just a few clicks. The LiveWire Data Dashboard’s interactive data visualization tools allow you to spot trends, compare MBA programs, and benchmark your stats against successful applicants at your target schools. Learn more here! Ready to explore the data? Purchase a 30-Day or 365-Day subscription in our shop for immediate access!

Diving Into Canada’s Best Healthcare MBA Programs

While a straightforward MBA will no doubt grant you all of the opportunities that you’ve anticipated—a great salary, a strong resume, and a wide range of job options—a specialized degree is also wise to consider.

With presence in both the public and private sectors, the healthcare industry is in constant need of professionals with a strong sense of how to manage its growth and structure. Following is a look at some of the leading programs in Canada that have healthcare-related specializations.

Top Online MBA’s that Do Not Require the GMAT

Why do schools require the GMAT?

Similar to how the SAT plays a role in undergraduate admission to higher education, the GMAT has been a consistent requirement for the majority of business programs globally. This standardized test has been one of a variety of factors that go into consideration when being accepted into programs. There are three main reasons that the GMAT has been part of the application process:

Reliable indicator of student success:

Based on surveys conducted by GMAC, the GMAT has been a reliable indicator of student success in the classroom among MBA programs.

Equalizer in admission process to gauge quality of prospective students:

The GMAT also provides a standardized test, which is applicable to all students entering admissions to top MBA programs. Other factors such as years of work experience and undergraduate GPA are subjective and can vary depending on the applicant.

Major factor in many major MBA rankings:

Major publication rankings such as the Financial Times, US News and BusinessWeek take into consideration the average GMAT score for each MBA programs incoming class. For example, the mean GMAT and GRE score is weighted at 0.1625% for the US News Ranking. Historically, schools have an incentive to accept students with higher GMAT scored for ranking purposes in these major publication rankings.

Why pursue an online MBA?

There are many reasons to pursue an online MBA degree versus a full-time on-site MBA or a part-time on-site MBA:

Advancement in technology:

The advancement in technology platforms, schools are increasingly able to provide an in-person atmosphere at remote locations for students. For example, many colleges utilize a web platform called ClassroomLIVE, which is an integrated, web-based learning environment that delivers programs in real-time from classrooms on college campus’s direct to students, in their homes, at their workplaces, or while traveling. This provides a synchronous learning opportunity where students are able to interact live with professors and other students during the class as it is taking place on campus. Take a look at an example of the interactive learning platform here.

More accepted among employers:

The stigma among corporate recruiters and hiring mangers when it came to online MBA job seekers was that it was not as respected compared to on-campus MBA offerings. However, with the online MBA becoming more popular among degree seekers, corporate recruiters and hiring managers are weighing the name of your college and the type of degree you have earned is more heavily than the method by which you earned your degree.

Flexibility:

One of the major issues facing MBA degree seekers is balancing their current career or family obligations while also being able to complete an MBA and the learning requirements. Many part-time programs are offered at specific locations on specific days, creating a barrier for applicants to pursue the degree offering. One of the major advantages of pursuing an online MBA program is the flexibility the learning experience offers. Many programs are beginning to offer students the option to attend the classroom learning in person, but not penalizing them for accessing the curriculum remotely.

Lower Cost on Average:

Since the overhead cost are lower for colleges and universities, online MBA programs are typically cheaper than on-site program offerings. This is another advantage for students who are looking to complete a flexible MBA degree at a lower cost. On average, online MBA programs are about 15-20% cheaper than an on-site offering due to the lower overhead.

What are the general requirements of online MBA programs that do not require the GMAT?

For applicants who are looking to bypass the GMAT and pursue an MBA that does not require the GMAT, there still are requirements to be eligible for admissions to many online MBA programs, they include:

- Schools application

- Bachelor’s degree

- Resume

- Letters of Recommendation

- Personal Statement

- Application Fee

What factors should I consider for choosing an online MBA?

Network of professors and faculty

The professors and faculty in your MBA program are one of the most important facilitators as you learn the curriculum of an MBA. Professors have in-depth knowledge of business practices as they apply to the real world and the best ones can challenge you to apply the skills you learn throughout your MBA to real-life scenarios to prepare you as a business professional. It is important to understand your professors background and experience and how it will impact their teaching style and expertise.

Network in the classroom

Although professors and faculty will steer high-level learning, your classmates will have a large impact on your classroom discussions, projects and case studies. Learning from experienced individuals will provide more value and insight throughout your MBA. It is important to prioritize the level of quality among your classmates to enhance your learning experience during your online MBA.

Alumni network

One of the most important assets an MBA program can provide is its inclusion to a wide range of alumni from CEO’s and CFO’s of Fortune 500 companies to presidents and general Managers of global corporations. It is important as you consider the quality of the MBA program, that you also heavily factor in the alumni network that each institution provides to its newly dubbed alumni. These networks open doors to employment and internship opportunities post-graduation.

Internship opportunities

Many MBA programs offer internship opportunities during your educational experience. MBA internships allow you to get your foot in the door while directly applying the knowledge and skills you gained during your MBA. It is also important to research the career services office to see where previous MBA students have interned to make sure the opportunities fit your goals.

List of top online MBA programs that do not require the GMAT:

Loading Programs

Loading Programs

Investing in Your Future With These New MBA Jobs

Finance careers continue to be a popular and lucrative option for recent MBA graduates. The work is varied, as finance relates to many industries and companies. In addition, the field is obviously very rewarding, with average graduate earning more than $140,000 according U.S. News & World Report. One of the most popular and well paid areas of finance is work at investment banks.

According to the Corporate Finance Institute, investment banking is the division of a financial institution that aides governments, corporations, and organizations through capital raising and mergers and acquisitions advisory services. Investment banks typically act as intermediaries between investors and corporations, and are often popular landing spots for MBA degree holders to bring their talents. Here’s a look at some of the best new MBA jobs in the investment banking sector: Continue reading…

Executive MBA

Yale Executive MBA Program Structure

The Yale School of Management MBA For Executives is a 22-month program. Classes are about 75 percent general management courses, with 25 percent of courses designated for areas specific to the student. Classes are held on Friday/Saturday sessions on alternating weekends. In total, there are four in-residence weeks and one Global Network Week.

Curriculum

The Yale MBA For Executives integrated core curriculum is built with a focus on areas at the nexus of business and society—asset management, healthcare, and sustainability—the Yale School of Management’s MBA for Executives combines rigorous analytical skills with a broad understanding of social context to prepare you to lead in a world without boundaries.

While the leadership development practicum and the colloquium take place throughout the program, students in the first year undertake core curriculum courses. Those in the second year complete advanced management, self-directed study, and the focus courses of their choosing.

2021 Yale SOM Executive MBA Rankings

• U.S. News & World Report: Unranked

• The Economist: 5th

Yale SOM Executive MBA Class Profile – 2022

The Yale SOM MBA for Executives Class of 2022 features 77 students. The average student is 36-years old and has 13 years of work experience. Women make up 31 percent of the class, and 40 percent hold advanced degrees.

Career Statistics

The three largest areas of focus for the Class of 2020 are healthcare (38 percent); sustainability (37 percent); and asset management (25 percent).

Tuition, Scholarships, and Financial Aid

The two-year, all-inclusive program fee for students entering in July of 2021 is $198,500. Program fees include tuition, required textbooks, study materials, and breakfast and lunch on all class days. Program fees also include lodging during summer residencies, Friday evenings during class weekends, and the EMBA Global Network Week. Payments are due in four installments (August/December of each year).

A small number of applicants may be eligible for certain scholarships within the business school. All enrolled students are automatically considered. In addition, applicants are eligible for multiple external scholarships to help with payment, which can be found here.

All U.S. students are eligible for Federal Direct Student Loans, in addition to private loans. International applicants can apply for the school’s loan program for assistance.

Admissions

In order to apply to the Yale SOM MBA For Executives program, applicants must submit:

• Official transcripts

• GMAT/GRE/EA scores (no minimum)

• A résumé

• Two letters of recommendation

• Employer approval

• Two essays (500 words each)

• A $225 application fee

2021-2022 Yale SOM Executive MBA Deadlines and Decision

Application Round Timelines

| EMBA CLASS OF 2024 TIMELINE | ROUND 1 | ROUND 2 | ROUND 3 |

|---|---|---|---|

| Application Round Deadline | November 3, 2021 | January 31, 2022 | March 30, 2022 |

| If advanced to interview, interviews will take place… | December 3-4, 2021 | February 25-26, 2022 | April 22-23, 2022 |

| Classes Begin | July 2022 | July 2022 | July 2022 |

Full-Time MBA

Yale Full-Time MBA Program Structure

The Yale full-time MBA can be completed over four semesters, each consisting of 12 weeks. Each of these semesters are divided into two separate six-week quarters.

To graduate, students must earn 72 credits. Among the total, 34 credits are designated for core courses and 38 are through electives.

Curriculum

First-year students must complete their core courses, starting with the seven-week Orientation to Management. They then complete the ten-course Organizational Perspectives segment, which lasts two quarters. First-year students also fulfill an international experience requirement during the spring, traveling on various faculty-led field trips. Please note, this may be impacted by COVID-19.

Students complete most of the electives in their second years, with the option to take multiple concurrent courses with many of Yale University’s other affiliated colleges, such as the Yale School of Law and the Yale School of Architecture. In addition, students can study at several international exchange partner schools during the fall semester of the second year.

Full-Time MBA Rankings

• U.S. News & World Report: 9

• Bloomberg: 14

• Forbes: 11

• Financial Times: 14

• The Economist: 21

Class Profile

The Yale full-time MBA Class of 2021 features 345 students. An estimated 42 percent of the class is made up of female students and 44percent international students. The median GMAT of the class is 720 and the median GPA is 3.66.

Career Statistics

The majority of graduates from the most recent Yale SOM full-time MBA class earned careers in consulting (37.2 percent), technology (12.8 percent), and finance (21.9 percent). The median salary of the class was $135,000 for domestic hires and $110,000 for international hires.

An estimated 92.4 percent of the Class of 2019 earned employment offers within three months of graduation.

Tuition, Scholarships, and Financial Aid

The current tuition cost for the Yale full-time MBA is $74,560. Combined with fees, room, board, and textbooks, the total for 2020-21 is $102,240.

All Yale SOM full-time MBA applicants are automatically eligible for merit-based scholarships. About 50 percent earn some form of a scholarship, while 29 students currently hold full-tuition scholarships. Additionally, U.S. armed services veterans are eligible for the Yellow Ribbon Program, which can greatly reduce tuition costs.

Financial aid is available to all students. U.S. students are eligible for Federal Application for Student Aid (FAFSA). The school currently estimates that the average indebtedness is more than $60,000 per student. On average, loans take 6.5 years for Yale SOM full-time MBAs to pay off.

Admissions

In order to apply to the Yale SOM full-time MBA program, applicants must submit:

• Official transcripts

• Two professional recommendations

• GMAT/GRE scores

• Video of answered application questions

• $250 application fee (can be waived for select applicants)

The business school encourages those with work experience to apply, but it is not a strict requirement for enrollment. There is also no minimum GMAT/GRE score requirement. International applicants are not required to take any English language proficiency test, although all transcripts must be translated to English for submission.

Interviews are required as part of the admissions process.

2021-2022 Yale Full-Time MBA Deadlines

Round 1

September 14, 2021

Decision

December 3, 2021

Round 2

January 6, 2022

Decision

March 25, 2022

Round 3

April 12, 2022

Decision

May 18, 2022

Yale Full-Time MBA FAQ

How has the university responded to the current pandemic?

Classes will be hybrid with an emphasis on online learning to keep students safe.

How much does the program cost?

The full-time MBA is $102,240/year including fees and living expenses. There are a 5-month and 10-month payment plan available to students.

Does Yale offer international experiences for MBA students?

Yes, while many have been postponed due to the current pandemic Yale has some enticing international experiences including Global Network Weeks and Global Network Courses.

Working on your Yale SOM application? Check out the Clear Admit Yale Essay Topic Analysis for advice on how to approach your essays.

Get an MBA Admissions Edge with the LiveWire Data Dashboard

Curious about your chances of gaining admission to top business schools? Now you can see how hundreds of previous applicants fared at Yale SOM in just a few clicks. The LiveWire Data Dashboard’s interactive data visualization tools allow you to spot trends, compare MBA programs, and benchmark your stats against successful applicants at your target schools. Learn more here! Ready to explore the data? Purchase a 30-Day or 365-Day subscription in our shop for immediate access!

MBA Job Profile: Senior Analytics Consultant

If you’re interested in big data, including developing and implementing analytics solutions at an organization, a job as a Senior Analytics Consultant could be ideal for you. You’ll be responsible for creating data mining projects and using that information to increase consumer brand awareness and revenue.

Currently, it’s still a somewhat developing field. However, many top companies regularly hire Senior Analytics Consultants, including Wells Fargo, Deloitte, Humana, Accenture, and KPMG. And, by 2020, the big data and business analytics market may reach $203 billion.

What is a Senior Analytics Consultant?

Senior Analytics Consultant are responsible for examining systems and recommending methodologies for improving data and usage. This includes executing data quality and data auditing plans as well as evaluating and presenting on your findings. In fact, one of your major job duties will be creating reports and suggesting business process changes for business users based on your analysis of large amounts of information and data. You’ll also be responsible for interviewing users to identify data needs and delivery mechanisms while also documenting process flows to fulfill business needs.

The role of a Senior Analytics Consultant is similar to most other consulting positions. You’ll be expected to demonstrate leadership qualities will also working well with a team. Regularly, you’ll work closely with other business departments on time-sensitive projects that you’ll have to prioritize in order of importance. In particular, you’ll be expected to demonstrate specific skills including:

- Data Analysis

- Web Analytics

- Data Modeling

- Project Management

- SAS

- SQL

- Statistical Analysis

In fact, according to PayScale, knowledge of web analytics, data modeling, and project management correlate to a pay increase of 23 percent, 17 percent, and 13 percent, respectively.

How Much Does It Pay?

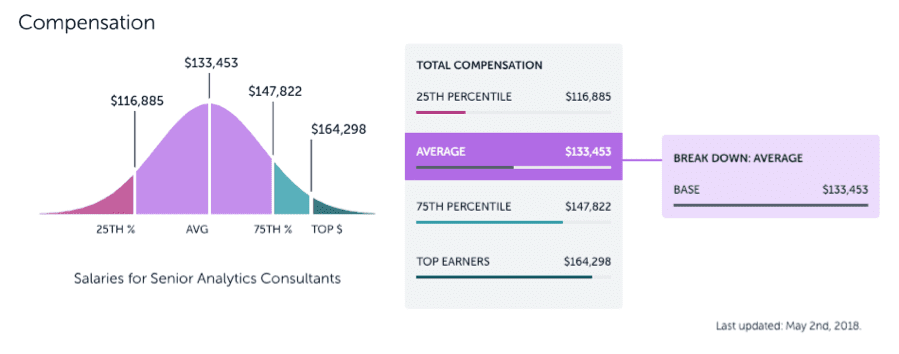

As for what you can expect to earn as a Senior Analytics Consultant, on average base pay starts at $133,343 and generally ranges from $116,885 to $147,822. Top earners may expect salary around $164,298.

However, salary can vary greatly depending on experience. About 38 percent of Senior Analytics Consultants have between just zero and two years of experience, while another 38 percent have between five to ten years of experience. The remaining 25 percent have between two and five years of experience.

Pay also depends on where you’re willing to live. Boston pays the best with average salaries 28 percent above the national average while Minneapolis is one of the worst paying with salaries 7 percent below the national average. Other cities that pay well include:

- Seattle (5 percent above avg)

- Atlanta (5 percent above avg)

- New York (4 percent above avg)

- San Francisco (4 percent above avg)

- Chicago (2 percent above avg)

Getting Started

The minimum requirement to be a Senior Analytics Consultant is a bachelor’s degree in mathematics, statistics, accounting, or a related field. Typically, industry experience in analytics reporting and industry-standard analytics software is also preferred. There are also potential industry certifications that can improve your chances such as the Amazon Web Services (AWS) Certified Big Data – Specialty. Other potential certifications can be found here.

Another great place to start in this career is with an MBA from a top-notch program. Here are a few of our favorite programs to help you on your career path.

Harvard Business School

In March 2018, Harvard Business School welcomed its first cohort of students to its online certificate program in business analytics. This certificate goes into the latest research on how data analytics plays a role in business and brings together HBS with the Harvard John A. Paulson School of Engineering and Applied Sciences. MBA graduates are welcome to expand their analytics skills with this immersive experience.

The Wharton School

The Wharton School knows what it takes for a career in data and analytics—significant research and networking. That’s why for MBAs at Wharton there are many opportunities to expand your skill and background in this area. There’s the MBA Data and Analytics Club (WDAC) and the Wharton Customer Analytics Initiative (WCAI), both of which stress the field of analytics. Wharton MBA students also have access to workshops where they can learn coding languages including R (Open Source Software), SQL, and Tableau.

Tepper School of Business

At Carnegie Mellon University’s Tepper School of Business, students can earn an MBA in Business Analytics. This specialized MBA program offers advanced courses in data analytics to improve business outcomes including theoretical and broad application knowledge. The program looks for business-minded students who want to develop their skills to make better data-driven business decisions. When students graduate, they walk away with hands-on experience in analytical tools and methodologies that will be valuable for their future careers.

The Top Healthcare MBA Programs in California

The California healthcare industry is booming. The industry employs more than 1.4 million people across ambulatory settings, hospitals, and residential care facilities. And as the population continues to age, there’s no doubt that the healthcare industry will continue to expand.

So, it should come as no surprise that an MBA in healthcare is becoming a more popular track for future business leaders. With the industry estimated to be worth $2.26 trillion, there are many opportunities across the board. The key is to choose the right healthcare MBA.

Here are our top six California Healthcare MBA programs:

These Tech Firms are Looking for Brand New MBA Talent

Not every new MBA job in the tech sector is at Google, Apple, Facebook or Microsoft—there are plenty of exciting opportunities for new tech MBA talent at companies like Hewlett-Packard, IBM, and Adobe. Continue reading…

Top MBA Employers: UBS – The Union Bank of Switzerland

In the MBA job hunt, you may wonder which company will be the best fit for you. Work-life balance, salary requirements, and company culture are all things to consider during your process. However, how much a potential employer values your degree is also crucial. One is wise to focus on companies that seek fresh, new MBA hires, but also for their potential to push future growth. The Union Bank of Switzerland (UBS) is one company that has developed a great reputation for hiring and cultivating student talent, making it a top recruiter for MBAs.

Designed to “unite your education with … hands-on experience” MBA Associate positions can take place either over the summer or full-time. Both positions are in UBS’ Corporate Client Solutions (CCS) division of their investment bank.

The 10-week summer position is open to MBAs between the first and second years of business school. Applications acceptations start in October of the previous year, for employment beginning the following June. Summer Associates will learn how to see transactions through from start to finish under the guidance of senior management, while gaining access to a full range of networking events and seminars.

Full-time Associates will have completed the summer position previous to hiring, and are placed with a team with which they can pursue the next level of immersion into the workings of the CCS.

Finding UBS MBA Internships

Currently, UBS is in search of interns for its Quantitative Trading desk. The quant trading intern will specialize in building predictive models, but will also learn the full range of duties associated with trading. This position requires a desire to learn about market impact, portfolio risk management, and more. An intern in quant trading will join the Investor Client Services team, on which he/she will learn how to offer advice to fund and asset managers as they purchase and sell securities. The position begins with a week long training, followed by nine weeks as a full team member. February 17, 2019 is the deadline for application.

For recent grads hoping to get some work experience first, UBS’s Graduate Talent Program may be a great fit. The New York office is hiring recent grads within its Investment Risk Control department. This position involves knowledge of regulations, laws and rules that govern the investment industry, along with the updating of marketing materials to ensure their accuracy. The Graduate Talent Program hire will gain the opportunity to rotate through the Market and Credit Risk Teams, preparing them for a future in the compliance and regulatory fields. No deadline is currently listed for application.

UBS hires MBA grads around the world as part of its numerous corporate programs, including the UBS Graduate Talent Program, currently looking for new entrants in New York City.

Internships are also available at the New York City, Weehawken, NJ and Stamford, CT offices for Group Operations positions. The focus of these positions is management of company processes to guarantee efficiency and maintain high performance. Servicing the Wealth Management, Asset Management, and Investment Banking divisions of UBS, the Group Operations Intern will analyze current systems, as well as assist in implementing new processes across each department. The deadline for application is June 1, 2019.

UBS MBA Culture

UBS prides itself upon hiring people with diverse backgrounds and experiences, encouraging applicants to draw upon all of their interests. Though your MBA may require focus on your current studies and past business experiences, other team-focused or planning activities are crucial when applying.

As UBS states, “Perhaps you’ve organized a fundraising event or taken part in team sports? Or persevered and passed an exam in a subject you found challenging? Think about how things you’ve achieved match the skills we’re after.”

UBS MBA Salary

According to PayScale, the average BA grad earns about $64,000 USD at UBS. When compared to MBA grads, these figures leap to over $80,000—a 20 percent increase. Salary differences are often depending upon specialty. Specifically, MBAs with a focus in finance earn around $75,000. While those graduating with a focus in information technology may earn over $150,000 per year.