Search results for career:

Top 5 Paying MBA Careers: Finance

Finance, no surprise, is an extremely popular field among MBA graduates. According to Payscale, finance is 4.7 times more popular among MBA graduates than other fields. The reasons for this are rather uncomplicated: its pretty lucrative.

The starting median salary for those with up to five years of experience is $62,100. After ten years, the reported median salary jumps to $120,000; a 93 percent increase. Given that it is finance, the bonuses that employees can earn are massive, making the field even more lucrative.

With such high salaries and the prospect of massive bonuses, those interested in finance might be curious about what the best positions are for them. These can vary by company, experience, and location.

Companies Recruiting Finance MBA Graduates

The firm you work for can affect how much you make. Larger firms tend to offer more than smaller houses. The following are the top five employers in terms of average salary for those with an MBA in finance.

Morgan Stanley: $136,500

Deloitte: $132,656

Microsoft: $123,684

Amazon: $123,678

Citigroup: $121,346

Finance MBA Experience

As one might expect, the more experience one has in a field, the higher their salary will be. According to Payscale, this is a breakdown of average salary based on years of experience.

- Up to 11 Months: $58,517

- 1–4 Years: $65,589

- 5–9 Years: $86,086

- 10–19 Years: $113,775

- 20+ Years: $135,016

Finance MBA Location

Along with company size and experience, location is the other major determinant of salary for finance MBA graduates. Given the fact that finance tends to be centralized in major cities, it is reasonable to assume that the largest salaries are to be found in cities with large, well-populated metropolitan areas. The following are the five cities where MBA graduates can earn the most.

- New York, NY: $120,962

- Los Angeles, CA: $111,727

- Boston, MA: $109,490

- Chicago, IL: $108,421

- Houston, TX: $101,643

For finance savvy MBA graduates, New York City offers the best average salary opportunities in the United States.

Top Paying Finance Careers

While there are many careers from which a finance MBA can choose, the following offer the highest salaries. To maximize a potential salary, one should consider the variables mentioned above when searching for a position.

#1: Vice President, Finance ($135,000–$195,000)

As a vice president of finance, your primary responsibility will be to direct finances and coordinate the budget. The VP of finance also sets goals and oversees lower-level employees in the financial department. Other responsibilities include engaging in accounting, operations, and finance management.

Common tasks include the following:

- Ensuring company financial plans are carried out

- Coordinating, preparing, and reviewing annual reports

- Directing accounting operations

The average salary of a VP of finance is $134,919. In addition, MBA graduates can earn an average of $24,430 in bonuses, $24,566 in commission, and $8,757 in profit sharing. The salary on this job can raise these numbers higher depending on where one works. Look for these positions in the following cities, where you can earn more than the average:

- San Francisco, CA: 28 percent more

- Los Angeles, CA: 16 percent more

- Boston, MA: 15 percent more

#2: Finance Director ($110,000–$160,000)

Finance directors are responsible for managing the goings on in the finance department of the company. In addition, effective finance directors can see problems and risks and design necessary solutions as needed.

Common tasks include the following:

- Overseeing the preparation of regulatory and financial reporting as required

- Developing policies and procedures to control and report financials

- Managing budget, forecast, and accounting preparations

The average salary of a finance director is $111,384. MBA graduates can expect to earn an average bonus of $18,556, $33,000 in commission, and $5,113 in profit sharing. According to Payscale, the following are three highest paying companies for this position:

- Nike: $150,000

- Lilly: $130,000

- CBRE Group: $128,000

#3: Investment Banker ($99,000–$207,000)

As an investment banker, your primary responsibility is to grow wealth for your clients. This can be through either strategic investing or raising capital. Investment bankers look through all of the financial information of a company to develop the best strategy for addressing its concerns and reaching its goals.

Common tasks include the following:

- Constructing financial models to aid in transactions and communications

- Performing valuation analyses

- Conducting industry and company research

On average, you can expect to earn an average of $98,831 in salary. Investment banking is rather lucrative, so it is not impossible to double your salary in commission alone. However, because if this, the salary scale can widely vary. The average commission for this position on Payscale is $90,000. To make that possible, you’ll need to go to a city where capital generation is needed. These three places pay more than the average, according to Payscale:

- San Francisco, CA: 52 percent higher

- New York, NY: 12 percent higher

- Dallas, TX: 5 percent higher

Investment bankers would do well to look into a career in the Bay Area. San Francisco-metro investment bankers make nearly 50 percent more than the national average, according to Payscale data.

#4: Finance Manager ($90,000–$124,000)

Finance managers are expected to watch departmental budgets. Their primary responsibilities include making financial forecasts for their company, working with other departments to establish future budgets, and keeping excellent track of the money going in and out of the company.

Common tasks for people in this position include the following:

- Identifying areas for cost reduction

- Providing analyses to the operations team

- Preparing informational analyses

Given the importance of this position, MBA graduates who pursue it will be compensated well. The average salary for a finance manager is $89,636. In addition to the base salary, an MBA graduate can expect an average of $9,959 in bonuses, $25,006 in commission, and $3,982 in profit sharing.

Because this position is so important, companies are willing to pay excellent candidates well. The following offer the three highest average salaries according to Payscale:

- Boeing: $119,000

- Amazon: $112,000

- Johnson & Johnson: $111,000

#5: Portfolio Manager ($84,000–$140,000)

Portfolio managers are responsible for investing their clients’ money, whether those clients are businesses or individuals. They work to get the highest return possible for their clients’ money.

Common tasks for this position include the following:

- Consulting with clients to develop investment goals

- Reporting on investment performance

- Managing portfolios to maximize returns

Portfolio managers earn an average of $84,443, with $10,274 in bonuses, $10,113 in commission, and $4,000 in profit sharing. According to Payscale, these positions tend to be centered in financial institutions and investment firms.

The following three banks offer the highest average salaries to their portfolio managers.

- Blackrock: $115,000

- S. Bank: $99,000

- Citizens Financial Group: $97,000

Friday News – Georgetown Executive Program Earns Top 10 Ranking, UVA Darden Launches Online Career Development Tool, and More

Let’s take a look at some of the biggest stories from this week, including the Georgetown Executive Education program earning some heady praise from the Financial Times.

Financial Times Ranks Executive Custom Programs #10 in U.S. – Georgetown McDonough School of Business News

Georgetown University’s McDonough School of Business has been recognized by the Financial Times as one of the top ten best executive education programs in the country.

On the news, Charles Skuba, Senior Associate Dean for Executive Custom Programs, says, “Our client-centered approach to executive education at Georgetown McDonough ensures every program is tailored to the specific needs of each organization … We’re proud of our ranking and the results we deliver for our loyal and growing number of clients.”

McDonough’s Executive Custom Programs are tailored to the needs of each individual and their organizations. Advisors consult with students to build a curriculum that will best meet their unique goals. Among the areas covered by custom programs are market strategy and non-market strategy, global leadership and operations; corporate responsibility, communications, project management, and finance.

You can learn more about the Georgetown Executive Education Custom programs here.

UVA Darden Launches Summer Program Offering Admitted Students Early Preparation for MBA Recruiting Success – UVA Darden School of Business News

The University of Virginia Darden School of Business has announced the launch of a new tool to assist incoming MBA students in preparing for internships and their future careers.

The program, Career Development WhyFinding, was developed by Darden’s Career Development Center. It features videos, interactive modules, and curated resources that are designed to guide students through the early stages of professional development. One of the main features of CDWhy is its ability to assist in preparation for the rigorous recruiting process.

Inside the UVA Darden Career Development Center / Photo via news.darden.virginia.edu

“Year after year, we hear from Darden students that they wish they had begun preparing for MBA recruiting in the summer before their First Year,” says Jeff McNish of the Career Development Center. “We are thrilled to now offer this service to Darden’s career-driven students so that they can gain a head-start in the competitive MBA recruiting process.”

CDWhy was developed with input from a diverse group of Darden students and alumni. The Career Development Center has planned to implement versions of CDWhy that are tailored to both Executive MBA and Business Analytics students. Learn more about the Center and about CDWhy here.

Tuck Makes Applicant-Friendly Changes for the 2019-2020 Admissions Cycle – Tuck School of Business News

With the goal of streamlining the admissions process, Dartmouth College’s Tuck School of Business has made some changes to its application process.

The application deadline for round one will be October 1, with decisions released in early December. November 1 is the cutoff for applicant-initiated interviews. Luke Anthony Peña, Executive Director of Admissions and Financial Aid, says:

“We pledge to listen and to be responsive to our applicants. Moving our round one deadline back two weeks provides several additional days for aspiring Tuck students to visit campus and interview before finalizing round one applications … And once again, we are committing to a shorter wait time for decisions.”

In the new application, there will be three 300-word essay questions, and the short answer portion has been omitted. In addition, Tuck has adopted the GMAC’s Common Letter of Recommendation questions. Both the essay and the recommendation questions can be found here.

Another Successful Showcase for the UCLA Anderson Venture Accelerator – UCLA Anderson News

At last month’s UCLA Anderson School of Management Venture Accelerator Showcase, ten companies presented their startups to an audience of venture capitalists and potential investors.

Among the presenters were a skin care company and a ready to drink cocktail, in addition to a product that uses WiFi to charge mobile devices. Created by a father and son team, this product has already received funding. Trish Halamandaris, Director of the Anderson accelerator, says of the showcase, “This year’s companies were further along in their product development, which resulted in some better funding … Much of that success can be attributed to the increased number of Anderson alumni who served as advisors and were instrumental in helping these companies accelerate their growth.”

Members of the 10 teams competing at this year’s UCLA Anderson School of Management Venture Accelerator Showcase / Photo via anderson.ucla.edu

The competitors were U-Defi, an anti-aging skin care product; Indarra, a fast-casual Indian restaurant; Bluprint, a presentation tool; Creative Propulsion Laboratory, a production company for children’s content; VoiceLife, a wireless charging product; Elenita, the ready-to-drink mescal cocktail; and Nutopia, a blockchain service for the film and television industry. You can read more on the competitors and the showcase here.

EMBA Students’ Alabama Road Trip: Reflections on Racial Injustice – Berkeley Haas News

A group of EMBA students from UC Berkeley’s Haas School of Business traveled to Selma and Montgomery, Alabama over Memorial Day to experience the history of the civil rights movement with the hope of informing their studies and their careers.

The trip held special significance for Lisa Rawlings (EMBA 19) whose grandmother was born in Alabama and moved to Memphis as a teenager. “Putting myself in my grandparents’ shoes, I realized that courage was not always resistance, but sometimes it was simply endurance, which often required unthinkable compromises to their dignity to save their lives and those of their loved ones,” she says of the visit.

Rawlings was joined by her EMBA classmates, touring the National Memorial for Peace and Justice, along with Dexter Avenue King Memorial Baptist Church, where Dr. Martin Luther King Jr. served as pastor. They also crossed the Edmund Pettus Bridge in Selma, where law enforcement and protesters for voting rights had a standoff in 1965.

You can learn more about the Berkeley Haas students’ journey to Alabama here.

New Finance Careers Openings Announced

Many MBA graduates pursue careers in financial services after completing their degrees. Jobs in this field include product managers, financial analysts and asset managers, as well as roles in related emerging sub-sectors like FinTech. For MBAs looking to break into this field, check out our list of five exciting new MBA jobs at these top financial services firms: Continue reading…

MBA Career Comparison: Finance Manager vs. Product Manager

Finance and product management are two possible career paths that MBA graduates would do well to consider.

Both roles deal with large-scale coordination of many moving parts. Finance managers consider the total financial health of a business, including long-term planning and investment activities. Product managers, on the other hand, oversee the development of a product or feature from inception to launch, which involves creating a business strategy and fine-tuning a product’s function. To get a better understanding, check out our breakdown of the professions below.

Pharma Careers Highlight This Week’s Newest MBA Jobs

As modern medicine and healthcare continues to advance, healthcare providers and pharmaceutical manufacturers require new hires with analytical abilities, business acumen and problem solving skills to help innovate. MBAs will be relied on to lead these firms, the miracle drugs they produce, and the lives they serve, into the future. Here are just a few new MBA jobs currently available in the healthcare provider and pharmaceutical fields. Continue reading…

Career Focus: Recruitment at Bristol-Myers Squibb

Pharmaceuticals—whether it’s the research & development side of the industry, or the IT, supply chain, marketing, HR or accounting end of things—is an industry that needs responsible leadership as it continues to transform. Fortunately for MBAs, there are a number of programs specializing in pharma and healthcare, with a diversity of openings.

Bristol-Myers Squibb is well known for its university recruitment and co-op/internship programs. With headquarters in New York City, and facilities across the country, BMS places students from some of the country’s leading universities within its ranks. The following is a rundown of Bristol-Myers Squibb’s university recruitment programs.

Northwestern Kellogg Faculty Offer Career Development Advice

To develop your career, you have to take steps to make it happen—strategic ones. To help, Northwestern University’s Kellogg School of Management faculty got together, offering five pieces of advice for career development, no matter where you are professionally.

1. Build Influence in Your Organization

You don’t need to be a manager or team leader to influence your organization. Power in the workplace isn’t about coercing people. Instead, it’s about “mobilizing political support,” says Management and Organizations Professor William Ocasio.

To build this type of political capital, he recommends seeking out assignments that are likely to succeed to build your good reputation early and quickly. He also recommends understanding your organization’s culture, so that you advertise yourself appropriately.

2. Learn to Negotiate

According to Victoria Medvec, Professor of Management and Organizations, you need to learn to negotiate if you want the best assignments and promotions. She recommends thinking through what the other side needs and then presenting your skills and experience in such a way that you fill in the blanks. She also says that you need to lead the discussion by making the first offer.

“You will gain an advantage by creating the starting point, putting the right issues on the table, and being the one who frames the rationale,” Medvec says.

3. Become a Mentor

You can learn a lot by becoming a mentor. It offers many benefits, providing insight into both an organization’s political environment as well as the effectiveness of your organization’s communication strategy. According to Senior Fellow and adjunct professor Diane Brink, mentors learn to understand their organization better, and they learn new skills. Sometimes, just by talking with another person, you can figure out new tools, techniques, and applications essential to your own role.

4. Look for a Second Act

If you’ve climbed as high as you can in your given career, it’s not the end of the road. Clinical assistant professor Ellen Taaffe recommends looking for a potential “second act”—a new professional phase where you apply your skills and talents in a social or educational arena. The key is to find confidence in your story and create a larger narrative that explains who you are.

Just make sure that when you leave your current professional arena that you don’t drop all your contacts there. Instead, continue to cultivate your network and look for new doors that you can walk through.

5. Take Time for Self-Reflection

There’s always room for growth. One way to continue growing is to go through daily self-reflection, according to Clinical Professor of Strategy Harry Kraemer. He commends that you take time every night to define your priorities and hold yourself accountable. This is how leaders ward off disaster, plan for every outcome, and build stronger teams.

Some prompts for self-reflection:

- What am I proud of? What am I not proud of?

- How did I lead people? How did I follow?

- What did I do today? What would I do differently?

Read the full article, “Take 5: How to Take Charge of Your Professional Development”

This article has been republished and edited with permissions from its original source, Clear Admit.

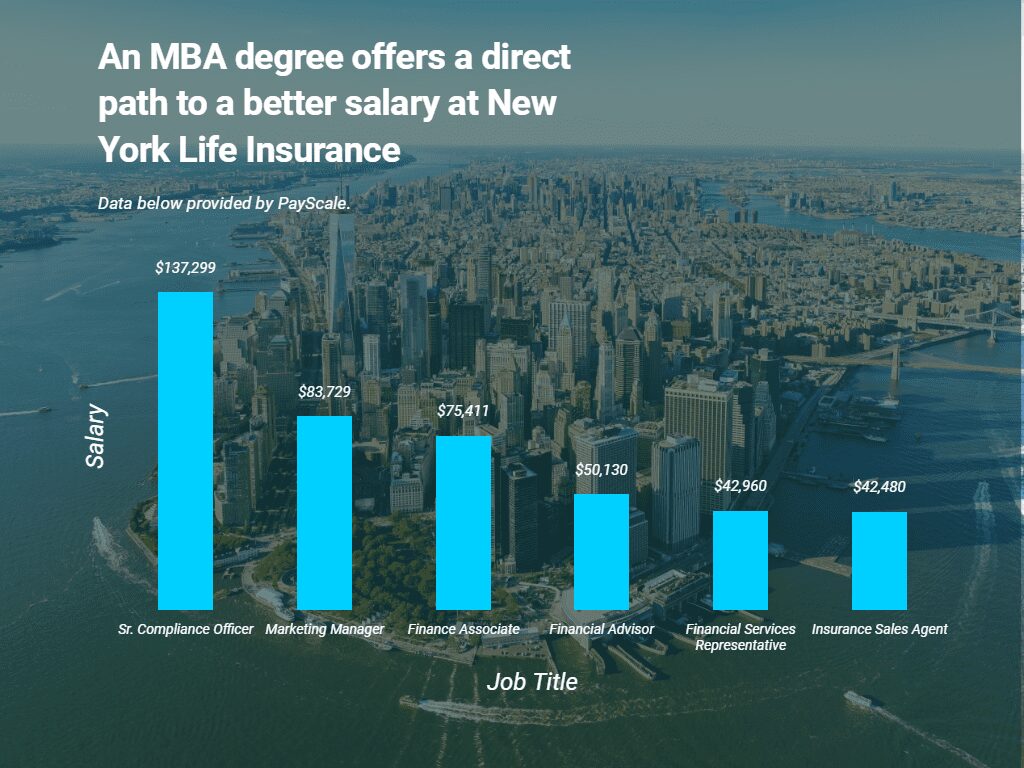

New York Life Careers: What MBAs Should Know

Choosing the right job after earning your MBA is always intimidating. The degree opens a multitude of paths for professionals entering the marketplace. However, the sheer number of available options can be a double-edged sword, and it is important that b-schoolers do their due diligence to find the right company and career track for them.

For those looking to work at a company with a rich history, New York Life Insurance Company may be the right choice. Not only if New York Life one of the US’s oldest Fortune 100 companies, the company consistently makes Fortune’s list of the “World’s Most Admired Companies.” Below, we’ve laid out some of the opportunities available to MBA’s looking to work at New York Life Insurance, so that you can gauge whether it might be the right fit.

New York Life Career Opportunities

Two possible tracks for those seeking employment with New York Life: as agents, or as a member of the corporate team.

There are many options for aspiring New York Life Agents. There are entry level positions for new agents looking to grow their business and gain experience and knowledge of the field. More experienced agents are also encouraged to apply. Experienced professionals can also apply for a sales management/partner position. Those in this position will oversee the recruitment and development of sales teams.

Though opportunities for non-MBAs abound, MBAs are at a significant advantage here. Those who have completed their MBA within 24 months are eligible for the management fast-track, a program wherein select employees can advance to management within a year of being hired. These hired will take on roles as Associate Partners once they have met training requirements. It should be noted that New York Life prefers for fast-track applicants to be Life and Health licensed, have some previous sales experience, and have FINRA registrations of Series 6 or 7 and Series 63.

What Kind of Salary Should You Expect at New York Life Insurance?

The salary of New York Life Insurance agents can vary wildly, considering commission is significant portion of the career incentive. According to Glassdoor data, base-level agents can expect a total annual pay of $51,322. This includes salary (around $42,000), plus benefits, commission, and more. Of course, an advanced degree can greatly increase annual compensation, with some agents earning over $100,000 per year.

Those seeking to enter the corporate side of New York Life also have plenty of options. With over 9,000 corporate employees, there is a position for nearly every type of business-minded application. Whether you want to work in marketing and communications, technology, sales support, investments, leadership and management, or a host of other fields, New York Life offers plenty options and support.

PayScale data indicates that several MBA-level positions offer obvious lucrative benefits. The average marketing manager at New York Life, for instance, makes an average annual salary of $83,729. This is early double the amount administrative assistants and client services representatives make.

New York Life Internship Opportunities

New York Life offers several internship opportunities based on the company’s specific needs. However, the company has a couple of specific programs tailored for interns. For those with an interest in actuarial studies in their junior or senior year of undergrad, or pursuing their MBA, the Actuarial Summer Internship Program may be a desirable option. In this program, interns receive projects from each area of the company actuarial departments and work alongside full-time actuaries. They receive training in the relevant software, meeting with the other interns every two weeks to touch base. They also benefit from monthly presentations by the New York Life actuaries, and a variety of social events.

The company also offers a Summer Finance Internship Program, wherein juniors and seniors balance a real-world work environment with weekly seminars and mentoring support from full-time employees. According to the New York Life Website, finance interns may be, “placed across the organization in Corporate Finance, the Insurance and Agency Group, and the Investments Group, including Mutual Funds and Investment Boutiques.”

An Inclusive, Diverse Company Culture

New York Life boasts a client-first culture, wherein employees ensure that the people they are serving are their first priority. That doesn’t mean clients are the only priority. In fact, Forbes ranks New York Life 18th on it’s list of Best Employers for Diversity. The company states:

“We collaborate, to make sure we deliver the absolute best for our clients. We go above and beyond to give back. And we never seek financial gains at the expense of our values.”

Profile Magazine recently highlighted the company, called, “How An Inclusive Culture is Reshaping New York Life.” The article highlights New York Life’s active efforts toward inclusivity, as well as the loyalty of the company’s employees, and the ethical approach the company takes to serving clients and the community.

The Best Business Schools for a Career in Project Management

Broadly defined by the Project Management Institute, project management is “the application of knowledge, skills, tools, and techniques … to meet a project’s requirements.”

A successful project comes to fruition only with the leadership of someone who is trained in time management, resource allocation, negotiation, conflict resolution, and budget planning. These are all skills one can acquire with a project management focused MBA. Continue reading…

The Perfect MBA Career: Portfolio Manager

If working in investment strategy seems appealing, then a job as a portfolio manager may be right for you.

Looking for a Career in Banking? Consider These MBA Programs

For MBAs who seek positions in finance, investment services, commercial and investment banking, or in the emerging universe of Fintech, a degree with a banking focus may be just the thing to pursue.

Here is a glimpse at some of the top schools for banking MBA programs.

MBA Recruiter: Starting Your MBA Career with Cisco Systems

Cisco Systems, a leader in computer networking, is constantly looking for MBA talent. Founded in 1984 by two computer scientists from Stanford University who sought an easier way to connect different types of computer systems, the multinational corporation now hires MBAs from top business school across the country. Continue reading…

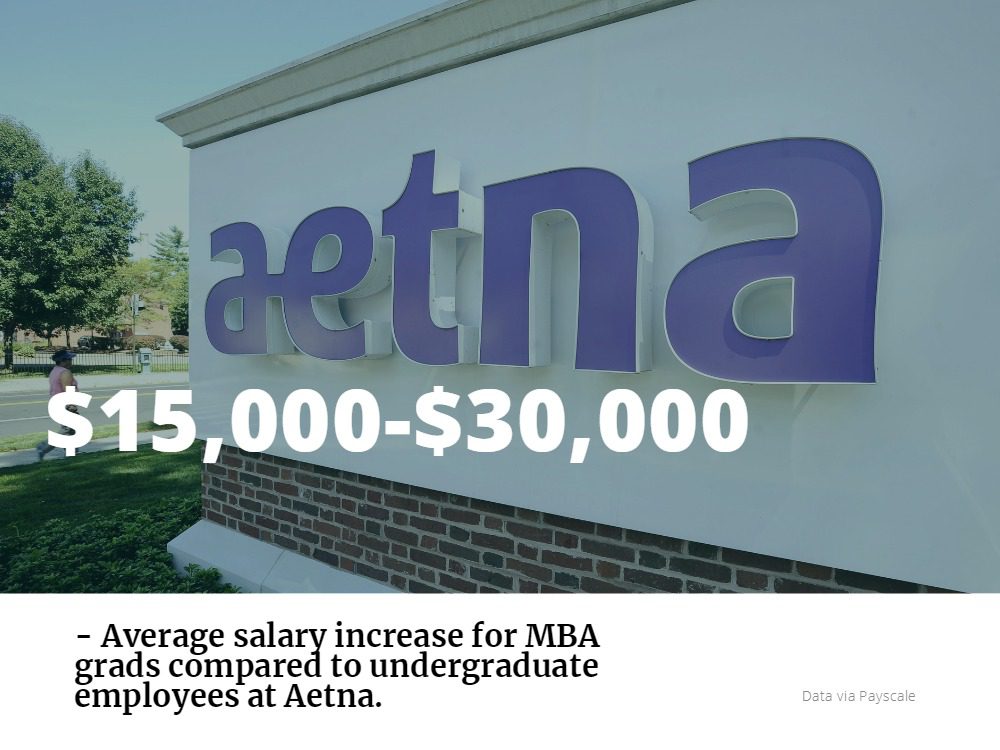

Finding Your New Career: What MBAs Need to Know About Aetna

Founded in 1853, Aetna Inc. has long been one of the most successful health care companies in the world. Serving roughly 37 million consumers, Aetna makes it a priority to recruit diverse and dedicated individuals to their team of nearly 50,000 employees throughout the U.S. The company’s wide reach and impact on the world of health care cannot be overstated; last year, the company made headlines with the huge announcement that it would be purchased by CVS in a $69 billion acquisition—a move which one New York Times report said would “reshape the American health care industry.”

With a commitment to finding skilled team members, and with needs ranging from health care to technology to financial services, it’s no wonder that Aetna and MBAs can make a perfect pair. Aetna has a long history of MBA recruitment, offering a Summer Associate Program which was recently named in Vault‘s 2018 “Top Internship Survey” as the second “Best Healthcare Internship” and ninth “Best Financial Services Internship.”

Why MBAs Love Aetna

Even with massive growth and the status of Fortune 50, Aetna can hardly be described as a stuffy or overly bureaucratic workplace. And it’s no wonder with a mission to help people and build a healthier world that that work should start with their own employees. The recognition Aetna has received for their diverse workplace speaks for itself: in 2016, the Human Rights Campaign Foundation named the company among the best places to work for LGBT employees. Other awards include a 2015 “Best Employer Healthy Lifestyles Platinum Award” form the National Business Group on Health, as well ranking in Training magazine’s “Training Top 125” as the 60th best company for employee development.

MBAs may be drawn to a potential Aetna career for its focus on employee development and creating a diverse workforce, but they probably stay for the payday. According to Payscale, MBAs at Aetna can make anywhere from $84,000 to to $10,200, a significant increase from the average salary for those with undergraduate degrees (around $70,000).

In addition, Aetna’s benefits package truly reflects the company’s strive towards healthy lifestyles. In addition to healthcare, company benefits include coverage for services like counseling, legal and financial support, employee discounts, and access to fitness centers.

Life at Aetna

Aetna offers a number of early career opportunities for recent graduates, which focus on area-specific training and providing access to a network of mentors and experienced professionals. Interested students will find development programs in a wide range of fields, including:

- Actuarial

- Finance

- General Management

- Human Resources

- Information Technology Leadership

- Information Technology Technical Training

- Sales

- Underwriting

The details of each program vary from field to field, but typically span anywhere from three to six years. Most programs also include rotations that will allow students exposure to the wide variety of opportunities open at Aetna, even within a particular area. For example, possible rotations included in the Financial Development Leadership Program include business finance, investor relations, tax, and corporate investment. After the program is completed, graduates will be placed in a full-time position, though the professional development and advancement opportunities will continue long after the program is done.

Landing an Aetna Career

Aetna is an active recruiter of MBAs and interested students should keep an eye out for professional recruiting events and career fairs throughout the country.

Each Aetna career has different requirements, but most early career programs expect applicants to have a GPA of 3.0 or higher, an undergraduate degree in a related field, strong analytical and communication skills, and the ability to succeed in a fast-paced environment.

In addition to the early career program, at the time of writing, there are 16 open jobs that require or strongly prefer applicants with MBA degrees. Below is a small sampling of the types of jobs available to MBA graduates at Aetna:

Product Strategy Manager – New Insurance Plan Design

- The Product Strategy Manager, a position for which candidates with top tier MBA degrees are preferred, will be at the forefront of decisions surrounding what healthcare is and how/where/when its delivered to those in need. According to data reported to Payscale, individuals in this role earn an average salary of $123,000 each year.

National Accounts Product & Solutions Leader

- Requiring an MBA and at least eight years of professional experience, the National Accounts Product & Solutions Director will “execute the product and solution strategy for the company in the national account employer group market” through collaboration as a member of the Large Group Solutions team.

Lead Marketing Analytics Consultant

- The Lead Marketing Analytics Consultant will use statistical predictive models to problem solve and help make decisions. The person in this role will also serve as a key contact for business stakeholders, and must be able to easily convey their predictions and recommendations to senior leadership. For this role, Aetna seeks someone with at least 7 years total business experience with an MBA preferred.

Finding A Real Estate Career with a Chicago MBA

The number of MBAs who pursue a real estate career may not be as large as those in finance or consulting, but even still, some of the most prestigious business schools in the Chicago metro offer MBA programs that specialize in the field. Continue reading…

Chicago MBA News: Kellogg Offers Sound Insights On How To Launch Your Career; Mendoza Research Finds That Extreme Pharma Price Competition May Pose Health Risks; Booth Prof Wins Onassis Prize

Let’s explore some of the most interesting stories that have emerged from Chicago business schools this week.

Launch Your Career on the Right Trajectory—Kellogg Insights

Kellogg recently published an article jam-packed with insights and skill cornerstones for current MBA students to more effectively launch their careers into the C-suite stratosphere. Here are a few takeaways from the piece:

- People Management

“Successful executives know how to manage people. The building blocks of people management include learning how to 1) manage your own performance, 2) manage your reporting relationship with your boss, 3) manage your performance as a team member, and later 4) manage a small team.”

- Business Core Knowledge

“The launch years are the time to gain mastery in one function such as finance, accounting, or marketing, while simultaneously building a basic understanding of all the other functions.”

- Organizational and Strategic Curiosity

“Leading at the top also requires understanding how organizations change over time and how organizational cultures can either help or hurt the change process.”

- Relationship- and Network-Building Skills

“Successful executives nurture and expand their web of relationships over the course of their careers. The launch years are the time to begin that process by getting to know well a group of people in a cohort, team, and function.”

Read the full article here.

Extreme Price Competition in Pharmaceutical Industry May Put Patients at Serious Health Risk, Study Shows—Mendoza Ideas & News

Mendoza Assistant Professor of IT, Analytics, and Operations Kaitlin Wowak, in conjunction with IU Kelley’s George Ball and the University of Minnesota’s Carlson School of Management’s Rachna Sh,ah recently published new research into the effects that pharmaceutical industry price competition has on patients

In “Product competition, managerial discretion and manufacturing recalls in the U.S. pharmaceutical industry,” due for publication in the Journal of Operations Management, the trio explored a tactic in which pharmaceutical industry policymakers “expedite approval process for generic drugs” by leveraging “regulations to increase product competition and lower prices.”

According to the article, this strategy “may encourage companies to relax quality standards during the manufacturing process, which may put more patients at serious health risk due to lower-quality products and more product recalls.”

Wowak writes, “We find that product competition is not only associated with more product recalls, but this relationship is contingent on the amount of managerial discretion surrounding the recall decision. Specifically, we find that product competition is positively associated with high-severity, low-discretion recalls—such as Class 1 and Class 2 recalls, which can cause death or medically reversible harm to consumers—and negatively associated with low-severity, high-discretion recalls—such as Class 3 recalls, which include minor mislabeling issues.”

Read the full article here.

Chicago Booth Professor Wins Onassis Prize in Finance–Booth Blog

Douglas W. Diamond, Merton H. Miller Distinguished Service Professor of Finance at Booth, was recently awarded the 2018 Onassis Prize in Finance for his groundbreaking work on what central bankers, regulators, policy makers and academics do, why they do it, and the consequences of these arrangements.

The $200,000 prize recognizes “the world’s foremost academics in the fields of finance, international trade and shipping.” Diamond is “considered the father of modern banking theory” whose research “changed the way people view banks.”

Read more about Professor Diamond and his fellow Onassis Prize winners here.

Listen to MBA Career Advice from These USC Marshall MBA Alumni

How does an MBA fit into your career? What are some steps you should take to ensure that your MBA aligns with your career goals? These are the questions that four MBA alumni seek to answer in the two-part Constructing a Career Podcast from the USC Marshall School of Business.

In the first part of the podcast, listeners hear from Doug Montgomery, the VP of customer insight at Warner Brothers, as well as Regina Leung, the founder of Mayflower Health Consulting. They each take the time to talk about pursuing an MBA no matter the stage of your career, providing tips and lessons learned along the way.

The second part talks about how an MBA can and should impact your job strategy. Advice is provided by Ana Maria Stingi Guemáraes, the audit director of MUFG Union Bank, and Grant Ingersoll, the president of Integrated Oncology Network.

All four are graduates of USC’s IBEAR MBA program, which gives them unique insight into using the USC Marshall MBA in your future career. Below are some of the most pertinent points and insight from both podcasts. Continue reading…

New Northwestern Career Video Series Tells You How to Own Your Career

The Career Management Center (CMC) at Northwestern University’s Kellogg School of Management recently launched the “Own Your Own Career” video series aimed to develop brave leaders.

The series was created for prospective and current students, along with alumni, to discuss aspects of managing a career throughout its life cycle. The videos also touch on how Kellogg students can bring value to employers and demonstrate the qualities they seek.

The goal of the video series is not only to help students launch their careers, but also to help them gain the skills and mindset they need to manage their careers over a lifetime, explains Liza Kirkpatrick, senior director of the CMC for the full-time MBA program at Kellogg.

Kellogg Senior Director of Career Management Liza Kirkpatrick

“To that end, we enlisted some of the best minds at Kellogg to address topics that are foundational to owning your career—developing your network, career agility, resiliency, selling your career, and leadership.”

Kirkpatrick continues, “These quick videos tell a narrative about career management that will resonate with and be informative to a broad array of audiences, including prospective and current students.”

The first four episodes of the “Own Your Own Career” series are already online.

- Episode 1: Starting the Career Journey—The first episode highlights three different individuals: Liza Kirkpatrick, Adnan Rukieh, director of the CMC for the executive MBA and evening & weekend MBA; and Matthew Temple, director of the CMC for alumni career and professional development. Together they discuss how individuals can start their career right now.

- Episode 2: Professor Harry Kraemer on Networking—The second episode delves into the importance of networking, emphasizing the value of helping others so they might return the favor in the future. Kraemer talks about networking as a lifelong journey and a key to reaching the C-suite.

- Episode 3: Associate Dean and Professor Bernie Banks on Leadership—This third episode discusses what it takes to be an influential leader who inspires people to perform. Banks dives deep into the situational nature of leadership and how to get people to fulfill your expectations.

- Episode 4: Professor Carter Cast on Career Agility—In episode four, Cast talks about being self-reflective during a career transition. He encourages viewers to understand their strengths and weaknesses and to think several steps ahead when it comes to their career.

“The video series enhances and expands the CMC’s foundational work by highlighting faculty and industry thought leaders who can provide practical examples based on their experience of how to actively manage or own one’s career,” Kirkpatrick says.

“The series provides a roadmap for being proactive and present in your own career development and encourages students to continue asking the right questions to shape their career, not only while looking for a job, but throughout their entire career life cycle.”

This article has been edited and republished with permissions from our sister site, Clear Admit.

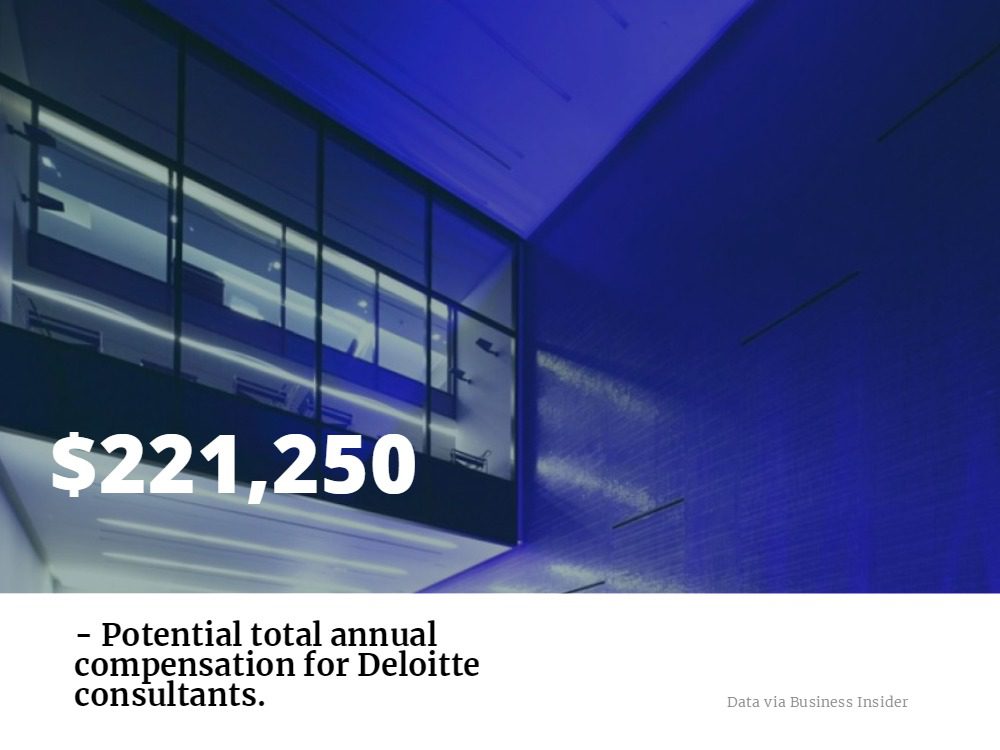

How Can You Earn a Career at Deloitte?

In 2017, Deloitte placed 11th out of “Fortune’s 100 Best Companies” to work for. It achieved its top slot thanks to the company’s focus on work/life balance where “you decide how fast paced/slow paced you want to take it.” In fact, 91 percent of Deloitte employees say their workplace is great with:

- Great challenges (96 percent)

- Great atmosphere (95 percent)

- Great rewards (94 percent)

- Great pride (97 percent)

- Great communication (95 percent)

- Great bosses (94 percent)

So, it’s no wonder that Deloitte is a top career choice for many MBA students. The company fits the 33 percent of 2016 post-graduate MBAs who want to work in consulting according to the 2017 Prospective Student Survey conducted by the Graduate Management Admissions Council (GMAC). And Deloitte also falls into the Big Four—KPMG, EY, PwC, and Deloitte—a prestigious place to be.

In addition, Deloitte is a major MBA recruiter with a depth of different career opportunities including Strategy & Operations, not just consulting. According to Transparent Career—a GlassDoor for MBA students—Deloitte ranks as the seventh best consulting company to work for with a composite score of 81/100.

Why You Should Consider Deloitte

So, why should you consider Deloitte as your next career move?

- Culture: For 18 years, Deloitte has been on Fortune’s “100 Best Companies to Work For” list. That indicates consistency.

- Giving Back: Deloitte supports more than 5,000 nonprofits each year through its workplace giving program. Plus, workers gave more than 440,000 volunteer hours in 2016.

- Inclusion: Approximately 2/3 of Deloitte’s new hires were women and minorities, and DiversityInc ranks it as one of the “Top 50 Companies for Diversity” and has done so for 13 years.

Deloitte also pays very well. In fact, according to a recent Business Insider article, Deloitte is ranked as the fifth best paying consulting firm for MBAs. Deloitte Consultants can expect a total compensation package of $221,250. The break down is as follows:

- $25,000 signing bonus

- $149,000 base salary

- $2,500 relocation local or $10,000 relocation out-of-state

- Up to $37,250 in performance bonuses

As for what working at Deloitte is like, according to efinancialcareers, “People say they love working for Deloitte because of its ‘dedicated workforce, dynamic and exciting work environment [with] opportunities for professional growth and advancement,’ as well as its ‘flexibility and mobility’ and ‘interesting assignments.’”

And one current employee described Deloitte as “invested in learning and development” saying that “partners and directors are very approachable” while coworkers are “well-educated and professional.”

Life at Deloitte

What’s a day in the life of a Deloitte new hire look like? It depends on where you work. Deloitte isn’t just a consulting company. MBAs can work in a variety of industries including banking, energy, national defense, real estate, and entertainment and in a variety of functions from mergers and acquisitions to audit and assurance, tax, and financial advisory.

Your career path at Deloitte will depend on where you’re hired. If you’re thinking of a career in management consulting, then joining the Strategy & Operations program as a Business Analyst is a smart move. As an MBA, you’ll start at the senior consultant level for two to three years. From there, you’ll move to manager for three to six years, senior manager for 406 years, and then finally reach principal/director. Within this career path, you’ll help market-leading client organizations tackle their complex business programs to drive results. You’ll be exposed to a variety of industries, clients, and projects.

There are quite a few other options as well. You can join Deloitte as a:

- Senior Consulting in Technology, where you’ll make strategic decisions where technology intersects with business strategy. In this position, you’ll use technology to help companies grow and evolve.

- Human Capital Consultant, where you’ll help clients develop solutions across their enterprise looking beyond human resources.

- Audit Staff Assistant, where you’ll work with a team to navigate the difficult landscape of auditing first-hand.

Depending on your previous experience, MBAs at Deloitte can work in one of eight divisions:

- Audit

- Consulting

- Financial Advisory

- Internal Client Services

- Real Estate

- Risk

- Tax Consulting

- Technology

Landing a Deloitte Career

Landing a job at Deloitte starts with their Deloitte Consulting Immersion Program, Client Service Internship, and various competitions. In each of these programs, MBA students will have the opportunity to interact with higher-ups at Deloitte who are responsible for hiring.

During the internship, MBA students will spend eight to ten weeks working in one of four business functions: risk and financial advisory, audit and assurance, consulting, and tax. On the other hand, the Immersion Program is just three days in length but provides MBAs with the opportunity to evaluate the depth, breadth, and quality of the job opportunities at Deloitte. As for the competitions, the National Case Competition and the National Consulting Case Competition are held at Deloitte University each year—inviting top students from MBA programs around the world.

Still, landing a job at Deloitte isn’t easy. Heidi Soltis-Berner, the Managing Director for talent at Deloitte, told efinancialcareers:

“We’re always looking for the best talent, and we’re pretty selective in who we hire. Overall, our applications were very similar to last year—we got around 500,000, and in the fiscal year 2016 we hired approximately 18,000 individuals, about 50 percent to 60 percent were from a campus setting, which equates to about a 4 percent hiring rate, pretty close to what it was last year.”

Specifically, at the graduate level, Deloitte added 6,400 new hires in 2016—most of those post-internship. According to the Deloitte website, qualified MBA candidates looking to earn a Senior Consultant position should have:

- 3-5 years work experience (preferably in a large company)

- A high level of personal and professional experience and history

- Superior analytical skills

- Willingness to travel

- Leadership capabilities and solid teamwork skills

- Exceptional communication and interpersonal skills