Search results for return on investment:

Check Out This Week’s Diverse Selection of New MBA Jobs

One of the best things about an MBA is how it can be applied to numerous fields and industries. The flexibility of the degree is especially evident in new MBA jobs listings, where new opportunities pop up in sectors ranging from financial services to defense, and everything in between. Continue reading…

Investing in Your Future With These New MBA Jobs

Finance careers continue to be a popular and lucrative option for recent MBA graduates. The work is varied, as finance relates to many industries and companies. In addition, the field is obviously very rewarding, with average graduate earning more than $140,000 according U.S. News & World Report. One of the most popular and well paid areas of finance is work at investment banks.

According to the Corporate Finance Institute, investment banking is the division of a financial institution that aides governments, corporations, and organizations through capital raising and mergers and acquisitions advisory services. Investment banks typically act as intermediaries between investors and corporations, and are often popular landing spots for MBA degree holders to bring their talents. Here’s a look at some of the best new MBA jobs in the investment banking sector: Continue reading…

H-1B Visa Challenges and Post-MBA Industry Employment Outlook

Immigration is in a precarious place in the United States. While media tend to focus on asylum and family separation, the Trump administration has taken aim at the H-1B Visa program. As Clear Admit previously outlined, the H-1B is necessary for any foreign-born individuals who want to work in the United States. Part of the Trump administration’s “America First” policy, the increased attention given to this visa program has created multiple issues for international students and the businesses that hire them.

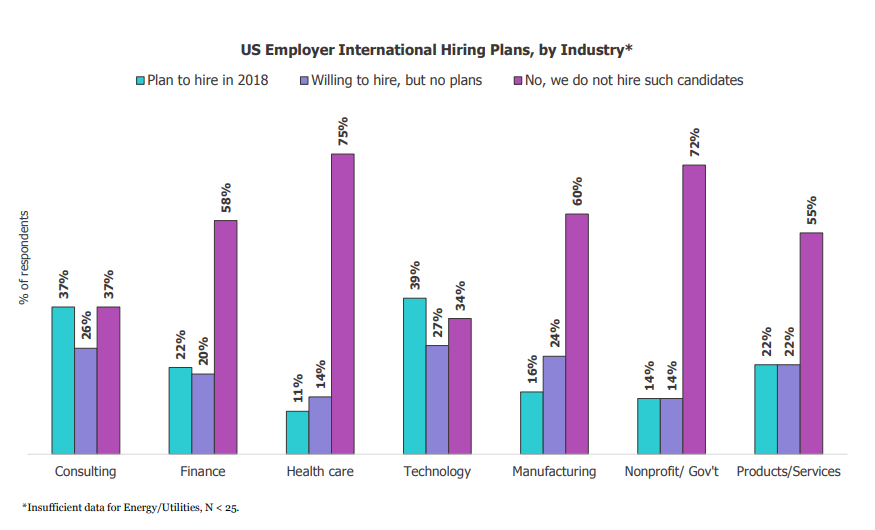

The first issue that most international MBAs who want to work in the United States will face is the lack of companies who are interested in hiring them. According to the 2018 GMAC Corporate Recruiters Survey, only 47 percent—down from 55 percent in 2017—of all companies surveyed in the United States intended to hiring international candidates. Students interested in working in finance, health care, manufacturing, and nonprofit sectors may want to change their plans as these are the sectors least likely to hire internationals. Only 11 percent of health care firms surveyed said they plan to hire international candidates in 2018, while 14 percent were willing, but had no plans. Seventy-five percent—the highest among the reporting industries—said they would not hire international personnel. Seventy-two percent of non-profit/government agencies and 60 percent of manufacturing companies also responded that they would not be hiring international candidates. The best sectors for international graduates are consulting and technology. Thirty-seven and 39 percent, relatively, reported that they plan to hire international candidates. Over a quarter of companies in both industries reported that they would be willing to hire internationally, but did not have concrete plans to do so.

The reason that it is so hard for international MBA graduates is the nature of the H-1B visa process. If an employer chooses an international graduate and is willing to sponsor their application, neither the firm nor the employee can be sure that the employee will be chosen for the visa lottery.

A current international first-year student at Dartmouth’s Tuck School of Business tells Clear Admit that they haven’t second-guessed their decision to attend a U.S. school:

“I do think about visas, but I am not worried. I look at my MBA from a top school as a long-term investment. I am confident it will deliver returns in many ways throughout my future. My advice to other international students is 1) know why you want the MBA and how precisely you want to utilize it before arriving to school and 2) complete the company research and practice to be extra prepared for recruiting.”

The number of international job-seekers in the United States has declined over the last two years from its peak of 236,000 in 2016. However, the number of applicants for H-1B visas remains high—190,000 people applied for 85,000 H1-B visas in 2018, filling the slots in five days, according to a U.S. Citizenship and Immigrant Services (USCIS) survey.

In addition to the small number of slots, applicants have to deal with the fact that USCIS has increased discretion over how visas are distributed. Although they are generally three years in length, H-1B visas under Trump’s USCIS have been of increasingly bizarre lengths. As noted in the lawsuit, ITServe Alliance v. USCIS, USCIS has issued visas that last one day and 12 days. One specific visa was expired for three weeks before it was received by the recipient. This has led to increased uncertainty around international MBA students getting the cover that they need to work in the United States.

If an international MBA student has received their three-year H-1B visa and has their desired position, he or she might run into difficulty being with their loved ones in the United States. H-1B holders can bring their partners over to stay with them on an H-4 visa while they wait for permanent residency; however, the Trump administration has spoken openly about eliminating this program. While legislation has been proffered to ensure that this program stays in place, the legislation’s chances of becoming law are slim to nil.

Although the current situation is grim, there are efforts being made to improve the situation. Tech firms, a primary beneficiary of the H-1B visa program, have been lobbying Congress to increase the 85,000-person cap for the visas. In addition, there is support among both parties in Congress to ensure that the H-4 program stays in place.

However, this might be too little, too late. These various difficulties have caused a decline in the number of international applicants at U.S.-based MBA programs. According to the GMAC 2018 Application Trends Survey Report, in the two years of the Trump administration, the number of international applicants to full-time MBA programs has decreased 13 percent.

With the system as it is oriented now, being an international MBA student will remain challenging. Tuck’s Emma He T’17 suggests that fellow (and hopeful) international students “target companies early, be willing to expand your search areas, and/or leverage your background for potential visa exceptions” in order to “mitigate visa concerns.”

Relief might come in the future, but it appears that putting America first will hurt U.S. MBA programs.

This article has been edited and republished with permissions from its original source, Clear Admit.

Let Introverts be Introverts, Says Stevens Guest Speaker – New York News

Let’s explore some of the most interesting stories that have emerged from New York business schools this week.

To Be Successful, Organizations Should Let Introverts Be Introverts, Says Stevens Speaker – Stevens Institute of Technology School of Business News

Introverts make up a third to a half of our workforce, and yet the majority of workplaces are built for extroverts—from open floor plans, bustling activity, to meetings dominated by who can be most assertive. These environments are not conducive to introverts, who are most productive when left alone to work and create.

Susan Cain, speaker at the Stevens Institute of Technology’s Excellence Through Diversity Lecture Series, shares how important it is to create that space for different work styles.

“There is no such thing as a one-size-fits-all environment. We need to be thinking day by day, team by team, office design by office design, how we can set things up so that there are varying levels of stimulation.”

Cain adds, “There have been a whole bunch of studies that have come out over the years showing that most people believe that introverts make inferior leaders and are passed over for leadership positions. On the other hand, there is another set of studies showing that introverts in leadership positions often deliver out-sized performance returns.”

You can read more about Cain’s lecture series event here.

Faster Internet Fuels Job Growth in Africa – Columbia Business School News

New research from Columbia Business School‘s Jonas Hjort and Uppsala’s Jonas Poulsen finds that the expansion of fast Internet in Africa has created jobs, increased employment rates, and greatly benefited populations with lower levels of education.

Professor Hjort writes, “These findings shed light on how modern information and communications technology can affect employment rates, structural change, job inequality, and firm growth in the poorest region of the world.”

“Our results imply that faster Internet allows firms to create (or retain) a lot of positions that otherwise would not be tenable in Africa,” adding that “access to information and communication can help give people with lower education a more secure foothold on the economic ladder, and improve living standards.”

You can read more about the growth here.

Impact Investing is About to Become More Mainstream Than Ever – Gabelli Connect

Last month, 350 guests gathered for Fordham’s inaugural Impact Investment Convening to discuss investing for social and environmental good.

Blended finance projects are already cited by the United States, Canada, Netherlands, and the Nordic countries as “proof that private capital could answer the problems that, historically, government couldn’t.” Investors are successfully driving interest in socially responsible investing and there is great potential to reach untapped markets.

The Convening was organized by Peter Lupoff, MBA ’86, Gabelli executive-in-residence and Center for Research in Contemporary Finance fellow. Lupoff explains, “What’s more is that the greatest transition in wealth is about to occur, from boomers to millennials. They care about how their money is spent, socially and environmentally, so it makes good sense for the traditional markets to embrace this – the capital will demand it.”

Keynote speaker Danielle Kayembe, CEO and founder of GreyFire Impact, points out, “The gender divide in consumer products and industry at large reflects a huge untapped area. Some estimates say women drive up to 85 percent of consumer spending in the United States, and, globally, women control some $36 trillion in total wealth.”

You can read more about impact investing here.

The Northeast Region’s Top Accelerated MBAs

The numerous advantages of an accelerated MBA start with one that’s particularly appealing–low cost. And while accelerated programs are more affordable, they are by no means less valuable or challenging than two year programs. In fact, they can be quite intensive in that they allow students to leverage their undergrad business education directly to MBA studies by covering core requirements.

UCLA Announces John Wooden Global Fellows for 2018, and More – Los Angeles News

Happy Friday!

Before we close out November, let’s look into some of the biggest news from the Los Angeles business school community from the week that was.

UCLA Anderson Announces 2018 John Wooden Global Leadership Fellows – UCLA Anderson News

The UCLA Anderson School of Management just announced the 2018 John Wooden Global Leadership Fellows, a program which, according to Anderson’s website, honors students who exemplify “leadership ideals and a commitment to improving the lives of others.”

The fellowship was named after Naismith Hall of Fame basketball coach John Wooden. Wooden, perhaps the most successful NCAA basketball coach of all-time, won 10 national championships with the UCLA men’s team from 1964 to 1975, coaching up NBA legends like Kareem Abdul-Jabaar and Bill Walton.

The four fellows, Jessica Barnette, Leah Maddock Loh, Gerry Sims, and Ryan Tan, are all currently pursuing MBA degrees at UCLA Anderson.

Barnette, who also received her master’s of public health at UCLA, is currently Director of Operations at WellStart Health, an organization that offers innovative methods to reduce chronic disease. Leah Maddock Loh also attended UCLA for her master of public health degree, and her current work focuses upon reproductive education with Kaiser Permanente.

Gerry Sims, a U.S. Marine veteran, received an undergraduate degree in management from Purdue University before deciding to join the military. He was deployed in Afghanistan twice, serving as an intelligence officer. Sims recently worked with Google’s small business division where he focused on increasing diversity. He works to raise money for the Special Operations Warrior Foundation, which provides assistance to families of veterans and the vets themselves as they re-enter civilian life.

Ryan Tan has also integrated his military service into his MBA and his career. A member of the armed services in Singapore, Tan is pursuing his EMBA at UCLA in conjunction with coursework at the National University of Singapore. He brings the values he learned from his extensive military service to his role as head of mergers and acquisitions at StarHub Ltd., one of Singapore’s largest telecommunications companies.

You can learn more about the John Wooden Global Leadership Fellows here, which will also featured a moderated discussion with celebrated Anderson alum and YouTube figurehead Susan Wojcicki.

LMU LA Hosts talk on Investment in Research Science – Loyola Marymount University LA News

Entrepreneur Jim Demetriades (LMU LA ’85), the founder of Kairos Ventures, returned to Loyola Marymount Los Angeles, discussing the importance of private funding for scientific research. Sponsored by the Fred Kiesner Center for Entrepreneurship, Demetriades’ talk was entitled “How Science Will Change the World in the Next Five Years.”

In the aftermath of several recent events, such as natural disasters and the cuts in research funding by the U.S., Demetriades believes that privatization of such funding is the wave of the future. With a background that combines computer science, mathematics, and economics, Demetriades formed his own software company which led to the formation of Kairos.

His goal is to “turn scientific breakthroughs into successful businesses.” Among his recent projects is raising $50 million for research at Caltech. He foresees innovative developments in various industries, such as wireless devices that can charge from up to 20 feet away, and artificial insect pheromones meant to increase crop efficiency.

You can learn more about the school’s investment in research here.

Banking on Success: A Look at Careers in the Banking Industry with CommerceWest CEO Ivo Tjan ’99 – Mihaylo College of Business

Ivo Tjan, (Mihaylo ’99) recently shared his insight with current Mihaylo College of Business MBAs into why the banking industry is an increasingly worthwhile as a career venture.

Tjan, who became a CEO at the incredibly young age of 27, had just received his undergrad degree when he earned the job. With a niche at CommerceWest that provides commercial services for companies with revenues between $5 million and $100 million, Tjan is a leader in providing services to small to medium sized companies.

“There are not many people going into banking because it is unsexy.” Tjan says. “But the unsexy part is the entry into the opportunities you will have. There is a huge vacuum for young people to take new roles and responsibilities that will create good value for them … [with a banking career] you get to meet many entrepreneurs and business owners who are starting off, on their way to becoming multi-million dollar successes.”

The talk focused also upon the importance of mentorship at Cal State Fullerton. “When I wanted to apply the real-world fundamentals to [my mentor’s] teachings, they were always open to discussing and talking about it, which helped me accelerate my understanding,” he says.

You can read more about Tjan’s recent discussion at his alma mater here.

Wharton Reveals 2018 MBA Employment Report, Announces $25 Mil Gift

Lots of news out of the Wharton School at the University of Pennsylvania recently. Employment statistics have been published for the most recent graduating class, and a big donation will fund a cool new building dedicated to entrepreneurship in West Philadelphia as well as more international scholarships for undergraduates.

Here’s what’s going on at the Wharton School.

Penn Employment Report (2018)

The 2018 MBA Career Report revealed a slight increase in job offers and salaries with finance drawing in more students than ever. In 2018, 36.9 percent of full-time MBA graduates went into financial services (up from 33 percent last year). Consulting lured the second most graduates at 25 percent, down from 28 percent in 2017. As for technology—the third most sought-after industry—this year there was a small dip down to 14.9 percent from 16 percent in 2017.

Employment Summary

Overall, of the 77.9 percent of Wharton MBAs seeking employment, 98.4 percent received a job offer 90 days post-graduation, and 94.6 percent accepted. For the remaining 17.2 percent not seeking employment—140 students—84 returned to their current company (60 percent), 34 started their own company (24 percent), 17 postponed their job search (12 percent), and five students gave another reason (3 percent).

As for top employers, many prominent companies hired two or more graduates including Accenture Strategy, Facebook, Amazon, Apple, Bain & Company, Deloitte Consulting, McKinsey & Company, Microsoft, and Tesla.

Salaries Rise

Wharton MBA salaries continued their climb, with the school reporting a $5,000 increase in total median base salary, bringing that figure to $135,000 in 2018. The highest median salary—$180,000—went to graduates heading into professional services, followed by venture capital at $175,000 and hedge fund managers at $162,000.

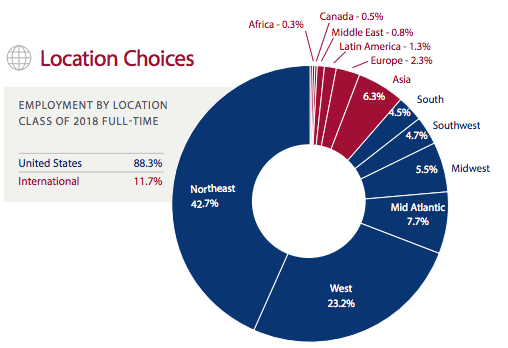

As for regional differences in salaries, the 42.7 percent of Wharton MBA graduates who accepted positions in the Northeastern United States commanded a median salary of $140,000. Another 23.2 percent of grads headed to the West, where the median annual salary was $135,000. The Mid-Atlantic region of the U.S., with its median annual salary of $139,000, drew the third largest percentage of grads, at 7.7 percent. Interestingly, those who took jobs in the Midwest and South reported the biggest paydays, with a median salary of $150,000. This was trailed by the Southwest, with a median annual salary of $145,000.

Another 11.7 percent of the graduating class sought post-graduation employment outside the United States, where salaries on the whole were lower. In Latin America, the median annual salary is $92,000. Salaries are slightly better in Europe, where the median is $119,000, and best in Asia, at $126,000.

$25 Million Gift for Scholarships and New Hall

Right on the heels of publishing its employment statistics last week, the Wharton School also announced a $25 million gift. The transformative gift will go toward constructing Tangen Hall, the first-ever dedicated space for cross-campus entrepreneurship at the University of Pennsylvania. It will also establish an international scholarship fund.

“This gift not only represents a profound commitment to Penn and Wharton student financial aid; it also energizes our entire campus community through Tangen Hall, a game-changing facility for innovation, entrepreneurship, and technology,” Wharton Dean Geoffrey Garrett said in a press release.

Alumnus Donation

Nicolai Tangen, the founder of London-based investment partnership AKO Capital and 1992 Wharton undergraduate alumnus, encouraged the AKO foundation to donate as part of Wharton’s More Than Ever fundraising campaign.

“Katja and I are continually inspired by Penn students and pleased to have the opportunity to engage with them and set them up for success,” Tangen says. “We look forward to their many achievements in the years ahead and to witnessing how this new building will bring together the next generation of entrepreneurs, leaders, and innovators to share their talents with one another and for the greater good.”

Tangen Hall

Tangen Hall will be located at 40th and Sansom Street, offering students almost 70,000 square-feet of space to pursue entrepreneurial goals. The hall brings together students from across the university to participate in the new Venture Lab. Also, the building will become the new home of many entrepreneurship-focused programs including:

- Penn Wharton Entrepreneurship

- Goergen Entrepreneurial Management Program

- Weiss Tech House

- Sol C. Snider Entrepreneurial Research Center

- Wharton Small Business Development Center

- The Master’s Level Integrated Product Design Program

Tangen Hall will have dozens of meeting and collaboration spaces for students, retail space for student ventures, a test kitchen, a maker lab with 3D printers and laser cutters, a VR cave, and a café.

“Tangen Hall marks a new chapter for the entrepreneurial community at Penn and in Philadelphia, providing a central hub for the groundbreaking innovations that happen here every day,” Wharton Vice Dean of Entrepreneurship and Innovation Karl Ulrich says. “This physical space will allow faculty to more strongly support students who turn ideas into outcomes that will transform business for years to come.”

Construction will begin in 2019 with completion slated for 2020.

International Scholarship Fund

Beyond Tangen Hall, the $25 million will also go toward a new Katja and Nicolai Tangen International Endowed Scholarship, which will provide funding for international undergraduate students. The goal is to help students who could otherwise not afford a Penn education.

It’s the fourth scholarship made possible thanks to the AKO Foundation and the Tangens. So far, they’ve supported a total of 22 Penn students since 2012.

“We are profoundly grateful to Nicolai and Katja Tangen for their extraordinary commitment to extend opportunities for entrepreneurship to all Penn students,” Penn President Amy Gutmann says. “We are also grateful that Nicolai and Katja are expanding their steadfast scholarship support, enabling the best students from every part of the world to attend Penn, to thrive in their studies, and to serve communities worldwide.”

This article has been edited and republished with permissions from Clear Admit.

Financing Strategies For “Nice” People, and More – New York News

Let’s explore some of the most interesting stories that have emerged from New York business schools this week.

When It Comes To Their Finances, Nice Guys Fall Short – Columbia Business School News

According to new research co-authored by Columbia Business School‘s Sandra Matz, “people who describe themselves as ‘agreeable’ are strongly connected to a bleak financial future—including lower savings, higher debt, and a higher likelihood of becoming financially insolvent.”

Matz elaborates, “This research proves that being nice may win friends but it can cost a lot of money. This is especially true for those who start off with less money, as they have no financial safety net to compensate for their personal habits. Unfortunately, having a nice and warm personality—in the arena of business and finances—can often have real financial costs.”

According to the article, “Agreeable individuals perceive money to be less important than their more disagreeable counterparts, and consequently have, on average, worse financial health—which is measured by savings, debt, and default behaviors.”

“Nice Guys Finish Last: When and Why Agreeableness Is Associated With Economic Hardship” was published in the Journal of Personality and Social Psychology.

You can read more about Matz’s research here.

Opportunities Abound in Distressed Debt Investing – Gabelli Connect

The Fordham University Gabelli School of Business recently hosted a talk at its McNally Amphitheatre on the subject of “distressed debt investing,” a multi-trillion dollar industry in which “investors hunt for opportunities where they can purchase debt [with the hope] that the gambit will pay off eventually.”

Attendees were privy to first-hand accounts of distressed debt investments and legal advice from a variety of experts. Baupost Group partner Fred Fogel highlights the “importance of both curiosity and perseverance.” Paul Weiss Bankruptcy and Corporate Reorganization Co-Chair Alan Kornberg “encouraged those just starting out to get a feel for the process by sitting in on bankruptcy hearings.”

Former Wachtell Lipton Bankruptcy Department Head Chaim Fortgang emphasizes the creation and maintenance of “good working relationships.”

You can read more about the talk here.

Look to Entrepreneurs For What’s Next in Healthcare – Johnson Business Feed

The Johnson Business Feed interviewed visiting faculty member Elspeth Murray about the increasing demand for innovation in the healthcare industry, from the use of smartphones to the expansion of ambulatory care.

“Consumer behavior has changed, and that will begin to push on the healthcare system. At a certain point, healthcare practitioners are either going to lose patients or be forced to adopt new ways of treating and accommodating patients.”

She advises students returning to school to focus beyond their specialty and remain “open to taking risks and re-framing your view of the industry, and to be aware of what is happening outside of your bailiwick. Take a good look around at what’s happening and go for it.”

Murray’s 2002 book, Fast Forward: Organizational Change in 100 Days, which she co-authored with Peter R. Richardson, explores how “entrepreneurial thinking gives you the creative ideas and the juice and design thinking helps you see the problems to be solved in the right way.”

Check out the rest of the Murray interview here.

Real Humans of the University of Georgia Terry College of Business

The University of Georgia can seem daunting from a distance. With nearly 40,000 total students, it is the largest university in the entire state, with over 400 buildings attached to its name spread across 30 Georgia counties. The university offers an impressive 140 degrees from its 17 constituent schools, including the C. Herman and Mary Virginia Terry College of Business, located on the main campus in Athens. Because of this, one may expect the size its MBA classes to be quite intimidating. But despite the grand scope of UGA, Terry MBA students have an intimate setting and an even more surprising bonus: extensive affordability.

Tuition for in-state full-time MBA students at the Terry College of Business starts at a comfortable $13,404 per year, while non-Georgia residents pay $32,112 per year. Compared to the tuition costs of some of the state’s other well-known universities, such as Emory ($124,000 for the entire two-year MBA), the price tag is relatively paltry. In fact, the Terry College of Business full-time MBA program is one of only five in the U.S. News & World Report top 50-ranked business schools that offers yearly in-state tuition under $15,000.

Alongside the impressive affordability, UGA Terry MBAs boast some eye-popping career statistics. Roughly 90 percent of the Class of 2018 was employed within just three months of graduation, reporting an average starting salary of $90,250 and an average signing bonus $14,214. When factoring in the meager tuition rates, it becomes readily apparent that the Terry MBA is one of the best returns on investment not just in Georgia, but in the U.S. as a whole.

But what kind of students make up the UGA Terry College of Business MBA Class? On the surface, the statistics may seem familiar. Just over 100 students are currently enrolled in the business school’s full-time MBA program, with nearly 66 percent male students and 34 percent female students. Those enrolled in the program boast an average GMAT score of 665 with a relatively high undergraduate GPA of 3.53. The vast majority of students in the class come from Georgia at 50 percent, while 25 percent of students are of international status. However, statistics like these could hardly tell the rich and complex stories of each individual student enrolled at UGA Terry.

To get a greater understanding of what it means to be a UGA Terry MBA, we spoke with several current students, including a former Army intelligence officer, a Fulbright recipient, and a Minneapolis marketing guru, alongside many other promising future grads. Read on to see their stories and what the future may hold for life after an MBA.

Wharton Economist, Berkeley Alum Ann Harrison Named New Haas Dean

Ann Harrison, a renowned economist and member of the faculty at the University of Pennsylvania’s Wharton School, has been named the next dean of the UC Berkeley Haas School of Business. Harrison earned her undergraduate degree from Berkeley and served as a professor in Berkeley’s Department of Agricultural and Resource Economics from 2001 to 2011.

“Professor Harrison is an accomplished administrator as well as a world-class economist who has dedicated her career to creating forward-looking policies in development economics, international trade, and global labor markets,” Berkeley Chancellor Carol Christ said in a statement announcing the appointment. “It is a great honor to welcome her back to Berkeley to become the dean of Haas, and I have no doubt that she will be a wonderful leader the institution.”

Harrison, who will begin her term on January 1, 2019, said she is thrilled to return to Berkeley and looks forward to meeting Haas students and alumni and working with its distinguished faculty and staff, according to the release from the school.

Harrison worked as director of development policy at the World Bank before joining the Wharton faculty in 2012, co-managing a team of 300 researchers and staff. In her time with the World Bank, she reformed its research fund allocation process and supervised its most important publications, including the annual World Development Report. Setting a milestone in transparency for the institution, she convinced the World Bank’s president to release all historical records on project loans.

Ann Harrison named new Haas dean

“Ann has a remarkable track record of pioneering research on trade and development, including influential studies of globalization’s effects on jobs and inequality,” Berkeley Economics Professor Maurice Obstfeld said in a statement. Obstfeld serves as chief economist at the International Monetary Fund and was a colleague of Harrison’s when she worked in Berkeley’s Agricultural and Resource Economics Department.

Princeton Professor Emeritus Sir Angus Deaton, who has known Harrison since her days as a graduate student at Princeton, praised her appointment. “Based on Ann’s experience at the World Bank, she will be an effective and much-loved manager,” said Deaton, who also holds the 2015 Nobel Laureate in Economic Sciences for his analysis of consumption, poverty, and welfare.

In addition to a Ph.D. in economics from Princeton, Harrison also holds a diplôme d’études universitaires générales from the University of Paris and is a research associate at the National Bureau of Economic Research and a member of the United Nations Committee for Development Policy. Author and editor of three books—including Globalization and Poverty and The Factory-Free Economy—Harrison is one of the most highly cited scholars globally on foreign investment and multinational firms.

Harrison replaces outgoing Dean Rich Lyons, who stepped down in June 2018 after serving as Haas dean for the past 11 years. He plans to return to teaching at Haas after completing a sabbatical. Haas Professor Laura Tyson, who has served as interim dean since Lyons’ departure, will remain in the role until January, 2019.

This article has been edited and published with permissions from our sister site, Clear Admit.

The Case for Business Curiosity from Harvard, and More – Boston News

Let’s explore some of the most interesting stories that have emerged from Boston business schools this week.

The Business Case for Curiosity – Harvard Business Review

Harvard Business School Professor of Business Administration and Behavioral Scientist Francesca Gino recently published an article in the Harvard Business Review in which she elaborated on the “benefits of and common barriers to curiosity in the workplace.”

Professor Gino points to research, which offers “three important insights about curiosity as it relates to business”

- Curiosity is essential to the performance of an enterprise, leading to “fewer decision-making errors, more innovation, reduced group conflict, and more-open communication and better team performance.”

- By “making small changes” to organization and management, leaders can do more to encourage their employees’ curiosity

- Leaders fear curiosity “will increase risk and inefficiency.”

To address these three insights, Professor Gino offered “five strategies that can help leaders get high returns on investments in employees’ curiosity and in their own”:

- Hire for curiosity.

- Model inquisitiveness.

- Emphasize learning goals.

- Let employees explore and broaden their interests.

- Have “Why?” “What if…?” and “How might we…?” days.

She concludes, “Maintaining a sense of wonder is crucial to creativity and innovation. The most effective leaders look for ways to nurture their employees’ curiosity to fuel learning and discovery.”

You can read more about the business curiosity research here.

Occasional Breaks Can Make Groups Smarter – Questrom School of Business News

BU Questrom’s Jesse Shore recently co-authored new PNAS research, which finds that scientists who integrate “short breaks into problem-solving sessions improves both the average performance of the group and increases the likelihood of getting the best solution.”

The study, which was co-authored by Harvard’s Ethan Bernstein and David Lazer, has “implications for the way we use always-on collaboration software, such as Slack and Google Docs.”

Shore explains, “In many of these [collaborative software tools], the goal seems to be to keep people constantly aware of what others are doing. But the reality is that if you’re getting an alert every time something happens and you’re not taking the time to work separately and have your own independent thoughts, it may hurt the group’s overall ability to solve complex problems.”

You can find the full article here.

Sound Advice: Marketing Students Help Sonos Better Understand Its Customers – Suffolk Experience

The Suffolk Experience recently highlighted Sawyer Business School marketing research collaboration with Sonos, a “go-to source for high-quality home sound systems” that just so happens to be within walking distance of campus.

To accommodate the prediction that over “50 percent of all searches worldwide will be done by voice within four years,” Sonos had thrown its hat in the voice-assistance ring with Apple’s HomePad, Amazon Echo, and Google Home. The company reached out to Sawyer to better understand how late millennial 18-to-24-year-old consumers interact with voice-assistant speakers.

Sonos Consumer Insights Manager Dennis Brosnan writes, “Sonos likes working with Sawyer Business School students because the analysis and recommendations they present are often different than the approach we would take.”

You can read more about the Sonos research here.

Cryptocurrency Volatility, a Vacation App, and More – Boston News

Let’s explore some of the most interesting stories that have emerged from Boston business schools this week.

Digital Tulips: High Risks, High Rewards in ICOs – Carroll School News

Boston University Carroll School of Management Assistant Professor of Finance Leonard Kostovetsky and Ph.D. candidate Hugo Benedetti (’19) recently co-authored a draft paper that explores how the high returns associated with Bitcoin, for instance, are in part a byproduct of the uncertainty that surrounds cryptocurrency. But as crypto becomes clearer, the researchers note that “that effect might be declining.”

The Social Science Research Network published the duo’s paper, entitled “Digital Tulips? Returns to Investors in Initial Coin Offerings,” which finds that “startups set a low, low price at the initial coin offering (ICO) stage to compensate for the volatility. In effect, it’s an uncertainty discount that keeps the price down, which drives up the returns.”

You can check out the full article on the official BC website.

People Aren’t Using Their Vacation Time. These Alumni Want to Fix That – D’Amore-McKim News

Treehoppr, “an online platform that tracks accrued time off,” was founded by Northeastern University D’Amore-McKim grads Kevin Corliss, DMSB (’16), Douglas Franklin, DMSB/E (’16), and Christopher Kenyon, CCIS (’17), in response to the “uniquely American” reality of how few working professionals take advantage of “paid time off.”

Treehoppr, an app created by a trio of D’Amore-McKim alumni, hopes to solve the uniquely American issue of not taking time off of work.

In an interview with their alma mater, Corliss says, “We want to help people eliminate these barriers to travel. What are the things you always hear when you ask people about traveling? They don’t have the time, the money, or the know-how when it comes to a foreign country. We want to help people solve all those issues.”

Dive into the trio’s story here.

The Gourmet MBA – Suffolk Experience

Suffolk University recently published a profile on current Sawyer Business School MBA Danielle Health (’19), whose @BostonBehavior Instagram profile demonstrates her knack for monetizing that very 21st century ritual of the meal snapshot—one she’s parlayed into a full-time job at social media management company Metter Media.

Health explains that she generally approaches the manager of “each restaurant she wants to visit as a one-time business partner.” She explains that her Instagram affords restaurants quite “a lot of visibility for a pretty minimal investment.”

She continues:

“Bigger food bloggers might have 100,000 followers. But that doesn’t matter if the people aren’t in Boston. About 90 percent of my followers are local to the Boston area, and most are my age. So I can deliver a really targeted and high-value group to a restaurant that I put on my feed.”

Check out the full profile here.

Top MBA Recruiters: The World of L.E.K. Consulting

L.E.K. Consulting is a leader in management consulting. Headquartered in London and Boston, the company is known for its services in corporate strategy, mergers and acquisitions, and operations. And with over 1,200 employees across 21 worldwide offices, it’s one of the most desirable companies for MBA graduates—trailing only Google—according to a 2017 national survey and ranking by TransparentCareer.

Founded in 1983 by three partners from Bain & Company, L.E.K Consulting offers MBA graduates the opportunity to work across all major industries including defense, aviation, life sciences, healthcare, energy, entertainment, transport, retail, consumer products, and finance. This wide breadth of expertise provides a unique opportunity to explore many different areas while working at a single company. It’s also one of the reasons L.E.K Consulting made it onto Forbes “2018 The Best Management Consulting Firms” list.

Other awards and recognition for L.E.K. Consulting include:

- Named “Strategic Consultants of the Year” at the 2015 Health Investor Awards

- Recognized by the 2016 Excellence in Social & Community Investment Awards

- Ranked #11 in Consulting Magazine’s 2016 Best Firms to Work For

MBA Recruiting at L.E.K Consulting

L.E.K Consulting looks for MBA job candidates who demonstrate exceptional performance and contributions. As a consultant, you can expect your role to involve:

- Regular collaboration with partners and managers

- Answering critical questions through analyses and structured approaches

- Managing your team’s day-to-day activities

In 2017, L.E.K. Consulting hired around 50 MBAs from U.S. business schools, looking for candidates with a diverse set of backgrounds and experiences. However, gaining a position at L.E.K. Consulting can be an intimidating experience. They’re ranked as having one of the world’s most challenging interview processes—ranking 3.4 on a 5-point scale—according to Fortune Magazine.

Salary & Benefits of Working at L.E.K. Consulting

According to TransparentCareer, the average total compensation for an L.E.K. Consulting employee with an MBA degree is $252,500. That can be broken down into approximately:

- Base: $150,000

- Performance Bonus: $25,000

- Retirement & Profit Sharing: up to $30,000

- Signing Bonus: $25,000

- Relocation: up to $5,000

As for employee benefits, it’s a large, multi-national organization, so there are many advantages including life insurance/disability, 401(k), paid holidays, and vacation.

MBA Internship Program

One of the best ways for an MBA candidate to get an “in” at L.E.K. Consulting is through their Summer Associate program. This eight- to ten-week program is available for top-performing MBA candidates who want to experience real casework as part of a team.

Students will dedicate 100 percent of their time to a single engagement, which will result in guiding and managing the client to a solution. As a Summer Consultant, you can expect to complete a range of day-to-day activities, and you’ll be responsible for:

- Identifying critical issues

- Structuring analyses

- Managing Associates

- Communicating insights

- Participating in client communication

Summer Consultants have the support of all full-time Consultants at L.E.K. This means that you’ll have a chance to be mentored throughout the summer with guidance and coaching.

International SWAP Program

One unique opportunity that L.E.K. Consulting offers its employees is their SWAP Program. This program gives consultants a chance to SWAP their position with another associate anywhere in the world for a short period. For example, a Boston consultant might head to Paris while the Paris associate heads to Boston for six months. During the SWAP, you do not change your job. Instead, you change your work location for a unique international experience.

YOU MAY ALSO LIKE: What Are The 5 Highest Paying Consulting Firms in the World?

Working at L.E.K. Consulting

What’s it like to work at L.E.K. Consulting? According to Glassdoor reviews, it’s a “fast-paced, dynamic work environment.” However, it can also be demanding and “hard to maintain a work-life balance.” One thing that most employees agree on is that the work is challenging with great people to work with who are talented, smart, and fun.

According to one consultant who has been at the company for three years, “L.E.K. runs teams lean compared to other consulting firms, meaning all team members will have meaningful step-up opportunities and more responsibility/ownership relative to their peers at other firms, earlier in their careers. The work is generally interesting, and the learning curve is steep. This job will keep you learning and challenged.”

On the flip-side, “Work/life balance seems worse at L.E.K. relative to other firms, because of the lean structure. Most projects are under-staffed. In addition, there are no systems/processes in place to retain talent that is burned out.”

The Highest Paying MBA Internships You Can Find

An MBA education can open the door to an astounding number of lucrative opportunities before you’ve even completed your degree. Many MBA interns are earning hourly wages unfathomable to the larger majority who spent their undergrad internships restocking break rooms and memorizing coffee orders, all for a whopping $0 per hour. Below, we’ve laid out the highest paying internships in some of the most common industries for MBAs.

Stats for MBA interns on Management Consulted dwarfed most other intern salaries. Though the reality of management consulting may lack the seedy glamor portrayed by Don Cheadle and Kristen Bell in House of Lies, these numbers are certainly compelling enough on their own to keep the attention of ambitious young interns.

Deloitte, a consistent top hirer of MBA’s according to Fortune, may be a top destination for MBA interns as well, if compensation is any indication. In 2016, MBA’s at Deloitte make an average of $11,380 per month for a ten-week internship, with the opportunity to receive full second year tuition reimbursement for returning interns. Depending on their goals, interests, and professional backgrounds, interns join a client service team in Deloitte & Touch LLP, Deloitte Tax LLP, Deloitte Risk and Financial Advisory, or Deloitte Consulting LLP.

Management Consulted put the average MBA intern salary at A.T. Kearney at a staggering $11,500 per month. A.T. Kearney offers a ten-week summer internship, during which interns will have unique experiences, such as a three-day opportunity in the middle of the summer to converge in a single location with all of the season’s interns. During these three days, students have the opportunity to network, socialize, and learn about the different facets of the company.

Outside of consulting, there are plenty of opportunities for MBA interns. It is no secret that some of the highest paying jobs out there are in tech. Luckily, there is a sizeable demand for MBA’s at tech companies.

Despite the recent, um, controversy surrounding Facebook’s security practices, the social networks interns are making out well. Facebooked topped Glassdoor’s list of Highest Paying Internships in 2017, with a median monthly salary of $8,000. The 12-week business internships offer frequent Q&A’s with higher-level employees and the opportunity to tackle real problems that face the social networking platform.

It would be remiss to talk about MBA’s in tech without mentioning Amazon, which is fast becoming one of the largest MBA tech recruiters. With a median monthly pay of $6,400, Amazon also made Glassdoor’s list of Highest Paying Internships in 2017. Keep in mind, this number is the median for all Amazon interns, and does not factor in MBA education, which would likely yield a much higher number. Interns are assigned a strategic project that provides the opportunity to contribute to solving a real business issue. Additionally, an internship with Amazon is often a foot in the door to a full-time career with the internet retail giant. Amazon’s website encourages MBA’s to apply, stating:

“You will have the autonomy to think strategically, make decisions, and drive significant impact to the customer experience and the business. To be successful, you must be passionate about the business, flourish in ambiguity, and demonstrate nimble leadership.”

Two Sigma Investments, a relatively young investment management company, has been getting a lot of press for its generous internship compensation. According to Business Insider, the $40 billion hedge fund, which started in 2001, grew 400 percent from 2012-17. The 10-week internships can pay upwards of $10,500 per month. Internships at Two Sigma are primarily in STEM, and MBA’s with an interest in Quantitative Research might find this program particularly rewarding.

Rotman Receives $6 Million Endowment, and More – Toronto News

This week, some of Toronto’s most prominent business schools have seen a wealth of exciting news (including actual wealth in Rotman’s case, in the form of a sizeable donation). We’ve rounded up some of the most exciting recent news from Toronto metro’s business schools.

Private Donations Give Specialty Programs a Shot in the Arm – The Globe and Mail

Over 20 years since the University of Toronto received a $15 million donation from the Rotman family, changing its name from the Faculty of Management to the current Rotman School of Management, the philanthropic family once again returned a sizable gift to the Toronto business school.

The new $6 million donation will boost the school’s healthcare management programs, according to the Globe and Mail. As well, the family gifted the school an additional $1 million to help “the reach of an award-winning program for Indigenous entrepreneurs.”

“The latest Rotman family donation is earmarked for three initiatives: recruitment of three faculty research chairs in artificial intelligence, life sciences commercialization and health economics and policy; scholarships for graduate students in health care management studies; and support for a new global executive MBA for health care and life sciences.”

You can learn more about the Rotmans’ donation here.

Schulich Researchers Analyze Canada’s Multicultural Marketplace – yFile

A new York University Schulich School of Business study from professors Ela Veresiu and Markus Giesler—“Beyond Acculturation: Multiculturalism and the Institutional Shaping of an Ethnic Consumer Subject”—found that “that Canada’s market-based form of multiculturalism fosters marketplace inclusion without resource redistribution, and maintains ethnic divides rather than uniting diverse communities.”

“We bring sociological theories of neoliberal governmentality and multiculturalism to bear on an in-depth analysis of the contemporary Canadian marketplace to reveal our concept of market-mediated multiculturation, which we define as an institutional mechanism for attenuating ethnic group conflicts through which immigrant-receiving cultures fetishize strangers and their strangeness in their commodification of differences, and the existence of inequalities between ethnicities is occluded,” said Veresiu.

You can read more about Veresiu and Giesler’s study here.

Investing Insights: Lessons from Tom Russo – Ivey Blog

Last month, Tom Russo, managing member of Pennsylvania investment firm Gardner Russo & Gardner, spoke with professor George Athanassakos’ value investing class at the Ivey Business School about his company’s investment philosophy, which broke down into three principles.

Gardner Russo & Gardner managing member Tom Russo / Photo via ivey.uwo.ca

- The capacity to invest

- The capacity to suffer

- The capacity do nothing

“Despite the long-term unattractiveness of holding cash, doing nothing may sometimes prove to be the right decision to make,” HBA and Computer Science dual degree candidate Leroi Yu writes on the Ivey Business School blog. Sitting on the sidelines instead of compromising on quality takes character. It provides optionality and may prove to be beneficial in the long-run.”

You can read more about Russo’s advice here.

The MBA Real Estate Boom: Inside The Schulich Real Estate Program

Real estate is booming. In fact, according to the Financial Times, commercial property asset values and investment yields have surpassed levels prior to the Great Recession, and there is continued strong demand for offices, urban apartments, and more. It’s all thanks to continued low interest rates and tight supply.

What has this real estate boom meant for business schools? It’s meant a decrease in interest in banking and an increase in interest for real estate study, particularly among MBA students who understand the cycle and want to get involved while they can. The reality is that there are many jobs in real estate, and that’s what MBA students want.

According to Sherena Hussain, an assistant professor in Infrastructure at the York University Schulich School of Business, “The real estate and infrastructure sectors account for a large proportion of a nation’s GDP.” So, it shouldn’t be surprising that many top MBA programs are prioritizing real estate curriculum, specializations, and clubs for their students.

Real Estate and Infrastructure at the Schulich School

Real estate and infrastructure have an indispensable role at the Schulich School. Not only does the school offer a Master of Real Estate and Infrastructure (REI), but MBA students can also specialize their curriculum with a focus on REI. The MBA specialization focuses on “creating and maintaining places for living, working, shopping, learning, recreation and culture, and the critical accompanying support systems ranging from mobility and logistical networks, to utilities and energy supply,” according to the school website.

One of the reasons behind the MBA REI specialization at Schulich is Toronto itself.

“Many of the leading global Real Estate and Infrastructure firms are located in Toronto,” explains Hussain. “If you are interested in a career in real estate and infrastructure, Schulich’s MBA specialization is a rare opportunity to develop your understanding, skills, and network in a way that leverages the specialization’s top-tier reputation and committed faculty and alumni base.”

As part of the REI specialization, students must complete 12 credits focused on real estate including two required courses: Real Estate Finance & Investment and Development Prototypes. Other potential courses include:

- Partnership Models for Infrastructure Delivery

- Structuring Real Estate Transactions

- Commercial Real Estate Asset Management

“The idea behind the REI MBA specialization is to bring students to industry and industry into the classroom,” Hussain outlined in an email exchange with MetroMBA.

“Our faculty and sessional instructors have real-world experience and bring this perspective into the classroom by leveraging experiential learning at its finest. Examples include flying in senior policy officials to judge a capstone assignment about international infrastructure, bringing leading CEOs into the classroom as guest speakers in REI investment classes, or partnering with a leading national-law firm to have our students learn how to negotiate joint venture agreements. This is a small sample of how the REI MBA specialization approaches holistic learning.”

But holistic learning isn’t just regulated to the MBA program and inside classrooms. It can be found throughout the school, including within Schulich’s Real Estate and Infrastructure Club (SREIC).

Schulich Real Estate and Infrastructure Club

SREIC is open to all Schulich business students interested in learning more about pursuing a career in real estate and infrastructure. The club acts as a liaison between students, the industry, and professionals.

“SREIC offers MBA students an opportunity to supplement their learning with real-world, co-curricular programming and unique networking opportunities,” says Hussain. “It’s a student-run group that has the full backing of Schulich’s Real Estate and Infrastructure program faculty, and it is one of the most active student groups at the business school.”

Programming offered by the club includes:

- Value-Oriented Programming: site visits, breakfast seminars, conference engagements, project panels, case competitions, etc.

- Deep Industry and Alumni Relations: on a one-on-one and broad basis through speed mentoring, recruitment breakfasts, and keynote events.

- Leadership Development Opportunities: including the semi-annual resume book circulated to recruiters and senior leaders.

There are also several keynote events that take place each year including Schulich’s Developers’ Den international case competition, ARGUS training, and Schulich’s annual Perspectives Lecture. And one event that just took place in February was the annual New York City real estate study tour.

The study tour is part of a partnership with Columbia University’s real estate program, beginning several years ago. It’s a three-day intensive and transformative real estate experience that takes students to site visits and tours of leading real estate and infrastructure firms all over NYC. Some of those firms include Blackstone, Related Companies, Oxford, Vornado Realty, WSP, Brookfield, and Silverstein Properties. The goal is to give students a glimpse into the future of real estate

“Schulich students benefit from learning more about a new market, as well as having a basis for global comparative learning,” Hussain explains. “The partnership [with Columbia] offers an opportunity to develop a network of peers engaged in commercial real estate development in New York City and across the U.S. Each year, the club visits a development class held at Columbia University to learn more about their approaches to learning about real estate. In return, the Schulich School hosts an annual friendship dinner in Manhattan to offer more opportunities for students, alumni, and friends of industry from Canada and the U.S. to forge relationships.”

The trek is a unique event that gives Schulich students a chance to explore real estate and infrastructure in a whole new way.

“The 2018 SREIC New York trip was an excellent and well-balanced learning experience for students who are truly passionate about real estate and infrastructure,” says James Chang, an MBA student working to his REI specialization. “A prime example of ‘outside the classroom’ learning with the perfect balance between education, relationship building, and fun. I would highly recommend it to students in the MREI or MBA program to take advantage of this opportunity next year!”

To learn more about real estate and infrastructure at the Schulich School of Business, visit the school’s website.

Rotman Prof Talks Theranos Fraud, and More – Toronto News

People affiliated with Toronto‘s finest business schools have been making the news. Below, we’ve laid out some of this week’s highlights.

How Board Diversity Might Have Prevented the Theranos Fiasco – The Globe & Mail

Andras Tilcsik, Canada Research Chair in strategy, organizations, and society at the University of Toronto’s Rotman School of Management coauthored an opinion piece in The Globe & Mail with Chris Clearfield, Principal at System Logic. The article addressed the fraud charges lodged against Theranos founder Elizabeth Holmes.

Holmes, who was listed as one of Forbes’ “Youngest Self-Made Billionaires” has been charged with “massive” fraud involving upwards of $700 million USD. Holmes has agreed to cede control of her company, which was boating more innovated methods of blood-testing to potential investors.

Tilcsik and Clearfield argue that Holmes’s mistakes might have been prevented had a systemic problem in businesses been addressed at Theranos: board diversity. All but two Theranos board members were white men over 60. According to the article, “… lab experiments show that while homogeneous groups do less well on complex tasks, they report feeling more confident about their decisions.”

Holmes’ equity stake in Theranos, the notorious blood-testing startup she founded, has been reduced to virtually nothing after being charged with large-scale fraud from the SEC.

Learn more about the importance of board diversity here.

YouTube Star Choreographs a Career Blending Bollywood and Business – The Globe & Mail

Shareen Ladha, graduate of York University’s Schulich School of Business, used her MBA to guide her in an unconventional career goal. She wanted to build success producing and dancing in Bollywood-esq videos on YouTube, achieving massive momentum when she did a Bollywood-style remix of Justin Bieber’s “Sorry.” The video quickly went viral, and now Ladha balances making YouTube videos with her career as a senior strategist with McCann.

“Through my MBA, I decided that this was the thing that made me unique and it was proof I could bring a creative aspect to strategy and consulting,” Ladha said in a recent profile with the Globe & Mail.

“It started getting woven into my daily life and daily conversations I would have with people. All my social media accounts were public, so if they ever looked me up or were friends with me, they’d know about it. There was such a positive response.”

You can read more about the YouTube star here.

Ivey Students Learn the Three Gs of Good Investing – News@Ivey

Multi-billion dollar Brazilian investment firm 3G Capital Management recently let students at the Ivey Business School at Western University Canada in on a simple secret: the three Gs to successful investing are “good business, good management, and good price.”

3G managing partner Pavel Begun spoke with professor George Athanassakos and his value investing class last month, further explaining what each of those three Gs (get it?) meant:

Good Business:

“’We define good business as one that is competitively entrenched, generates high return of invested capital and is in solid financial shape.’” Specifically, 3G looks at businesses that are industry leaders and show industry longevity in order to predict their future value. They also look to businesses that generate with ROEs, or return on equity, of 15 per cent and above. Finally, they look at the debt payback period of business to ensure it is no greater than three to five years, helping to determine their financial shape.”

To read the rest of the advice gifted from Begun, click here.

What Toronto MBA Can You Earn in the Least Amount of Time? – MetroMBA

Several of the most well-regarded business schools in Toronto offer MBA programs that do not take the typical two-years that a traditional full-time degree often requires.

For instance, the DeGroote School of Business at McMaster University has an accelerated program that takes just eight months to complete. Alanna Shaffer further explains:

“By exempting students from the required first year MBA courses, students can earn their degree quickly while also cutting their overall tuition expenses in half and accelerating their path to employment. The program is designed for students who have earned their undergraduate business degree in the last ten years, and have at least one year of professional experience. Students may start the program in either September or January.”

Check up on the rest of the fastest MBA programs in Toronto here.

Here Are The 7 Hardest MBA Admissions Interview Questions

Clear Admit recently explored seven of the hardest MBA interview questions you may encounter, with helpful tips on how to handle them.

We recently shared our list of the most commonly asked MBA admissions interview questions, along with extensive advice on how to approach such queries. In light of the popularity of that piece, we’ve decided to up the ante this time around and spend some time deconstructing the absolute worst, totally unfair, just all-around-tough MBA admissions interview questions.

How did we do this, you ask? We called on three members of our team—all of whom have significant admissions experience at top schools—to comb through our extensive Clear Admit MBA interview archive and hand pick a set of particularly challenging questions. The only ground rule was that they needed to be questions posed to applicants with some degree of regularity, as opposed to one-off, oddball questions from an ‘off the reservation’ alum.

Arriving readily enough at a set of incredibly tough questions, our team of former admissions officers then crafted extensive guidelines on how to approach each one.

WARNING: Some questions on the list appear very sweet and innocent. Be aware that looks can be deceiving.

If you’re preparing for an upcoming interview, you won’t want to miss this valuable insider advice. It can help make answering even the most challenging questions feel like a walk in the park.

The Seven Hardest MBA Admissions Interview Questions

1. Describe a failure in which you were involved.

Why It’s Tough

Most candidates, when preparing for an interview, focus on the positive aspects of their story. They cannot wait to share their successes and highlight their strengths. So when asked directly to describe a failure, they can be unnerved at best and completely thrown at worst, especially if they haven’t given such a question any thought.

Key Considerations

The type of failure, the time frame of the failure and what you learned as a result will all be relevant in terms of addressing the question.

Risks:

- Picking a failure that is really just a veiled success story, i.e. not a real failure. “We missed one deadline (failure) but we shipped an outstanding product (success).” This type of answer can be perceived as avoiding the question.

- Picking a failure that is so substantial, and recent, that the interviewer genuinely worries that you might make the very same type of mistake again—either due to incompetence or because you just simply haven’t had time to learn from it yet.

Planning Your Response

Make sure you prepare to address a real failure that you played a part in and acknowledge your direct role. While the failure should be substantial, it should not be catastrophic to an organization. Address the process you went through in terms of deconstructing the failure and how you have learned from the experience. Finally, discuss a more recent success that demonstrates your use of the lessons learned from the earlier failure.

2. What other schools are you applying to?

Why It’s Tough

Many professionals in the admissions community feel that this question is simply unfair. There are several reasons for this, one of which is that applicants don’t really know how the answer is going to be used (more on this below). In addition, it’s not as though candidates are allowed to ask their interviewer about the other applicants the committee is considering…

Key Considerations

Fair or unfair, let’s unpack the purpose of the question a bit: Is it to determine your likelihood of attending the program you are interviewing for? Is it to assess whether you are ambitious in terms of school selection or more conservative? Is it simply to see if your list of target schools makes sense and demonstrates a thoughtful approach on your part? Any or all of these options are possible depending on the school interviewing you.

In most instances where this question is used, it is being asked by schools that are concerned about their yield. They want to avoid admitting candidates that clearly will select another school when given the choice. That being said, there are admissions interviewers who ask this question merely to better understand your approach to selecting target schools—and to determine whether you are simply applying to schools ranked in the top 10 or have a more nuanced approach. Regardless, you should prepare a solid answer.

Planning Your Response

There are three parts to addressing the question. First, you do want to be honest even if the question feels unfair. Second, as you list your schools, explain why you chose them. You want to demonstrate that your selections are thoughtful ones resulting from thorough research and careful consideration of your career plan, preferred teaching methods, campus environment, etc. Finally, should make the case for why the school you are interviewing with is a very excellent choice among the group of schools you’ve listed—citing specific elements of the program that fit well with the criteria that drove your overall school selection.

3. Describe a conflict at work and your role in it.

Why It’s Tough

It can be hard to discuss conflict without taking sides or painting some of your colleagues (or yourself) in a negative light. It can also be dangerous to highlight a conflict and appear detached from it—e.g. downplaying your role—because that could suggest either that you did nothing to stop it or that you simply aren’t important enough at work to have played a role/taken a side. In short, this kind of question is loaded with “damned if you do, damned if you don’t” issues.

Key Considerations

A common question in an MBA interview will look at how you handle conflict, and usually conflict at work. Schools ask this question to test your emotional intelligence and to see how you talk about your peers, your bosses, your organization, etc. Even the slightest whiff of “throwing someone under the bus” can backfire. It’s also important to showcase your ability to see the various sides of a conflict.

Preparing Your Response

It makes sense to prepare a particular conflict you have had at work and be ready to use the example. A strong response to this question needs to show your role in the conflict, who it was with, how it was addressed (if, in fact, it was addressed) and what the result was. Equally as important will be to share what you learned from the experience and how a subsequent situation at work was resolved positively or avoided altogether as a result of what you learned.